- United States

- /

- Biotech

- /

- NasdaqGS:RXRX

Recursion Pharmaceuticals (RXRX) Sees Sales And Revenue Growth In Q2 2025

Reviewed by Simply Wall St

Recursion Pharmaceuticals (RXRX) reported significant growth in sales and revenue for Q2 and the first half of 2025 but also experienced widening net losses. The release of their Boltz-2 model underscored a commitment to innovation, which resonates positively in a market focusing on technological advancements. Meanwhile, broader markets, including the S&P 500, faced a 1.5% decline, affected by investor caution ahead of Federal Reserve Chair Powell's speech. Within this market context, the company's stock reflected a 15% increase over the last quarter, suggesting that Recursion's financial results and product developments may have provided a counterbalance to the general market trend.

Find companies with promising cash flow potential yet trading below their fair value.

The recent developments of Recursion Pharmaceuticals underscore significant growth potential, leveraging advanced AI and machine learning to transform drug discovery. However, despite the impressive Q2 sales growth and the launch of the Boltz-2 model, challenges such as increasing net losses persist, affecting revenue stability. Over the past year, the stock's total return was a 37.40% decline, indicating potential volatility and investor caution amid ongoing losses and internal pipeline risks.

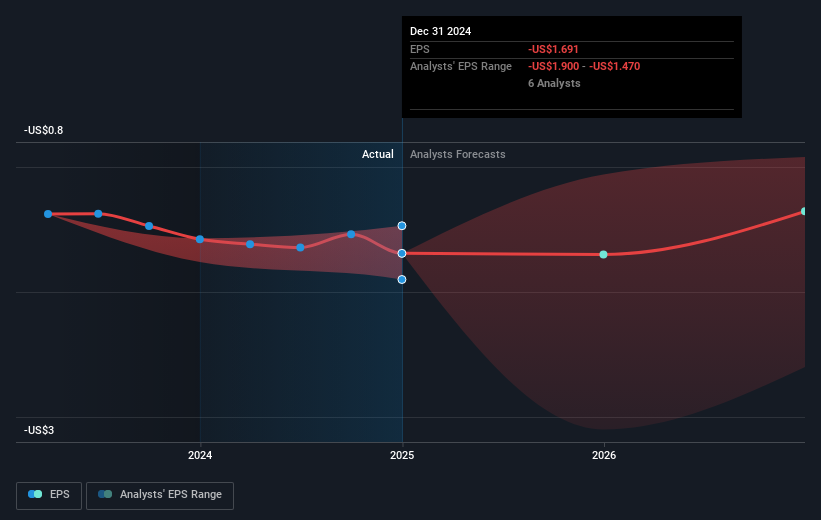

When compared to the broader market, Recursion underperformed relative to the S&P 500, which returned 14.4% over the same period. The company's stock has been highly volatile. Analysts have set a consensus price target of US$6.47, which positions the current share price of US$4.77 at a discount. This suggests potential upside as investors weigh risks against the prospects of revenue growth and partnership developments. However, analysts assume Recursion will remain unprofitable in the near term, impacting earnings forecasts. Increased AI-driven R&D efficiency and innovative capabilities could drive future revenue growth, yet real challenges in sustaining partnerships and optimizing financial performance remain.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RXRX

Recursion Pharmaceuticals

Operates as a clinical-stage biotechnology company, engages in the decoding biology and chemistry by integrating technological innovations across biology, chemistry, automation, data science, and engineering to industrialize drug discovery in the United States.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives