- United States

- /

- Banks

- /

- NYSEAM:BHB

3 Undervalued Small Caps With Insider Buying Across Regions

Reviewed by Simply Wall St

As the U.S. stock market navigates a landscape of mixed signals, with the Nasdaq reaching new heights while inflation data and interest rate expectations loom large, small-cap stocks are attracting attention for their potential resilience and growth opportunities. In such a climate, identifying promising small-cap companies involves looking at factors like insider buying trends and regional diversification, which can offer valuable insights into a company's perceived value and future prospects.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Angel Oak Mortgage REIT | 6.2x | 4.0x | 32.41% | ★★★★★★ |

| PCB Bancorp | 10.0x | 3.0x | 32.62% | ★★★★★☆ |

| Citizens & Northern | 11.6x | 2.9x | 39.76% | ★★★★☆☆ |

| Limbach Holdings | 34.9x | 2.2x | 32.96% | ★★★★☆☆ |

| First Northern Community Bancorp | 9.4x | 2.7x | 49.82% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 30.46% | ★★★★☆☆ |

| Tilray Brands | NA | 1.5x | 4.96% | ★★★★☆☆ |

| Industrial Logistics Properties Trust | NA | 1.0x | 14.43% | ★★★★☆☆ |

| Shore Bancshares | 10.6x | 2.7x | -91.58% | ★★★☆☆☆ |

| Farmland Partners | 7.2x | 8.7x | -47.21% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

Limbach Holdings (LMB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Limbach Holdings is a company that specializes in mechanical, electrical, and plumbing services for both owner direct relationships and general contractor relationships, with a market capitalization of approximately $145.56 million.

Operations: Limbach Holdings generates revenue primarily through Owner Direct Relationships (ODR) and General Contractor Relationships (GCR), with ODR contributing a significant portion. The company has shown an upward trend in its gross profit margin, reaching 28.26% by the latest period. Operating expenses have also increased over time, impacting overall profitability.

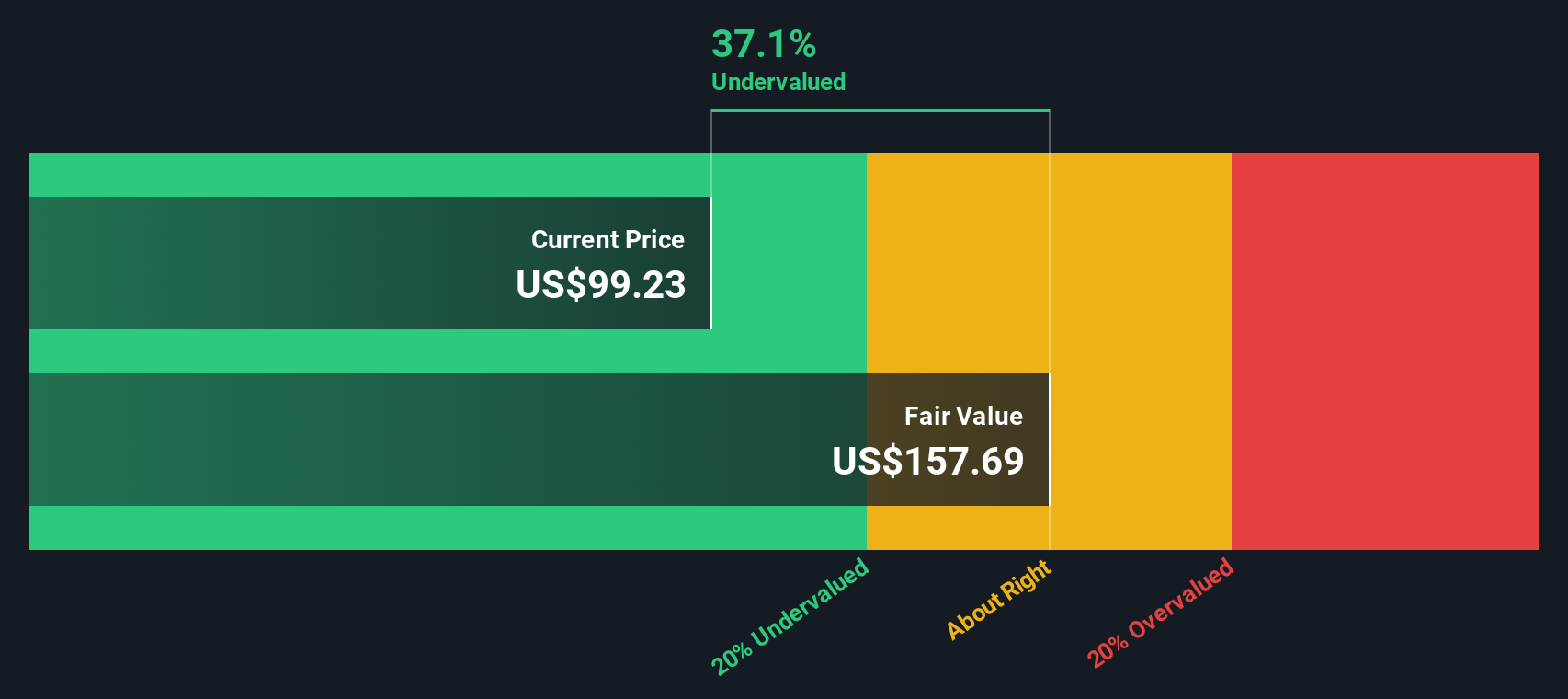

PE: 34.9x

Limbach Holdings, a small-cap company, shows potential as an undervalued investment. Recent insider confidence is evident with share purchases in the past six months. The company reported Q2 2025 sales of US$142 million, up from US$122 million a year prior, and net income rose to US$7.8 million from US$6 million. They raised their 2025 revenue guidance to between US$650 and US$680 million. Despite relying on external borrowing for funding, Limbach's earnings are projected to grow annually by 22%.

- Navigate through the intricacies of Limbach Holdings with our comprehensive valuation report here.

Understand Limbach Holdings' track record by examining our Past report.

Tilray Brands (TLRY)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Tilray Brands operates in the beverage, cannabis, wellness, and distribution sectors with a focus on developing and selling products across these categories; it has a market capitalization of approximately $1.64 billion.

Operations: Tilray Brands generates revenue primarily from its Cannabis, Beverage, Wellness, and Distribution segments. The company's gross profit margin has shown fluctuations over time, reaching 30.95% in the latest period. Operating expenses are a significant component of costs, with General & Administrative and Sales & Marketing being notable contributors.

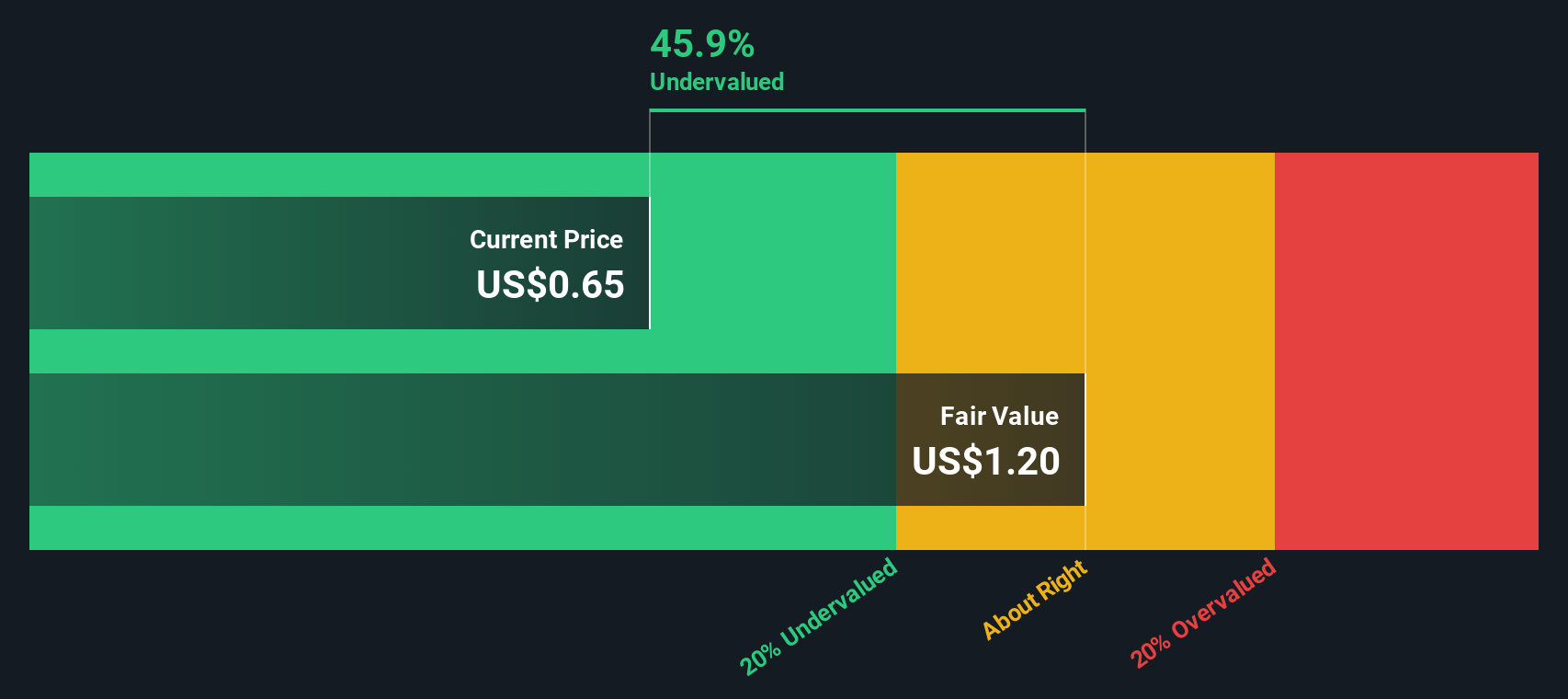

PE: -0.6x

Tilray Brands, a player in the cannabis industry, has seen insider confidence with Irwin Simon purchasing 165,000 shares valued at US$100,106. Despite recent financial challenges including a significant net loss of US$1.27 billion for Q4 ending May 2025 and impairment charges of US$1.4 billion, Tilray is expanding its product lineup in Germany and the U.S., introducing new medical cannabis strains and Delta-9 THC beverages. The company is actively seeking acquisitions to leverage its balance sheet strength for future growth opportunities while navigating market volatility and exploring reverse stock split options to maintain Nasdaq listing compliance.

Bar Harbor Bankshares (BHB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bar Harbor Bankshares operates primarily in the community banking industry, providing financial services and products, with a market capitalization of $0.33 billion.

Operations: Bar Harbor Bankshares generates revenue primarily from the community banking sector, with recent figures showing $147.01 million in revenue. The company's net income margin has shown variability, reaching 31.20% in March 2023 and adjusting to 26.86% by June 2025, reflecting changes in profitability over time. Operating expenses are a significant cost factor, consistently comprising a large portion of total expenses, with general and administrative costs accounting for a substantial part of these expenses.

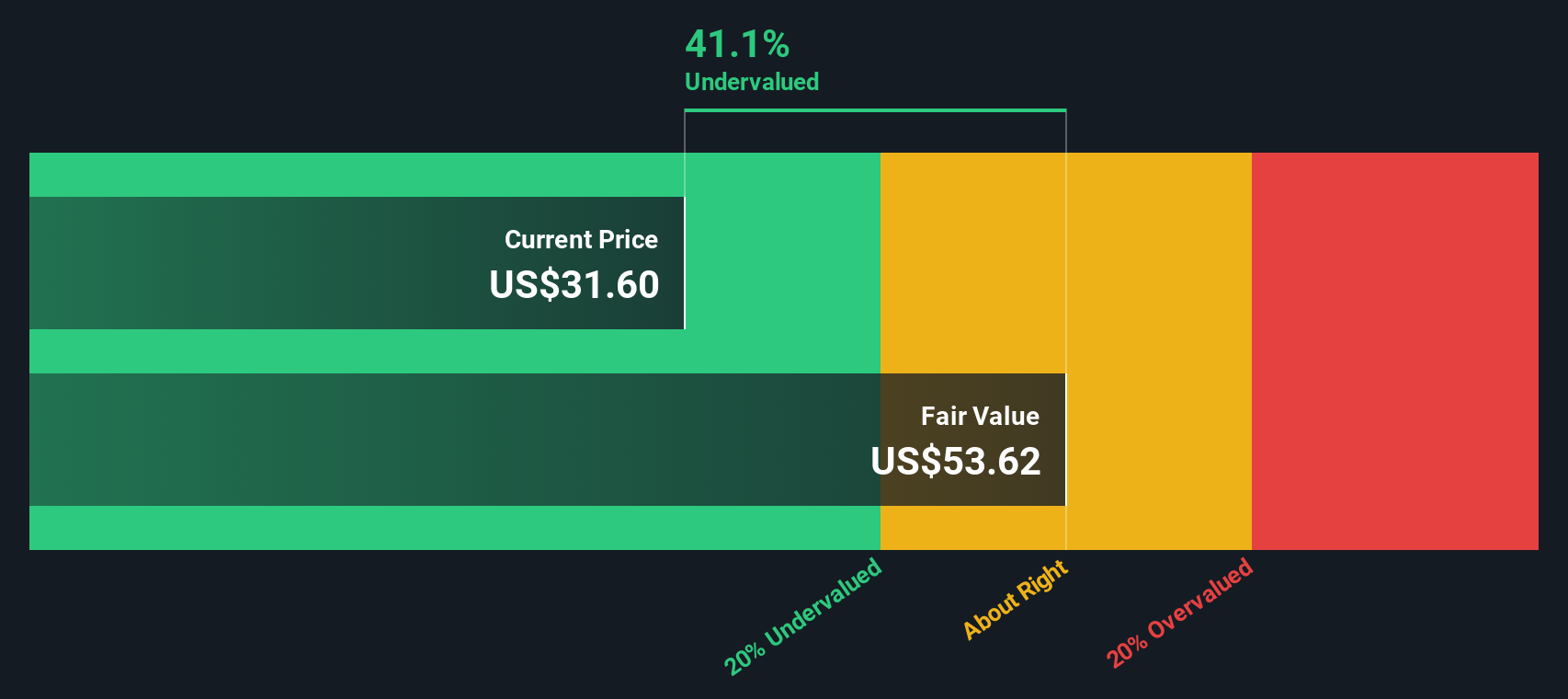

PE: 13.7x

Bar Harbor Bankshares, a smaller player in the financial sector, recently reported a dip in net income to US$6.09 million for Q2 2025 from US$10.26 million the previous year, reflecting some financial challenges. Despite this, insider confidence is evident with recent share purchases by key individuals. The appointment of James E. Graham to the board following a merger signals potential strategic shifts and growth opportunities. Earnings are projected to grow at an annual rate of 25%, suggesting future potential amidst current undervaluation concerns.

- Dive into the specifics of Bar Harbor Bankshares here with our thorough valuation report.

Evaluate Bar Harbor Bankshares' historical performance by accessing our past performance report.

Where To Now?

- Explore the 73 names from our Undervalued US Small Caps With Insider Buying screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bar Harbor Bankshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:BHB

Bar Harbor Bankshares

Operates as the holding company for Bar Harbor Bank & Trust that provides banking and nonbanking products and services primarily to consumers and businesses.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives