- United States

- /

- Biotech

- /

- NasdaqGM:ZNTL

US Exchange Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

The U.S. stock market has recently experienced volatility, with the Nasdaq Composite and S&P 500 indices declining sharply due to concerns over China's advancements in artificial intelligence. Amidst these fluctuations, investors are increasingly exploring diverse opportunities, including penny stocks—an investment area that continues to intrigue despite its somewhat outdated terminology. These stocks often represent smaller or newer companies and can offer a blend of affordability and growth potential, particularly when they possess strong financials and promising business models.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $128.29M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.86 | $6.22M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.80 | $11.49M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.97 | $2.18B | ★★★★☆☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2874 | $10.58M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.48 | $49.83M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.03 | $60.21M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.30 | $23.41M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8893 | $80.06M | ★★★★★☆ |

Click here to see the full list of 713 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

MediciNova (NasdaqGM:MNOV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MediciNova, Inc. is a biopharmaceutical company that develops novel and small molecule therapeutics for treating serious diseases with unmet medical needs in the United States, with a market cap of approximately $92.70 million.

Operations: MediciNova, Inc. does not have any reported revenue segments.

Market Cap: $92.7M

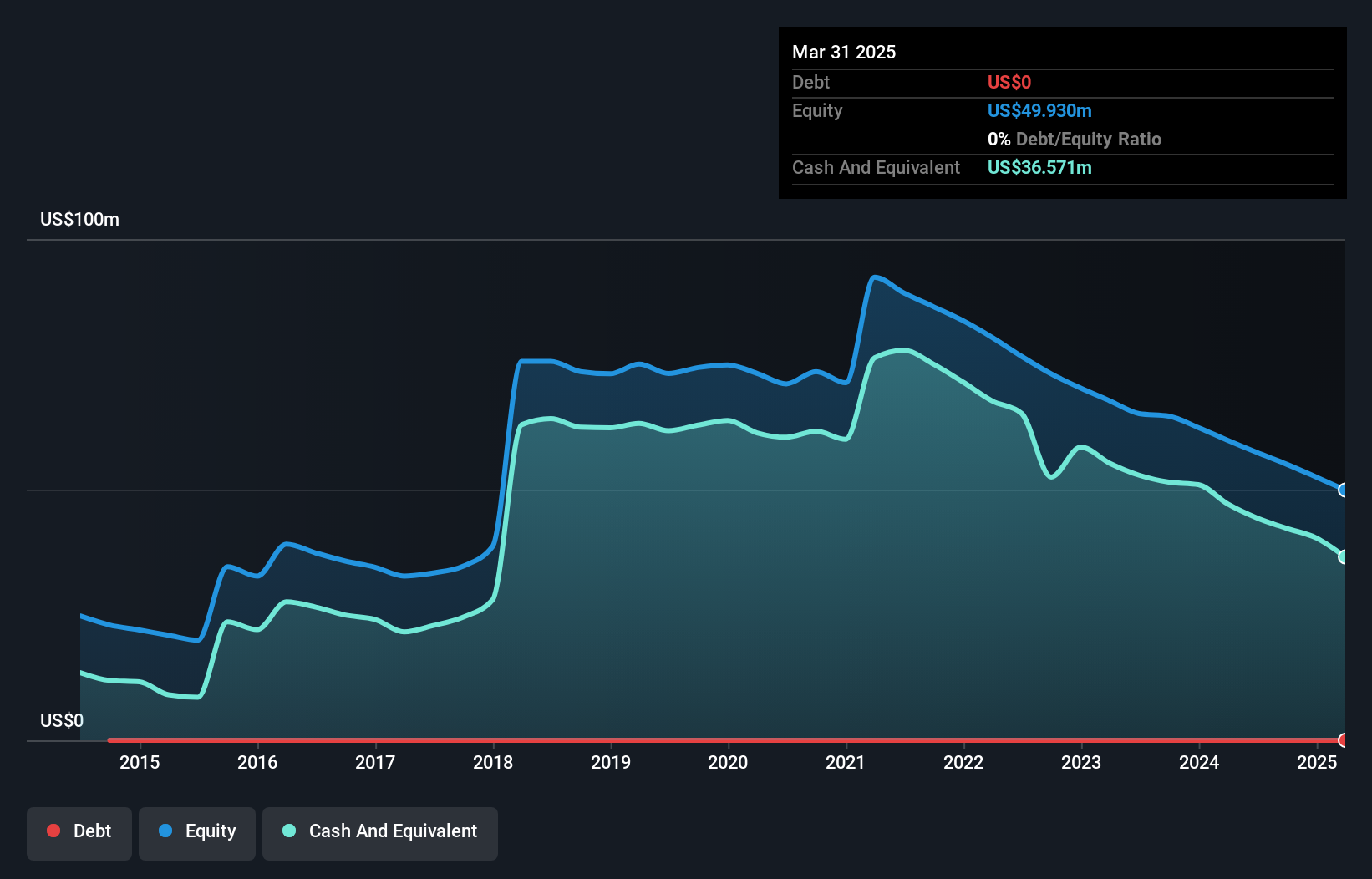

MediciNova, Inc., with a market cap of approximately US$92.70 million, is pre-revenue and unprofitable but has managed to reduce its losses annually over the past five years. The company maintains a strong cash position with no debt and has sufficient cash runway for more than three years at current free cash flow rates. Recent developments include receiving a Notice of Allowance from the USPTO for MN-001 (Tipelukast), which could provide long-term intellectual property protection until 2042, highlighting potential growth in their therapeutic pipeline despite current financial challenges. However, volatility remains high and earnings are forecasted to decline.

- Navigate through the intricacies of MediciNova with our comprehensive balance sheet health report here.

- Gain insights into MediciNova's outlook and expected performance with our report on the company's earnings estimates.

Vanda Pharmaceuticals (NasdaqGM:VNDA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vanda Pharmaceuticals Inc. is a biopharmaceutical company dedicated to developing and commercializing therapies for high unmet medical needs globally, with a market cap of $256.56 million.

Operations: The company's revenue is derived from its Biotechnology (Startups) segment, which generated $190.86 million.

Market Cap: $256.56M

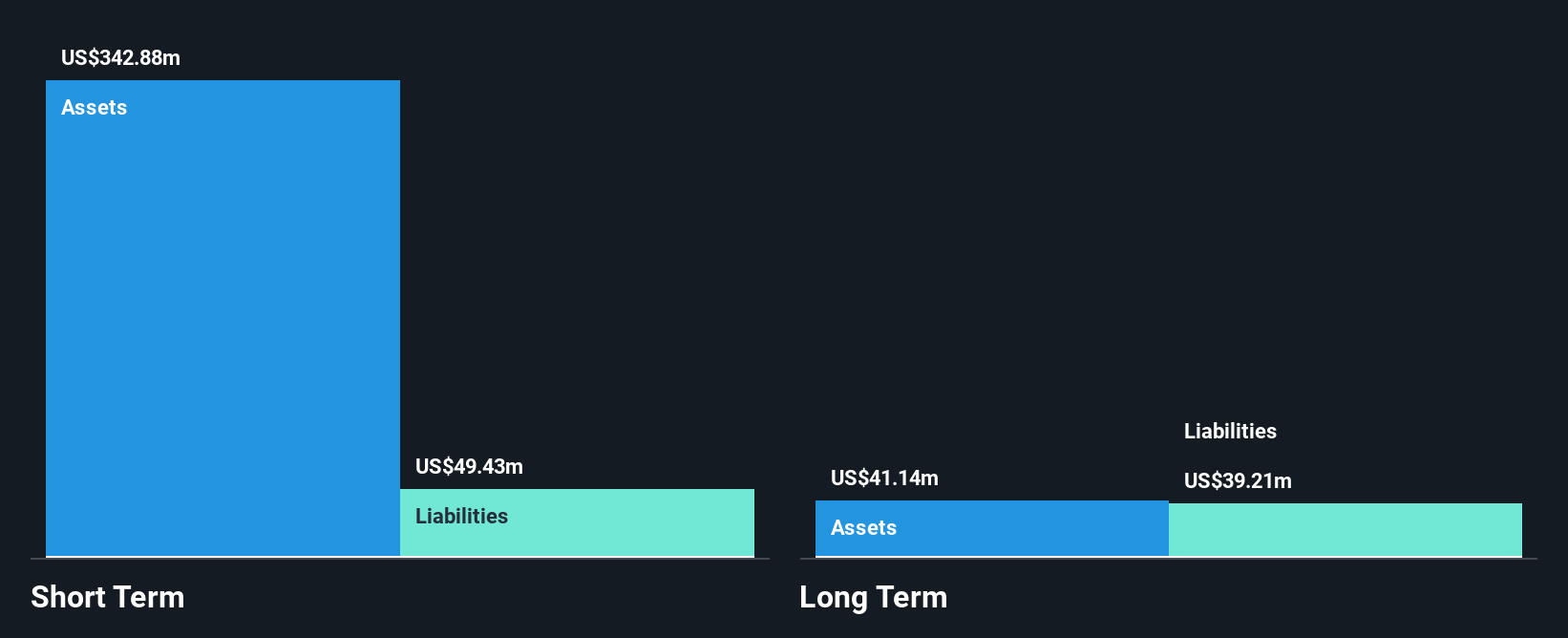

Vanda Pharmaceuticals, with a market cap of US$256.56 million, faces challenges as its tradipitant drug application was rejected by the FDA, despite showing statistically significant results in studies. The company remains unprofitable with increasing losses over five years but maintains a strong cash position without debt and has short-term assets exceeding liabilities. Recent earnings showed revenue growth to US$47.65 million for Q3 2024, yet a net loss of US$5.32 million was reported. Vanda's management and board are experienced, and the company is trading at a substantial discount to estimated fair value while revising revenue guidance upwards for 2024.

- Jump into the full analysis health report here for a deeper understanding of Vanda Pharmaceuticals.

- Assess Vanda Pharmaceuticals' future earnings estimates with our detailed growth reports.

Zentalis Pharmaceuticals (NasdaqGM:ZNTL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zentalis Pharmaceuticals, Inc. is a clinical-stage biopharmaceutical company dedicated to discovering and developing small molecule therapeutics for cancer treatment, with a market cap of approximately $158.21 million.

Operations: Zentalis Pharmaceuticals, Inc. currently does not report any revenue segments.

Market Cap: $158.21M

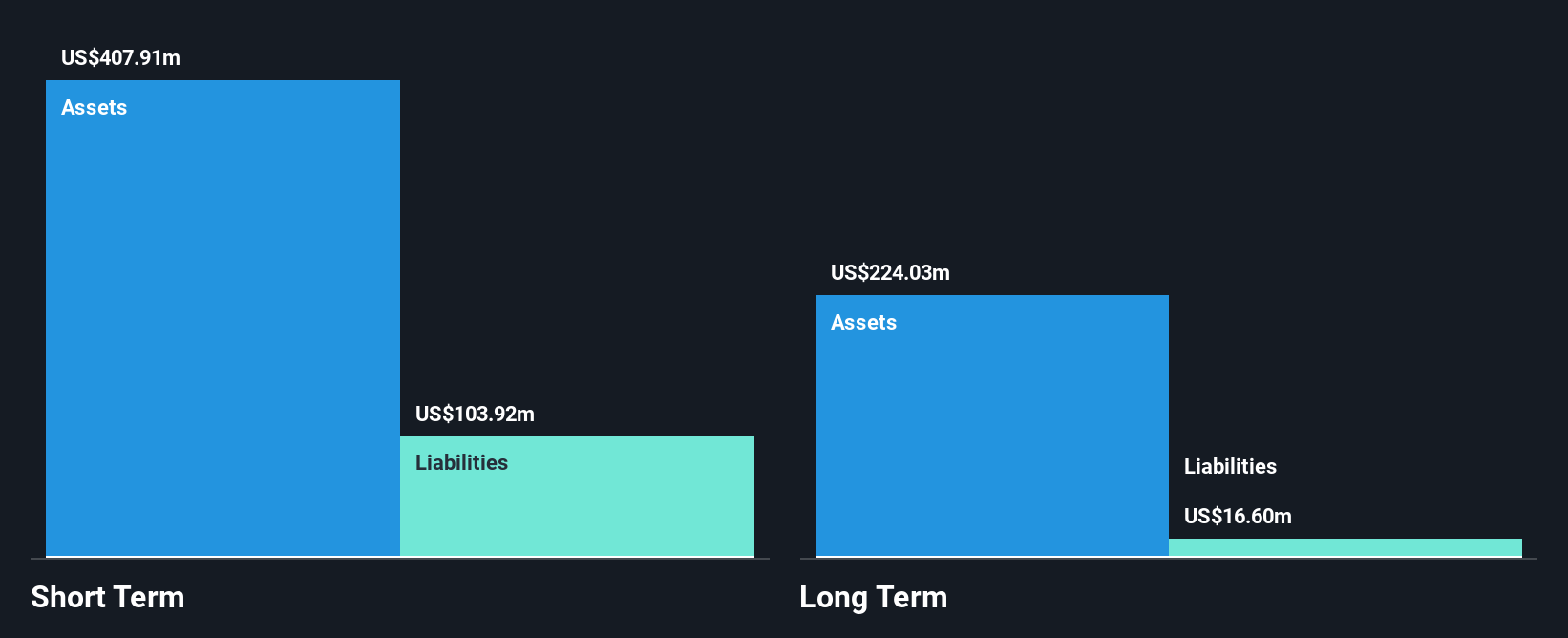

Zentalis Pharmaceuticals, with a market cap of US$158.21 million, is pre-revenue and currently unprofitable, though its short-term assets of US$400.3 million comfortably exceed both short- and long-term liabilities. The company has no debt and has not diluted shareholder value recently. Despite a volatile share price, Zentalis trades significantly below estimated fair value compared to peers. Recent FDA Fast Track Designation for its lead drug candidate azenosertib highlights potential in cancer therapeutics development. However, the management team is relatively new with an average tenure under two years, suggesting ongoing strategic adjustments within the company.

- Click to explore a detailed breakdown of our findings in Zentalis Pharmaceuticals' financial health report.

- Learn about Zentalis Pharmaceuticals' future growth trajectory here.

Key Takeaways

- Take a closer look at our US Penny Stocks list of 713 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zentalis Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ZNTL

Zentalis Pharmaceuticals

A clinical-stage biopharmaceutical company, focuses on discovering and developing small molecule therapeutics for the treatment of various cancers.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives