- United States

- /

- Biotech

- /

- NasdaqGS:UPB

Why Upstream Bio (UPB) Is Up 14.0% After Positive Phase 2 Verekitug Data and Novel Dosing Approach

Reviewed by Sasha Jovanovic

- At the recent European Respiratory Society Congress, Upstream Bio presented new mechanistic and structural data on verekitug, its TSLP receptor-targeting therapy, alongside positive Phase 2 results in chronic rhinosinusitis with nasal polyps using 12-week dosing intervals.

- This distinct receptor-targeting approach, compared to conventional TSLP ligand therapies, could offer meaningful benefits including less frequent dosing for patients with inflammatory respiratory diseases.

- We'll explore how verekitug’s long-lasting TSLP receptor inhibition is influencing Upstream Bio's investment narrative and future prospects.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Upstream Bio's Investment Narrative?

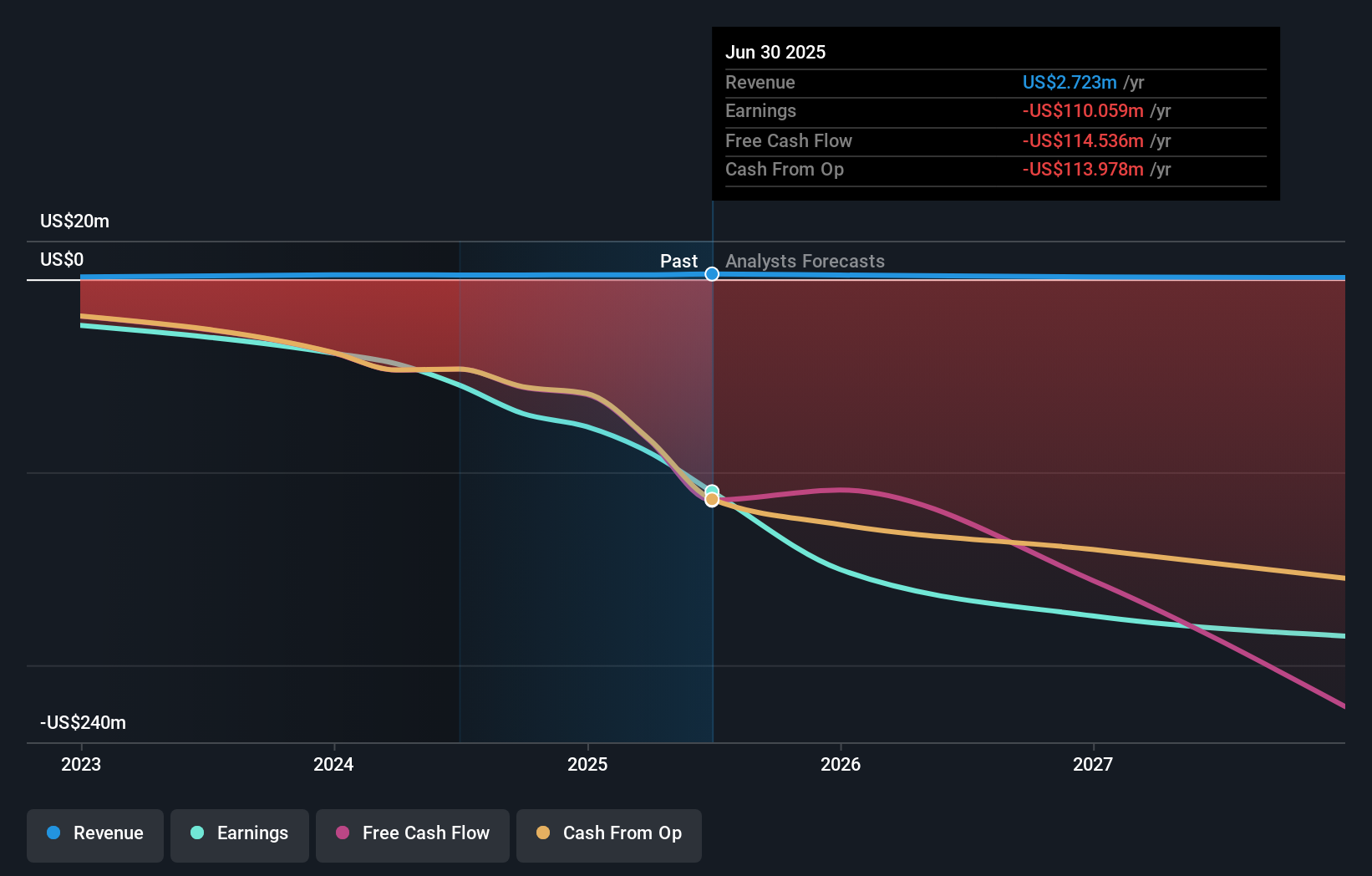

For investors considering Upstream Bio, the core thesis revolves around verekitug’s ability to address large unmet needs in respiratory diseases by uniquely targeting the TSLP receptor, with the promise of less frequent dosing and broad clinical impact. The recent ERS Congress data add weight, as they show rapid, potent, and long-lasting receptor inhibition, backing up the positive Phase 2 VIBrant trial results. This bolsters the pipeline’s credibility and may accelerate investor attention toward late-stage assets. The biggest short-term catalyst remains Phase 2 readouts in severe asthma and COPD. Following the latest news, confidence in the program may increase, but it also raises the stakes, regulatory risk and competition with established therapies still dominate, especially with profitability a distant prospect and share price volatility evident. If these new data push expectations higher, any misstep could have outsized impact on sentiment.

However, it’s crucial to remember that UPB remains unprofitable and faces regulatory uncertainties as trials advance.

Exploring Other Perspectives

Explore another fair value estimate on Upstream Bio - why the stock might be worth just $50.67!

Build Your Own Upstream Bio Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Upstream Bio research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Upstream Bio research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Upstream Bio's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UPB

Upstream Bio

A clinical-stage biotechnology company, develops treatments for inflammatory diseases focusing on severe respiratory disorders.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives