- United States

- /

- Biotech

- /

- NasdaqGM:RYTM

Investors in Rhythm Pharmaceuticals (NASDAQ:RYTM) have seen fantastic returns of 577% over the past three years

Investing can be hard but the potential fo an individual stock to pay off big time inspires us. You won't get it right every time, but when you do, the returns can be truly splendid. For example, the Rhythm Pharmaceuticals, Inc. (NASDAQ:RYTM) share price is up a whopping 577% in the last three years, a handsome return for long term holders. In the last week shares have slid back 1.5%. Anyone who held for that rewarding ride would probably be keen to talk about it.

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

See our latest analysis for Rhythm Pharmaceuticals

Given that Rhythm Pharmaceuticals didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Rhythm Pharmaceuticals' revenue trended up 88% each year over three years. That's much better than most loss-making companies. In light of this attractive revenue growth, it seems somewhat appropriate that the share price has been rocketing, boasting a gain of 89% per year, over the same period. Despite the strong run, top performers like Rhythm Pharmaceuticals have been known to go on winning for decades. In fact, it might be time to put it on your watchlist, if you're not already familiar with the stock.

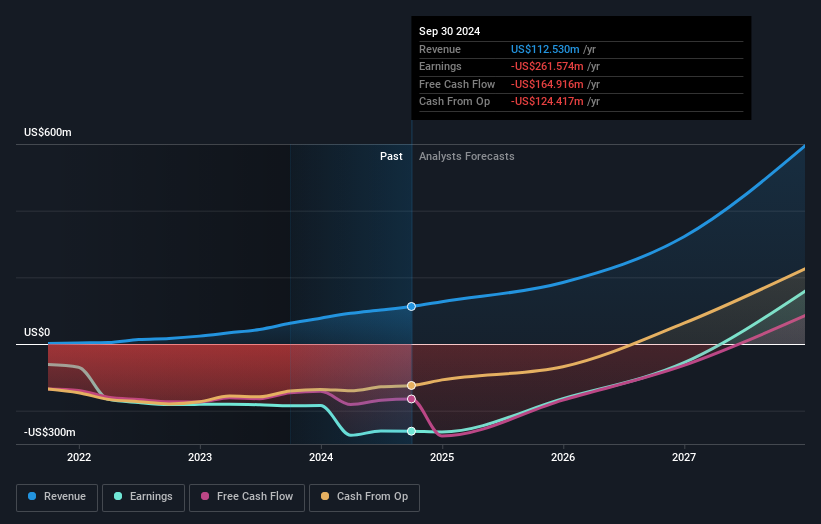

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Rhythm Pharmaceuticals is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Rhythm Pharmaceuticals stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

Rhythm Pharmaceuticals provided a TSR of 15% over the last twelve months. But that was short of the market average. If we look back over five years, the returns are even better, coming in at 25% per year for five years. Maybe the share price is just taking a breather while the business executes on its growth strategy. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

We will like Rhythm Pharmaceuticals better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:RYTM

Rhythm Pharmaceuticals

A commercial-stage biopharmaceutical company, focuses on the rare neuroendocrine diseases.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives