- United States

- /

- Pharma

- /

- NasdaqGS:TLRY

Undervalued Small Caps With Insider Buying Across Regions

Reviewed by Simply Wall St

In recent days, the U.S. stock market has experienced significant volatility, with major indices like the Nasdaq and S&P 500 rebounding sharply following a softer tone from President Trump on trade tensions with China. This environment of fluctuating market sentiment underscores the potential opportunities within small-cap stocks, particularly those that may be undervalued and are experiencing insider buying. Identifying such stocks requires a keen understanding of market dynamics and economic indicators that influence small-cap performance.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Limbach Holdings | 30.3x | 1.9x | 41.17% | ★★★★★★ |

| Citizens & Northern | 11.3x | 2.8x | 41.82% | ★★★★★☆ |

| PCB Bancorp | 9.3x | 2.8x | 37.04% | ★★★★★☆ |

| Peoples Bancorp | 9.9x | 1.8x | 45.20% | ★★★★★☆ |

| First Northern Community Bancorp | 9.8x | 2.8x | 47.30% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.6x | 36.92% | ★★★★☆☆ |

| Arrow Financial | 14.3x | 3.1x | 22.24% | ★★★☆☆☆ |

| Farmland Partners | 6.7x | 8.2x | -39.75% | ★★★☆☆☆ |

| LifeStance Health Group | NA | 1.5x | 14.84% | ★★★☆☆☆ |

| Tilray Brands | NA | 2.3x | -47.72% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

Limbach Holdings (LMB)

Simply Wall St Value Rating: ★★★★★★

Overview: Limbach Holdings specializes in providing mechanical, electrical, and plumbing services with a focus on owner direct relationships and general contractor relationships, and has a market cap of approximately $0.13 billion.

Operations: Limbach Holdings generates revenue primarily through Owner Direct Relationships (ODR) and General Contractor Relationships (GCR), with recent figures showing $387.83 million from ODR and $165.09 million from GCR. The company's gross profit margin has shown a notable increase, reaching 28.26% as of the latest period in 2025, up from earlier periods such as 20.21% in early 2023. Operating expenses are a significant component of costs, with general and administrative expenses being a substantial part of this category, amounting to $104.30 million in the most recent data available for 2025.

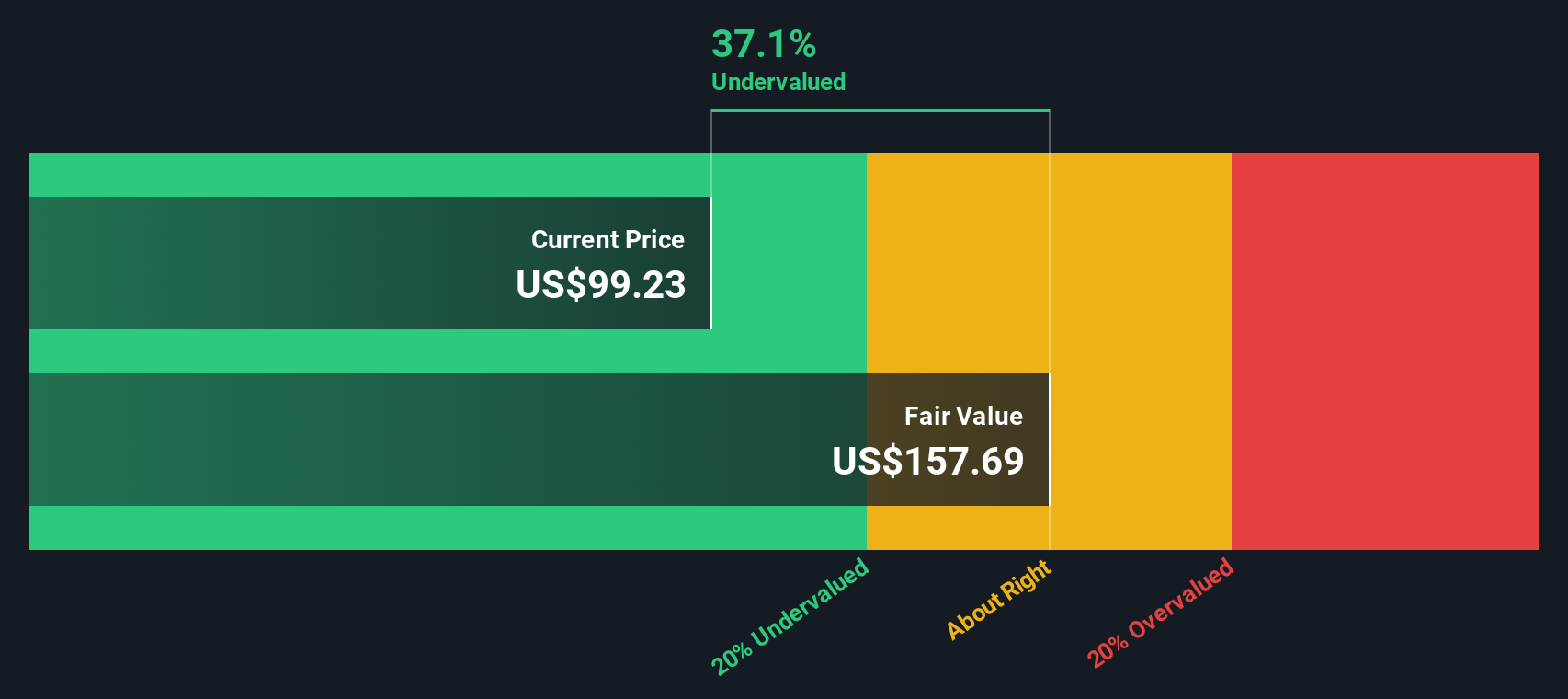

PE: 30.3x

Limbach Holdings, a U.S. company with a market cap under $1 billion, is gaining attention for its potential growth. Recent insider confidence is evident as they purchased shares between July and September 2025. The company's earnings guidance for 2025 has been revised upwards to US$650 million - US$680 million, reflecting strong sales performance in Q2 with revenues of US$142 million compared to last year's US$122 million. Earnings are forecasted to grow by over 22% annually despite reliance on external borrowing for funding.

- Delve into the full analysis valuation report here for a deeper understanding of Limbach Holdings.

Understand Limbach Holdings' track record by examining our Past report.

Tilray Brands (TLRY)

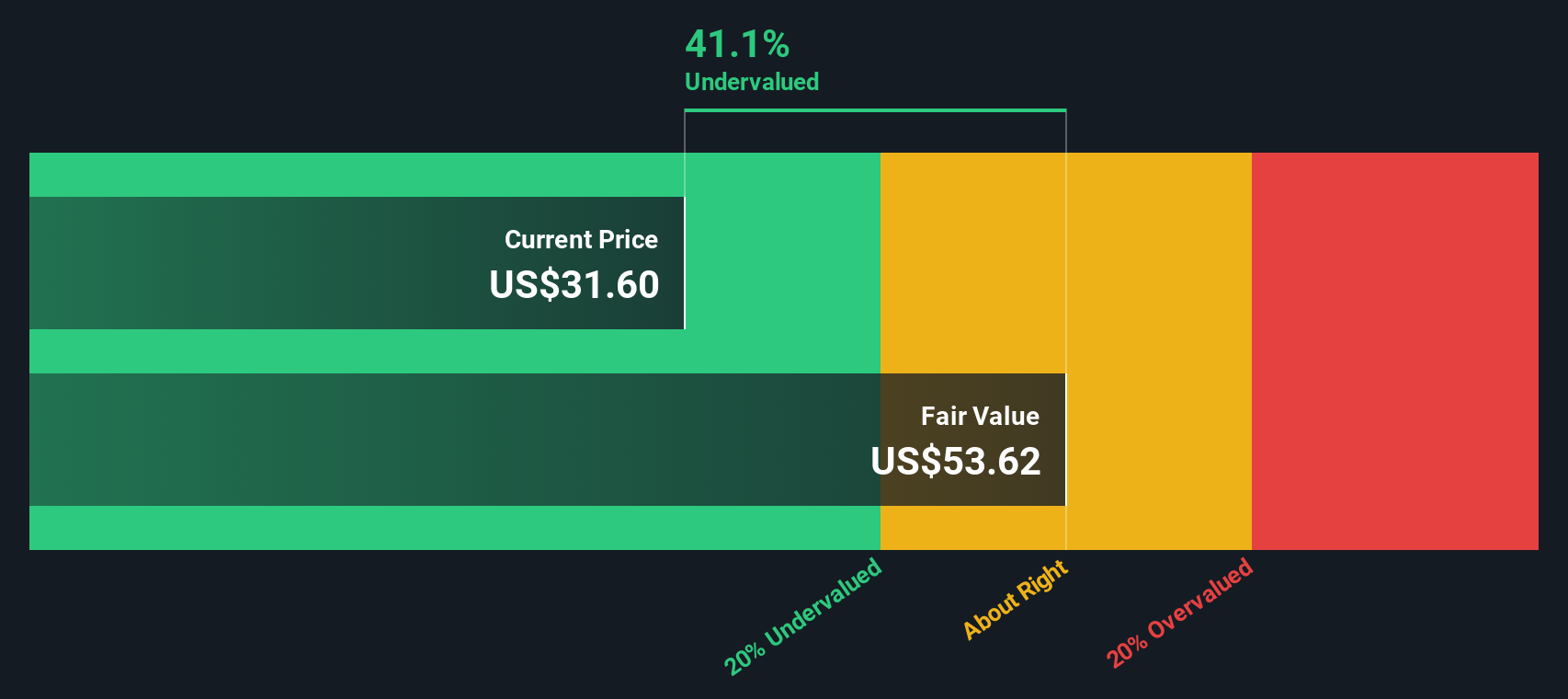

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Tilray Brands is a diversified company engaged in the cannabis, wellness, distribution, and beverage alcohol sectors with a market cap of approximately $1.50 billion.

Operations: Tilray Brands generates revenue primarily from four segments: cannabis, wellness, distribution, and beverage alcohol. The company reported a gross profit margin of 29.86% for the period ending May 2024. Operating expenses are significant, with general and administrative costs being the largest component followed by sales and marketing expenses.

PE: -0.9x

Tilray Brands, a cannabis-focused company, is expanding its medical operations into Panama through a joint venture with Top Tech Global Inc., enhancing its international footprint. Despite reporting a net loss of US$0.32 million for Q1 2025, an improvement from the previous year's US$39.17 million loss, the company remains unprofitable and relies on higher-risk external borrowing for funding. Insider confidence is evident as Irwin Simon purchased 165,000 shares in September 2025.

- Navigate through the intricacies of Tilray Brands with our comprehensive valuation report here.

Review our historical performance report to gain insights into Tilray Brands''s past performance.

Bar Harbor Bankshares (BHB)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Bar Harbor Bankshares operates in the community banking industry, providing financial services and products, with a market capitalization of approximately $0.36 billion.

Operations: The company's revenue primarily comes from its community banking operations, with recent figures showing $147.01 million in revenue. Operating expenses are significant, with general and administrative expenses being a major component, reaching $78.15 million in the latest period. The net income margin has shown variability but was recorded at 26.86% most recently, indicating profitability challenges despite consistent gross profit margins of 100%.

PE: 12.3x

Bar Harbor Bankshares, a smaller player in the financial sector, has recently caught attention due to insider confidence. Independent Director Brian Shaw increased their stake by purchasing 10,000 shares for approximately US$320,850 between July and August 2025. Despite a dip in net income to US$6.09 million for Q2 2025 from US$10.26 million the previous year, earnings are projected to grow annually by over 18%. The company also affirmed a quarterly dividend of US$0.32 per share payable September 12, reflecting steady shareholder returns amidst evolving board dynamics with James E. Graham's recent appointment post-merger integration.

Turning Ideas Into Actions

- Explore the 77 names from our Undervalued US Small Caps With Insider Buying screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tilray Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TLRY

Tilray Brands

A lifestyle consumer products company, engages in the research, cultivation, processing, and distribution of medical cannabis products in Canada, the United States, Europe, the Middle East, Africa, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives