- United States

- /

- Pharma

- /

- NYSE:BMY

Bristol Myers Squibb (BMY): $6.1B One-Off Loss Undermines Recent Profitability Narrative

Reviewed by Simply Wall St

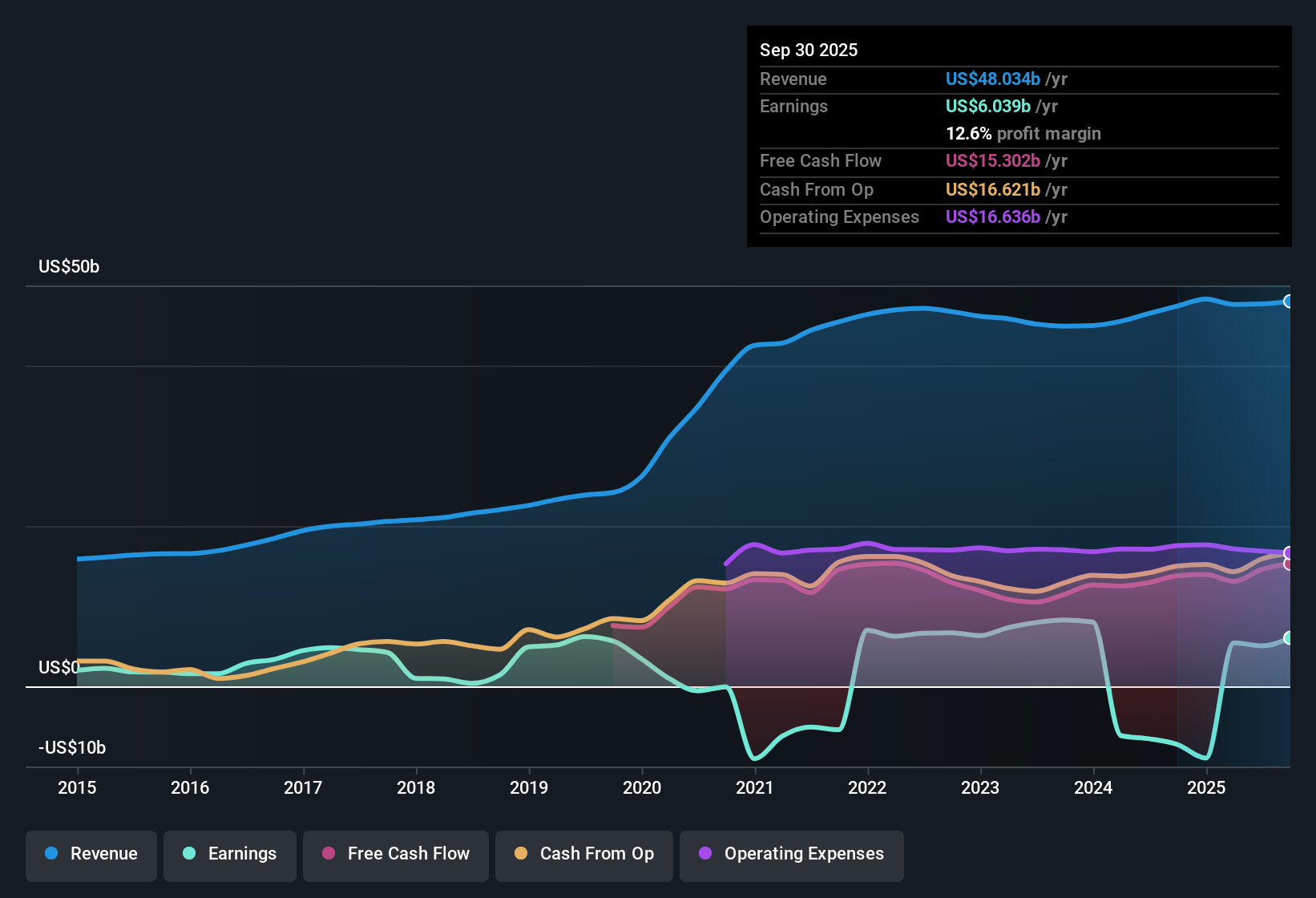

Bristol-Myers Squibb (BMY) posted a 7.8% annual earnings growth rate over the past five years and has recently returned to profitability, with net profit margins showing year-over-year improvement. The company’s latest results, however, were marked by a one-off $6.1 billion loss, and forward guidance points to a 6.3% annual decline in revenue and a 2.9% annual decrease in earnings over the next three years. Despite shares trading at $45.62, well below the estimated fair value of $132.29, the stock’s valuation appears stretched relative to peers and its industry averages based on its price-to-earnings ratio.

See our full analysis for Bristol-Myers Squibb.The next section puts these headline numbers head-to-head with the major market narratives. We examine which storylines hold up, and which may require a reality check.

See what the community is saying about Bristol-Myers Squibb

Margins Projected to More Than Double by 2028

- Profit margins are forecast to increase from 10.6% today to 22.4% within the next three years, even though both revenue and earnings are expected to decline annually by 6.3% and 2.9%, respectively.

- According to analysts' consensus view, bold pipeline expansion and clinical investment are expected to offset headwinds from upcoming patent expiries and significant U.S. price pressures.

- This margin growth is supported by new drug launches and operational streamlining. Together, these factors are viewed as helping to support long-term financial stability.

- At the same time, the company’s heavy reliance on a few blockbusters and increased regulatory scrutiny creates a situation where strong execution is critical for the margin improvement plan to succeed.

- For more on how analysts believe margin improvements could reshape the outlook, explore the full range of consensus perspectives. 📊 Read the full Bristol-Myers Squibb Consensus Narrative.

Patent Risks and Revenue Concentration Loom

- Upcoming patent cliffs, especially for top sellers such as Eliquis (expected to go generic in 2028) and Opdivo, present a significant risk of generic competition impacting future revenues, which are already projected to decrease by 4.7% per year.

- The consensus narrative notes these risks are partially offset by a robust late-stage pipeline and high-value partnerships aimed at expanding approvals and indications.

- However, any setback in major clinical trials or disappointing launches, particularly for drugs like Cobenfy, would increase Bristol-Myers Squibb’s exposure to declining sales from older products.

- Analysts are monitoring whether diversification and lifecycle management strategies will be sufficient to counter potentially steep declines from patent expiries.

Valuation Discount Versus DCF, But Not Peers

- Although the current share price is $45.62, over 65% below the DCF fair value estimate of $132.29, Bristol-Myers Squibb’s P/E ratio of 18.4x remains a premium to both its peer average (16.5x) and the U.S. Pharmaceuticals industry (18.1x).

- The analysts' consensus view highlights this tension. Bulls note the apparent deep discount to fair value, but the market’s reluctance to invest at higher levels likely reflects projected declines in key financial metrics and ongoing concerns over reduced pricing power.

- To reach the current analyst price target of $53.05, which represents a 16.3% upside from today, analysts anticipate a decrease in the forward P/E multiple over time and improvement in profit margins. Achieving this may prove challenging without clear pipeline successes.

- Investors may face a value-versus-quality decision, with an appealing entry price tempered by skepticism regarding future growth and profitability.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Bristol-Myers Squibb on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? Share your perspective in just a few minutes and shape your own view of Bristol-Myers Squibb's story. Do it your way

A great starting point for your Bristol-Myers Squibb research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Bristol-Myers Squibb faces declining revenues, margin pressure, and heavy reliance on a few drugs. These factors raise concerns about future growth and stability.

If you want to avoid stocks with falling revenues and uncertain outlooks, use stable growth stocks screener (2110 results) to zero in on companies producing dependable growth through all market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bristol-Myers Squibb might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BMY

Bristol-Myers Squibb

Bristol-Myers Squibb Company discovers, develops, licenses, manufactures, markets, distributes, and sells biopharmaceutical products worldwide.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion