- United States

- /

- Life Sciences

- /

- NYSE:A

Agilent Technologies (A) Raises 2025 Revenue Guidance With Strong Q3 US$160M Sales Surge

Reviewed by Simply Wall St

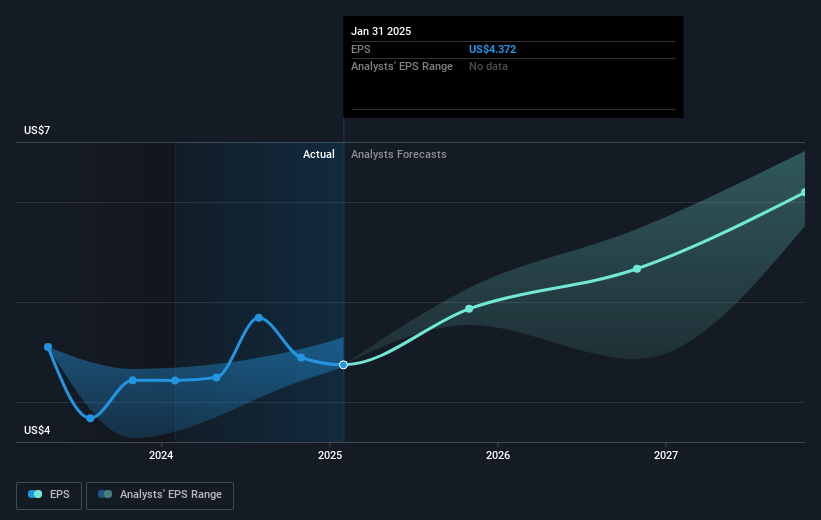

Agilent Technologies (A) recently raised its earnings guidance for fiscal year 2025, projecting revenue growth between 6.2% and 6.5%, while confirming its fourth-quarter expectations. This positive corporate guidance, along with strong third-quarter earnings where sales increased from $1,578 million to $1,738 million, and net income rose from $282 million to $336 million, likely added weight to the broader market movements. During the last quarter, the company's stock price rose by 5%, aligning closely with the general market trends, including an 18% climb over the past year and recent S&P 500 highs.

The recent positive developments at Agilent Technologies, including the raised earnings guidance and revenue growth forecasts, could further support the company's long-term growth initiatives. Agilent's focus on digital enhancements and automation, as illustrated by the Ignite transformation and partnerships, suggests potential for increased revenues and expanded margins. Over the past five years, Agilent's total shareholder return, including share price appreciation and dividends, was 18.71%. This longer-term performance provides a sturdy backdrop for assessing the impact of recent news.

In the past year, Agilent's share price climbed by 18%, closely aligning with broader market bullish trends, albeit underperforming the US market which had a 16.2% increase. Despite facing some challenges, such as currency fluctuations and economic uncertainties, the company's strategic initiatives might sustain its growth trajectory. With current analyst consensus indicating a future PE ratio of 27.9 times earnings by 2028, there's a potential alignment towards a price target of US$137.57. The current share price at US$118.69 reveals a 14% discount to this target, providing insights into potential market opportunities while considering the risks associated with global economic dynamics.

Assess Agilent Technologies' previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:A

Agilent Technologies

Provides application focused solutions to the life sciences, diagnostics, and applied chemical markets worldwide.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026