- United States

- /

- Pharma

- /

- NasdaqGM:SIGA

Discovering US Market Gems October 2025

Reviewed by Simply Wall St

As the U.S. market navigates through a wave of volatility driven by geopolitical tensions and economic policy shifts, small-cap stocks have been at the forefront of investor interest, with indices such as the S&P 600 reflecting these dynamic changes. In this environment, identifying promising opportunities involves looking for companies that demonstrate resilience and adaptability amidst broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| Oakworth Capital | 87.50% | 15.82% | 9.79% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| Valhi | 44.30% | 1.10% | -1.40% | ★★★★★☆ |

| NameSilo Technologies | 14.73% | 14.50% | -1.32% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Linkhome Holdings | 7.03% | 215.05% | 239.56% | ★★★★★☆ |

| Gulf Island Fabrication | 20.48% | 3.25% | 43.31% | ★★★★★☆ |

| Greenfire Resources | 35.48% | -1.31% | -25.79% | ★★★★☆☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

SIGA Technologies (SIGA)

Simply Wall St Value Rating: ★★★★★★

Overview: SIGA Technologies, Inc. is a commercial-stage pharmaceutical company that specializes in the health security market in the United States, with a market cap of $588.60 million.

Operations: The company generates revenue primarily from its pharmaceuticals segment, which reported $179.64 million. It operates within the health security market in the United States.

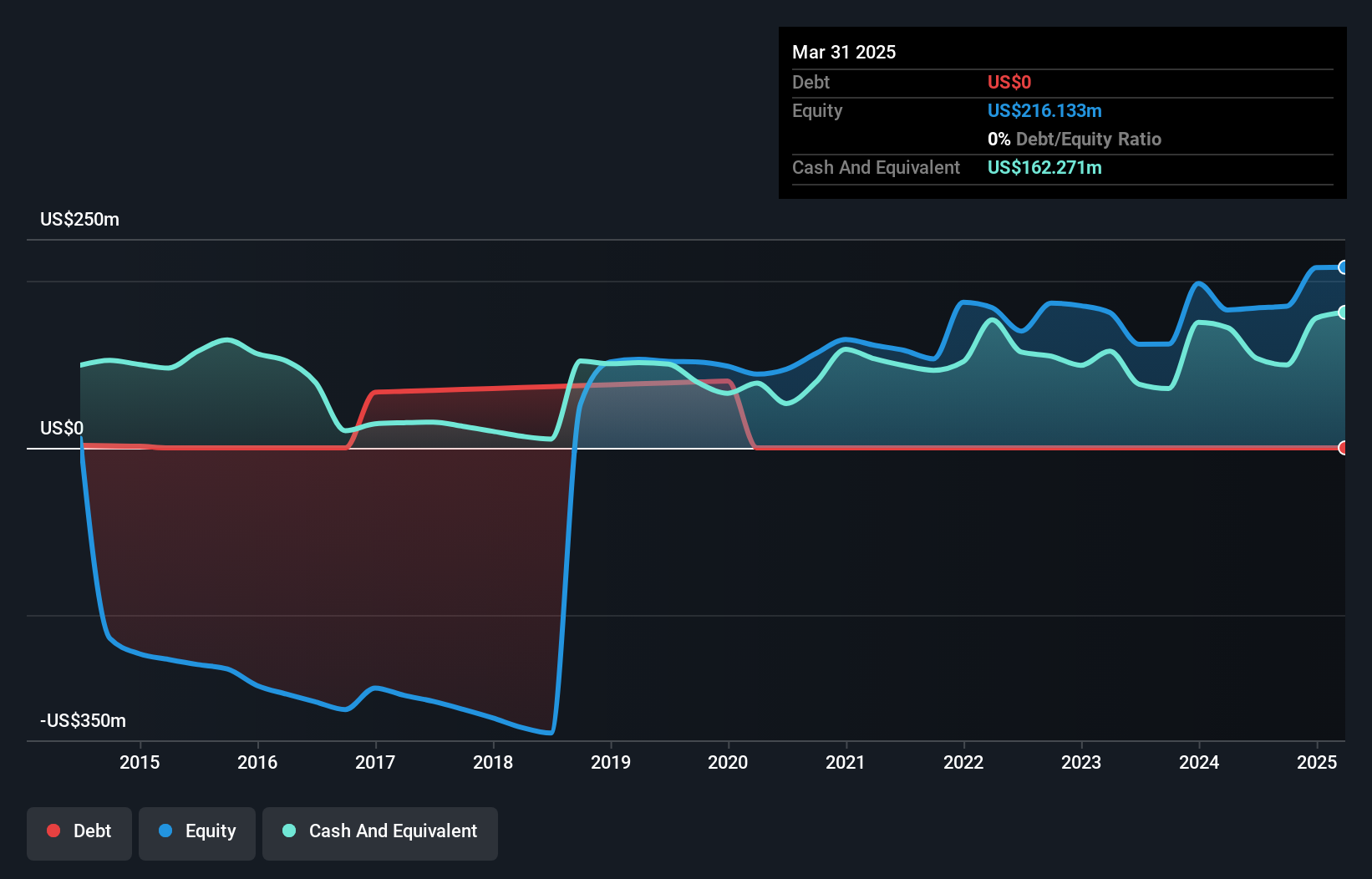

SIGA Technologies, a nimble player in the pharmaceuticals sector, is currently debt-free and trades at 91.8% below its estimated fair value. Despite a negative earnings growth of 2.1% over the past year, SIGA's financial health remains robust with positive free cash flow and high-quality earnings. Recent results show significant revenue growth from US$21.81 million to US$81.12 million in Q2 2025, boosting net income to US$35.48 million from US$1.83 million year-over-year and basic EPS rising to $0.50 from $0.03 last year, indicating strong operational performance despite industry challenges.

- Click here to discover the nuances of SIGA Technologies with our detailed analytical health report.

Explore historical data to track SIGA Technologies' performance over time in our Past section.

Mission Produce (AVO)

Simply Wall St Value Rating: ★★★★★★

Overview: Mission Produce, Inc. is involved in the sourcing, farming, packaging, marketing, and distribution of avocados, mangoes, and blueberries to food retailers, wholesalers, and foodservice customers both in the United States and internationally, with a market cap of approximately $829.77 million.

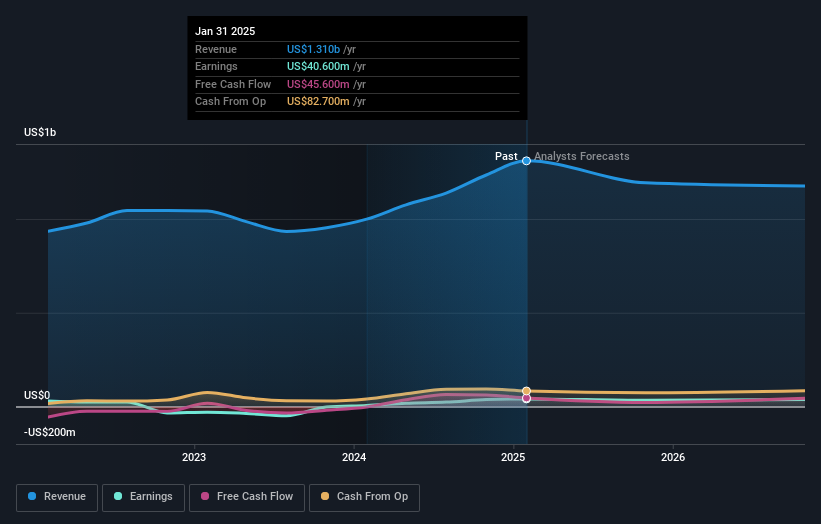

Operations: Mission Produce's revenue primarily stems from its Marketing & Distribution segment, which generates $1.32 billion, followed by International Farming at $96.60 million and Blueberries at $88.20 million. The company's financial performance is impacted by intercompany eliminations amounting to -$80.20 million.

Mission Produce, a notable player in the produce industry, is making strides with its diversified sourcing and international infrastructure investments. The company reported US$357.7 million in sales for Q3 2025, up from US$324 million the previous year, while net income rose to US$14.7 million from US$12.4 million. With a satisfactory net debt to equity ratio of 15%, Mission's financial health appears solid as it navigates industry challenges like climate risks and price competition. Despite analysts forecasting revenue declines, profit margins are expected to improve slightly with earnings projected at US$40.7 million by September 2028.

Build-A-Bear Workshop (BBW)

Simply Wall St Value Rating: ★★★★★★

Overview: Build-A-Bear Workshop, Inc. is a multi-channel retailer specializing in plush animals and related products with operations in the United States, Canada, the United Kingdom, Ireland, and internationally; it has a market cap of approximately $771.76 million.

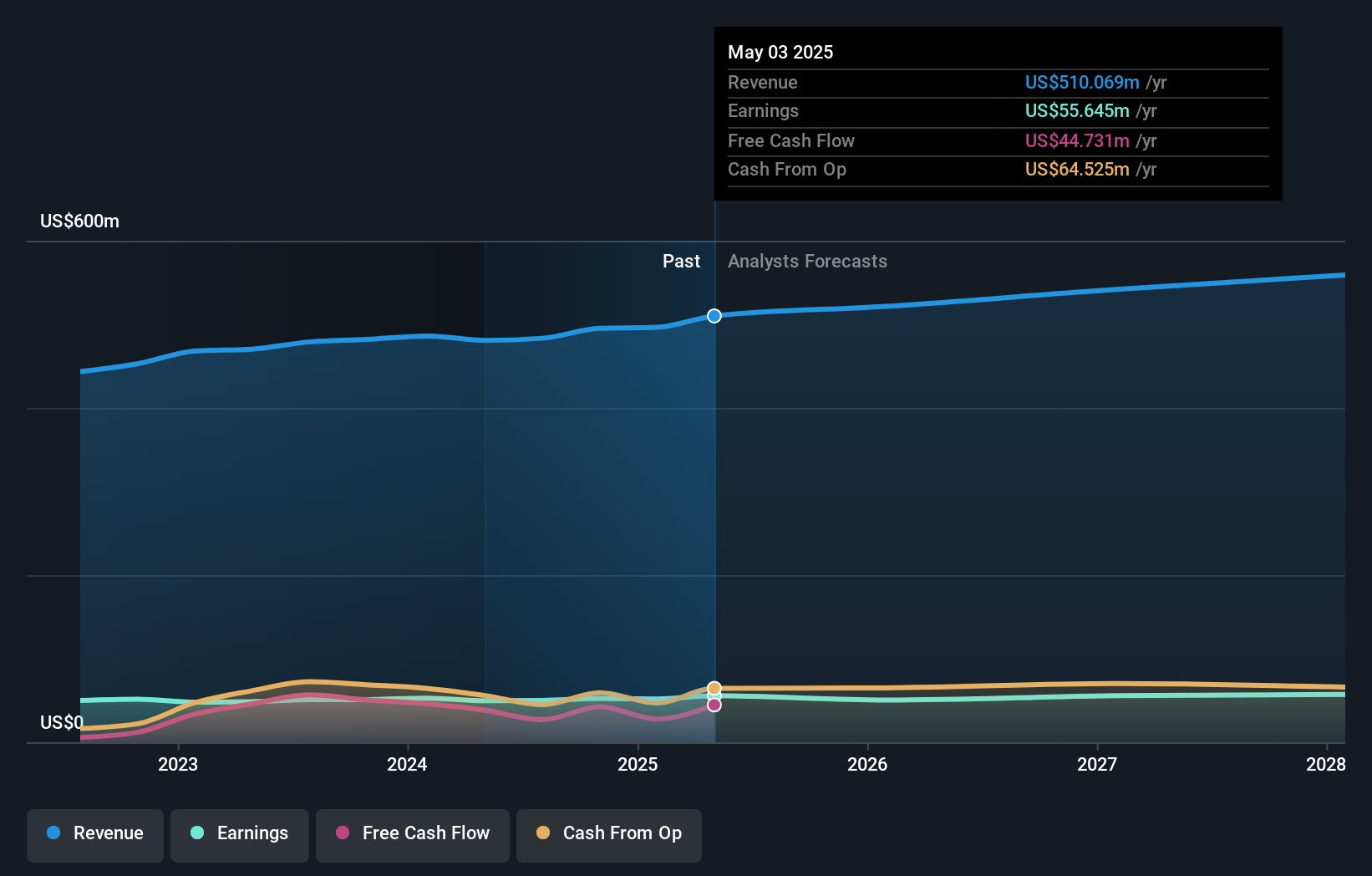

Operations: BBW generates revenue primarily through its Direct-To-Consumer segment, which accounts for $483.23 million, followed by the Commercial segment at $34.36 million, and International Franchising at $4.93 million.

Build-A-Bear Workshop, a nimble player in the specialty retail sector, has seen its earnings grow by 18% over the past year, outpacing industry peers. With no debt on its books and a price-to-earnings ratio of 13x compared to the US market's 18.5x, it offers good value. Recent efforts in international expansion and digital transformation are broadening its reach beyond traditional markets. The company repurchased shares worth $20 million recently and declared a quarterly dividend of $0.22 per share. For Q2 2025, revenue hit $124 million with net income at $12 million, reflecting solid financial health.

Make It Happen

- Access the full spectrum of 291 US Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SIGA

SIGA Technologies

A commercial-stage pharmaceutical company, focuses on the health security market in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives