- United States

- /

- Pharma

- /

- NYSE:LLY

Eli Lilly (LLY): Revisiting Valuation After a Powerful Multi‑Month Share Price Rally

Reviewed by Simply Wall St

Market context for Eli Lilly

Eli Lilly (LLY) has been quietly grinding higher, with the stock up about 4% over the past month and nearly 39% in the past 3 months, far outpacing the broader market.

See our latest analysis for Eli Lilly.

That move fits into a powerful run, with a roughly 36.5% year to date share price return and a 37.4% one year total shareholder return. This suggests momentum is still very much building rather than fading.

If Lilly’s surge has you rethinking healthcare exposure, this could be a good moment to explore other quality names using our healthcare stocks as a starting shortlist.

With shares near 1,062 dollars and only a small gap to Wall Street targets, yet still showing double digit earnings and revenue growth, is Eli Lilly undervalued or is the market already pricing in its next leg higher?

Most Popular Narrative: 10.7% Undervalued

Based on the most followed narrative, Eli Lilly’s fair value sits meaningfully above the last close, framing today’s price as a potential discount to long term growth.

Mounjaro/Zepbound, Lilly’s tirzepatide franchise is the engine of growth. Mounjaro (for type 2 diabetes) and Zepbound (obesity) each grew rapidly in 2024. Analysts project Mounjaro sales of $18.4 B in 2025 and $22.8B in 2026, and Zepbound jumping from $4.9B (2024) to $12.5 B in 2025 (and $18.1B in 2026). In other words, Lilly’s tirzepatide sales are expected to surpass Novo’s by 2026.

According to eat_dis_watermelon, this valuation leans on compound revenue expansion, rising margins and a rich future earnings multiple. If you are curious how those levers combine to justify a price well above today’s level, and what growth runway they are baking in over the next decade, despite rising competition and capacity constraints, you will need to unpack the full narrative to see how each assumption shapes that target.

Result: Fair Value of $1189.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there is still meaningful risk that capacity expansions slip or safety concerns flare; either of these could rapidly cool the current momentum.

Find out about the key risks to this Eli Lilly narrative.

Another Take on Valuation

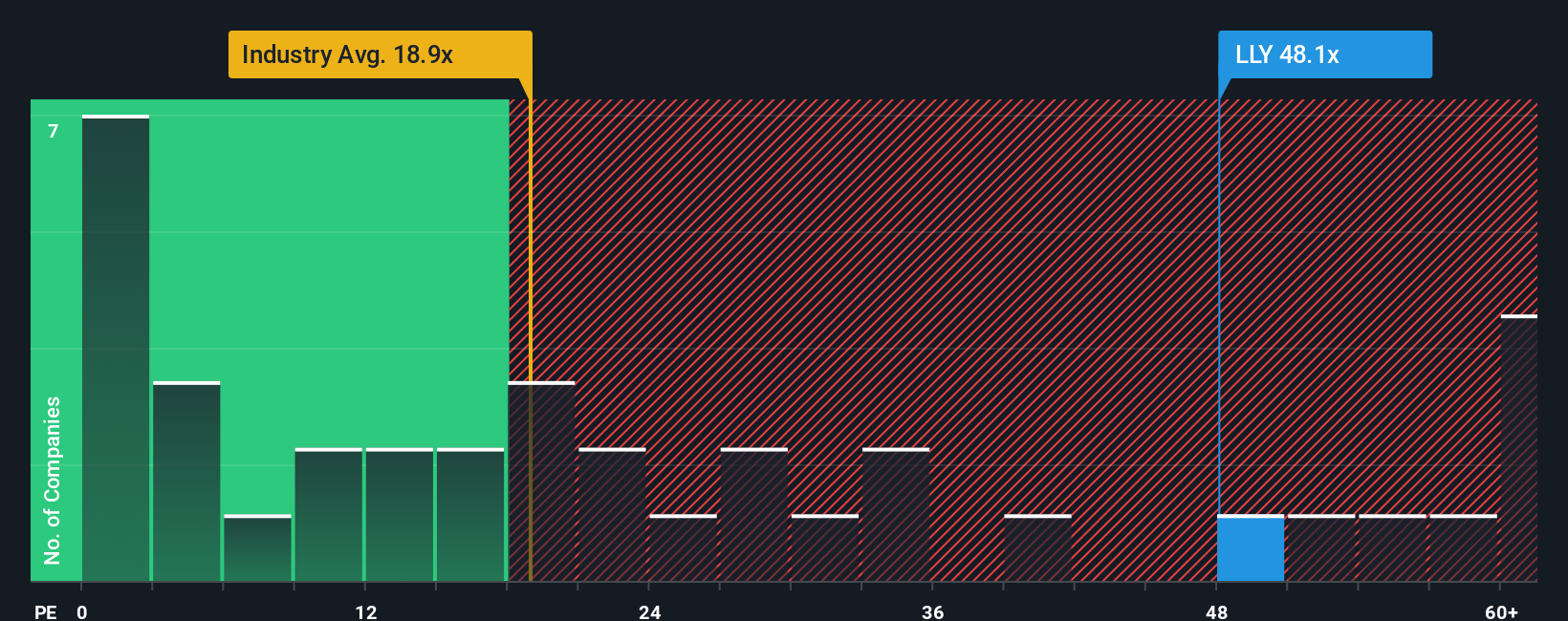

Our valuation checks paint a sharper picture. On earnings, Lilly trades at about 51.7 times profits versus a fair ratio of 43.1 and only 19.7 for the wider US pharma group, and roughly 16.8 for peers. That rich gap implies far less room for execution slip ups or GLP 1 disappointments.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Eli Lilly Narrative

If you see things differently, or prefer to dig into the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your Eli Lilly research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before momentum shifts again, take a few minutes now to line up your next opportunities with hand picked stock ideas built from the Simply Wall St Screener.

- Lock in potential value by reviewing these 908 undervalued stocks based on cash flows that may still be trading at attractive prices before the broader market catches on.

- Ride structural growth trends by targeting these 30 healthcare AI stocks using data driven insights to sharpen your edge in this transforming sector.

- Strengthen your long term income stream by focusing on these 13 dividend stocks with yields > 3% that can help compound returns through consistent cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Eli Lilly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LLY

Eli Lilly

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)