- United States

- /

- Biotech

- /

- NasdaqGM:ZLAB

We're Hopeful That Zai Lab (NASDAQ:ZLAB) Will Use Its Cash Wisely

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

Given this risk, we thought we'd take a look at whether Zai Lab (NASDAQ:ZLAB) shareholders should be worried about its cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

Check out our latest analysis for Zai Lab

How Long Is Zai Lab's Cash Runway?

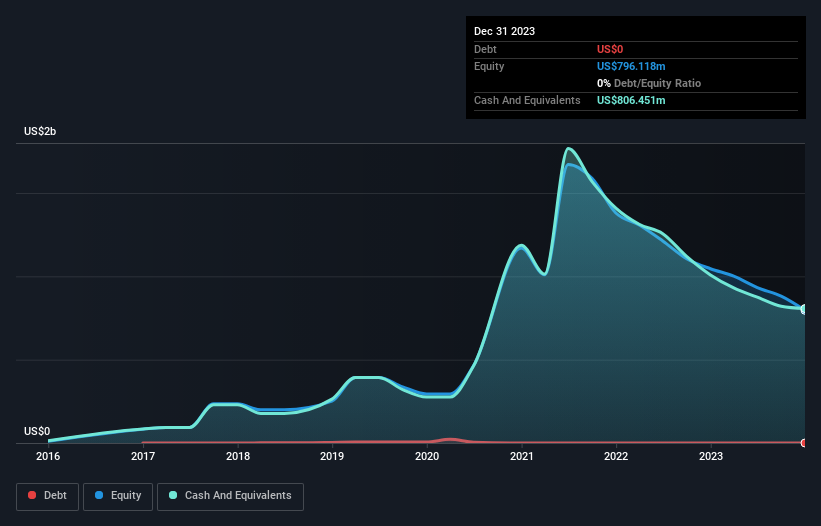

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. When Zai Lab last reported its December 2023 balance sheet in February 2024, it had zero debt and cash worth US$806m. Importantly, its cash burn was US$193m over the trailing twelve months. So it had a cash runway of about 4.2 years from December 2023. Notably, however, analysts think that Zai Lab will break even (at a free cash flow level) before then. If that happens, then the length of its cash runway, today, would become a moot point. Depicted below, you can see how its cash holdings have changed over time.

How Well Is Zai Lab Growing?

We reckon the fact that Zai Lab managed to shrink its cash burn by 51% over the last year is rather encouraging. And considering that its operating revenue gained 24% during that period, that's great to see. We think it is growing rather well, upon reflection. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Easily Can Zai Lab Raise Cash?

We are certainly impressed with the progress Zai Lab has made over the last year, but it is also worth considering how costly it would be if it wanted to raise more cash to fund faster growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Zai Lab's cash burn of US$193m is about 12% of its US$1.6b market capitalisation. Given that situation, it's fair to say the company wouldn't have much trouble raising more cash for growth, but shareholders would be somewhat diluted.

Is Zai Lab's Cash Burn A Worry?

As you can probably tell by now, we're not too worried about Zai Lab's cash burn. For example, we think its cash runway suggests that the company is on a good path. Its cash burn relative to its market cap wasn't quite as good, but was still rather encouraging! Shareholders can take heart from the fact that analysts are forecasting it will reach breakeven. Looking at all the measures in this article, together, we're not worried about its rate of cash burn; the company seems well on top of its medium-term spending needs. Readers need to have a sound understanding of business risks before investing in a stock, and we've spotted 2 warning signs for Zai Lab that potential shareholders should take into account before putting money into a stock.

Of course Zai Lab may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Zai Lab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:ZLAB

Zai Lab

A biopharmaceutical company, focuses on discovering, developing, and commercializing products that address medical conditions in the areas of oncology, immunology, neuroscience, and infectious diseases.

High growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)