- United States

- /

- Biotech

- /

- NasdaqCM:VXRT

While shareholders of Vaxart (NASDAQ:VXRT) are in the black over 5 years, those who bought a week ago aren't so fortunate

The Vaxart, Inc. (NASDAQ:VXRT) share price has had a bad week, falling 13%. But in stark contrast, the returns over the last half decade have impressed. We think most investors would be happy with the 109% return, over that period. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. Only time will tell if there is still too much optimism currently reflected in the share price. While the returns over the last 5 years have been good, we do feel sorry for those shareholders who haven't held shares that long, because the share price is down 89% in the last three years.

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

See our latest analysis for Vaxart

Because Vaxart made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last half decade Vaxart's revenue has actually been trending down at about 6.8% per year. On the other hand, the share price done the opposite, gaining 16%, compound, each year. It's a good reminder that expectations about the future, not the past history, always impact share prices. Still, we are a bit cautious in this kind of situation.

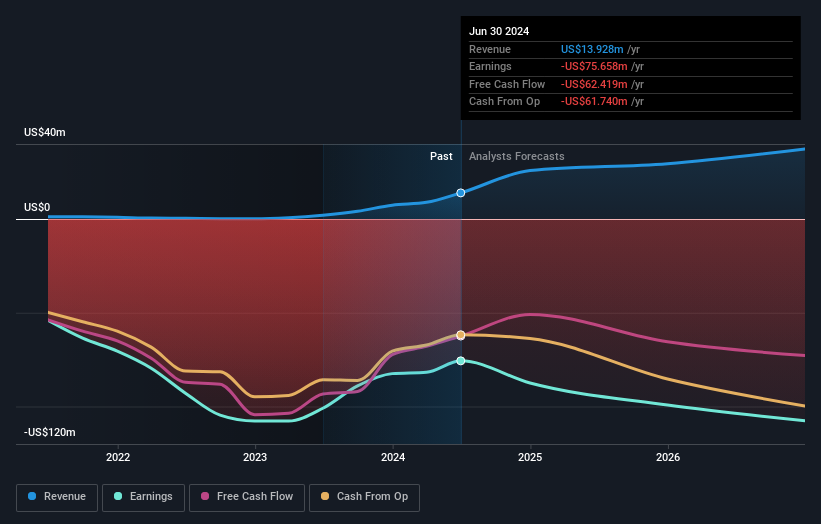

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Vaxart's financial health with this free report on its balance sheet.

A Different Perspective

Vaxart shareholders are up 1.4% for the year. But that was short of the market average. If we look back over five years, the returns are even better, coming in at 16% per year for five years. Maybe the share price is just taking a breather while the business executes on its growth strategy. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 4 warning signs for Vaxart (1 is concerning) that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:VXRT

Vaxart

A clinical-stage biotechnology company, discovers and develops oral recombinant protein vaccines based on its vector-adjuvant-antigen standardized technology proprietary oral vaccine platform in the United States.

Excellent balance sheet and good value.

Market Insights

Community Narratives