- United States

- /

- Capital Markets

- /

- NYSE:PEO

US Market's Undiscovered Gems Featuring Three Promising Small Caps

Reviewed by Simply Wall St

As the U.S. market navigates through a mixed landscape of inflation data and fluctuating indices, small-cap stocks are drawing attention for their potential amidst broader economic shifts. In this dynamic environment, identifying promising small caps involves looking for companies with strong fundamentals and growth potential that can thrive regardless of market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| West Bancorporation | 169.96% | -1.41% | -8.52% | ★★★★★★ |

| Morris State Bancshares | 9.62% | 4.26% | 5.10% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| Senstar Technologies | NA | -20.82% | 14.32% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| China SXT Pharmaceuticals | 64.25% | -29.05% | 10.33% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Vantage | 6.72% | -16.62% | -15.47% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

SIGA Technologies (SIGA)

Simply Wall St Value Rating: ★★★★★★

Overview: SIGA Technologies, Inc. is a commercial-stage pharmaceutical company specializing in the health security market in the United States, with a market cap of approximately $483.66 million.

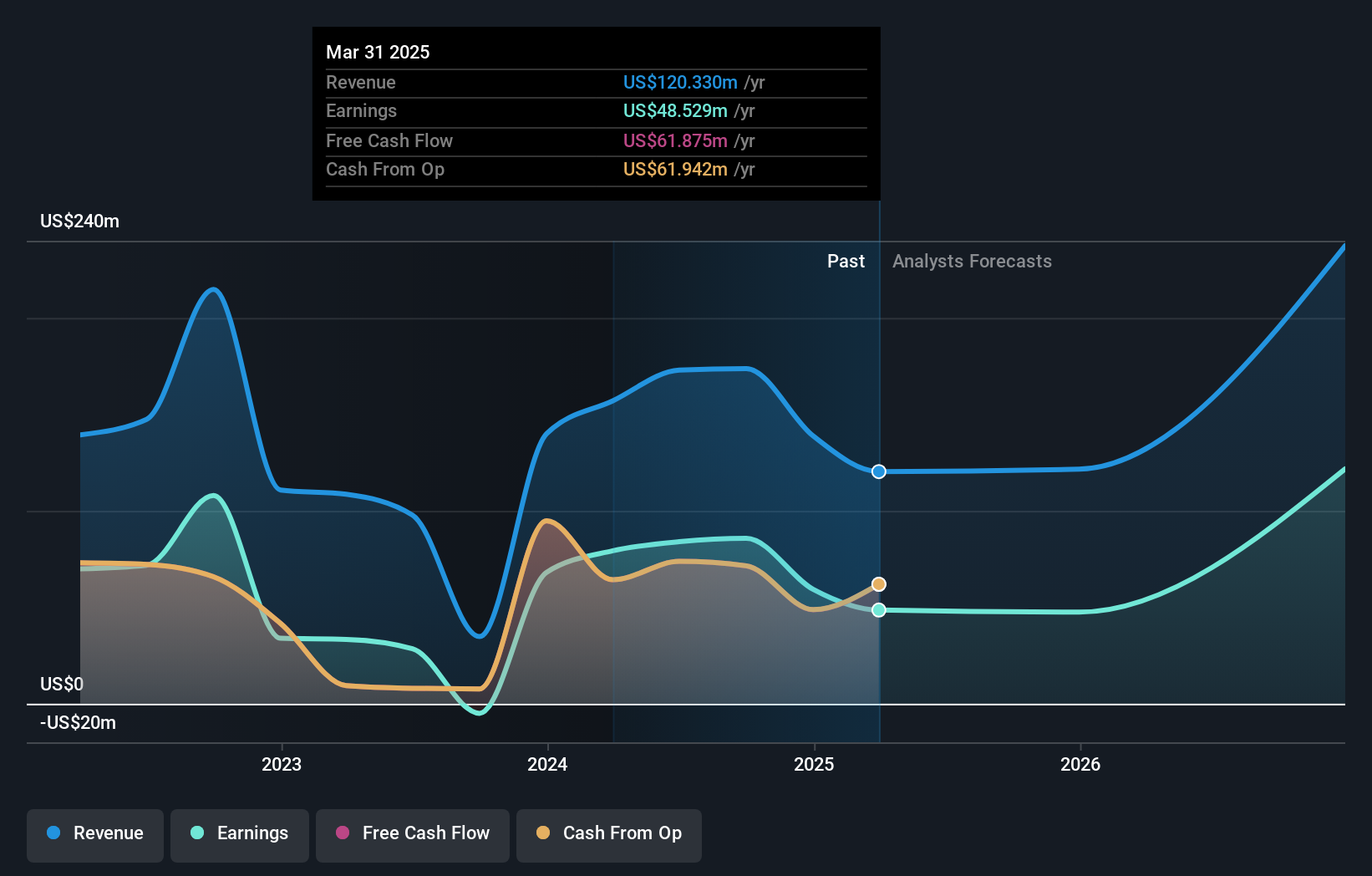

Operations: The company's revenue is primarily derived from its pharmaceuticals segment, amounting to $120.33 million.

SIGA Technologies, a nimble player in the pharmaceuticals sector, has faced challenges with its earnings shrinking by 38.8% over the past year, contrasting sharply with the industry average growth of 13.1%. Despite this setback, SIGA trades at a significant discount—69.6% below estimated fair value—suggesting potential undervaluation. The company is debt-free and boasts high-quality past earnings, providing some stability amidst financial turbulence. Recent changes to corporate bylaws aim to streamline legal proceedings and limit officer liability, while partnerships with firms like Armis highlight efforts to expand its technological reach in cybersecurity solutions.

- Get an in-depth perspective on SIGA Technologies' performance by reading our health report here.

Evaluate SIGA Technologies' historical performance by accessing our past performance report.

Timberland Bancorp (TSBK)

Simply Wall St Value Rating: ★★★★★★

Overview: Timberland Bancorp, Inc. is a bank holding company for Timberland Bank, offering a range of community banking services in Washington, with a market cap of $254.58 million.

Operations: Timberland Bancorp's primary revenue stream is from its community banking services, generating $76.81 million.

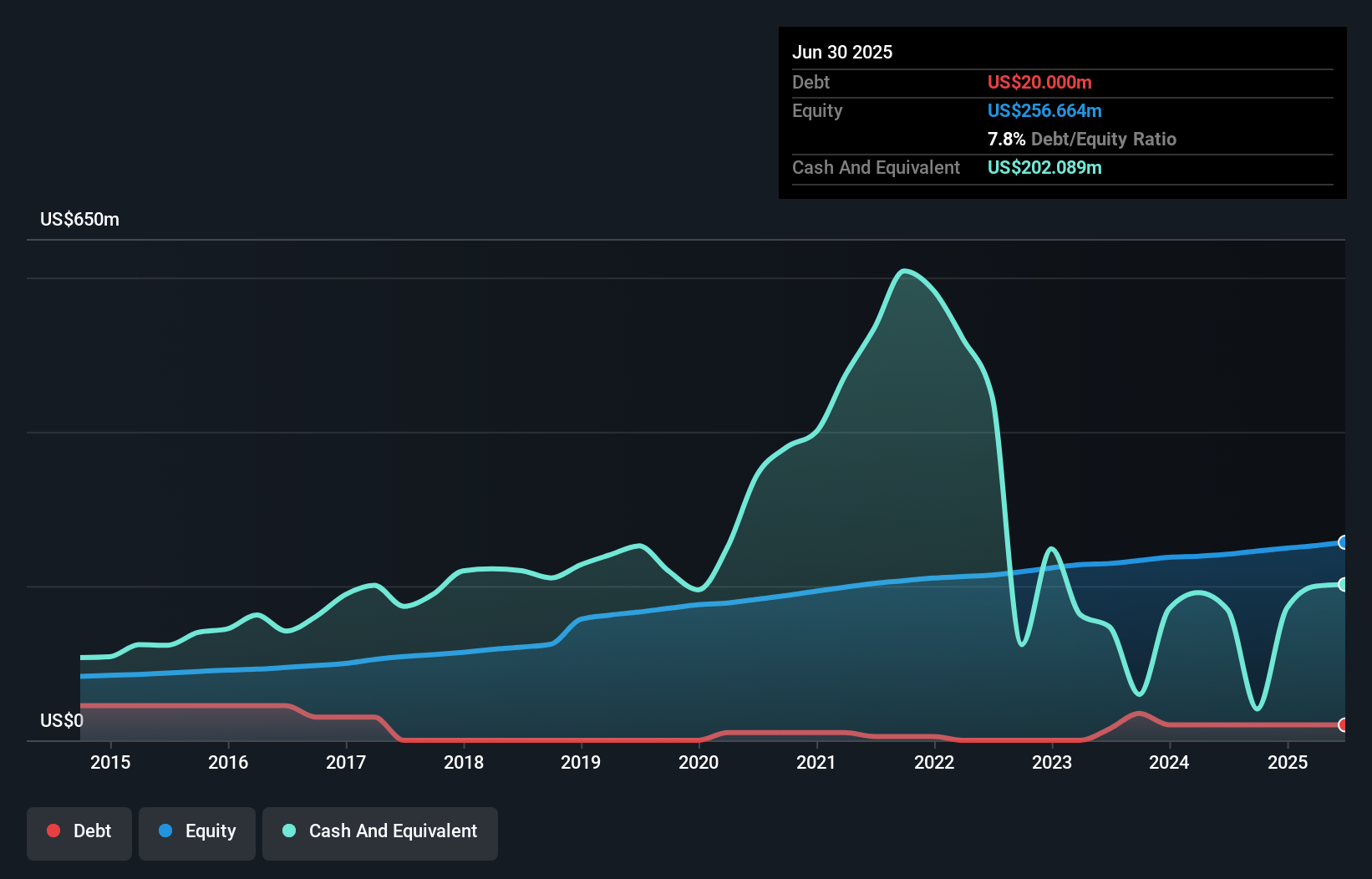

Timberland Bancorp, with assets of US$1.9 billion and equity of US$252.5 million, offers a compelling profile with its strong financial footing. The company has total deposits of US$1.7 billion and loans amounting to US$1.4 billion, reflecting robust operational dynamics in the banking sector. Its allowance for bad loans stands at 753%, ensuring a solid buffer against potential losses, while non-performing loans are minimal at 0.2%. Recently, Timberland repurchased 61,764 shares for US$1.91 million and announced a dividend increase to $0.26 per share, signaling confidence in its ongoing performance and shareholder value enhancement strategies.

- Take a closer look at Timberland Bancorp's potential here in our health report.

Understand Timberland Bancorp's track record by examining our Past report.

Adams Natural Resources Fund (PEO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Adams Natural Resources Fund, Inc. is a publicly owned investment manager with a market capitalization of $585.88 million.

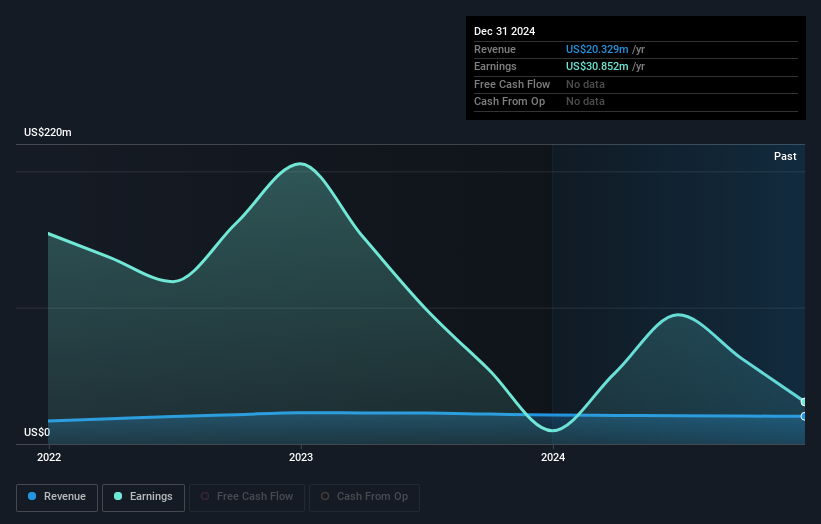

Operations: Adams Natural Resources Fund generates revenue primarily through its financial services, specifically from closed-end funds, amounting to $20.33 million.

Adams Natural Resources Fund, a small cap player in the energy and utilities sector, has shown impressive earnings growth of 218.3% over the past year, significantly outpacing the Capital Markets industry average of 14.2%. The fund is debt-free and recently experienced a notable one-off gain of US$14.2M impacting its financial results to December 2024. Trading at 57.5% below estimated fair value suggests potential undervaluation opportunities for investors. Recent leadership changes saw Gregory W. Buckley appointed as President, bringing extensive experience from his roles at BNP Paribas and Citadel LLC to bolster strategic direction in navigating market dynamics.

Make It Happen

- Reveal the 280 hidden gems among our US Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PEO

Excellent balance sheet and good value.

Market Insights

Community Narratives