- United States

- /

- Biotech

- /

- NasdaqGS:RXRX

Does Recursion Stock Present an Opportunity After a 32% Drop in 2024?

Reviewed by Bailey Pemberton

If you are wondering what to do with Recursion Pharmaceuticals stock right now, you are not alone. This is one of those companies that sparks lively debates among investors, especially after a year like this one. Shares are trading at $4.72 as of the last close, which is a far cry from earlier highs. Over the past year, Recursion has seen a -32.4% drop, and the picture is even starker when you look at the year-to-date return of -34.5%. In just the past week and month, the stock slipped another -3.9% and -3.5%. Investors understandably have questions about the long-term potential and what factors are driving these moves.

Much of the recent price movement reflects changing attitudes in the market about risk and opportunity in the biotechnology sector. Investors are re-evaluating growth stories, and Recursion, despite exciting advances in AI-driven drug discovery, has not been immune. Broader shifts in biotech sentiment and a cautious macro environment have kept downward pressure on share prices, and Recursion’s story has played out right in the thick of that volatility.

With these moves in mind, valuation becomes all the more important. By looking at Recursion’s value score, a metric that counts how many major checks the company clears for being undervalued, there may be room for caution. Out of 6 possible checks, Recursion’s value score stands at just 1. That is not exactly a ringing endorsement from traditional valuation models. But does it tell the whole story? Let’s take a closer look at how Recursion stacks up through different valuation lenses, and explore an even deeper way to think about pricing this stock at the end of the article.

Recursion Pharmaceuticals scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Recursion Pharmaceuticals Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's worth by projecting its future cash flows and discounting them back to their present value. For Recursion Pharmaceuticals, this involves examining the likely cash the business will generate over the coming years, even if many biotech firms, like Recursion, currently have negative cash flow.

Currently, Recursion reported a last twelve months (LTM) Free Cash Flow of -$403.99 Million. Analyst projections suggest that free cash flow will remain negative until 2027, before turning positive in 2028 and increasing to $135.68 Million by 2035. Early projections for the next five years are provided by analysts, while longer-term numbers are extrapolated by Simply Wall St. All these future cash flows are discounted back to the present, making them smaller the further in the future they occur.

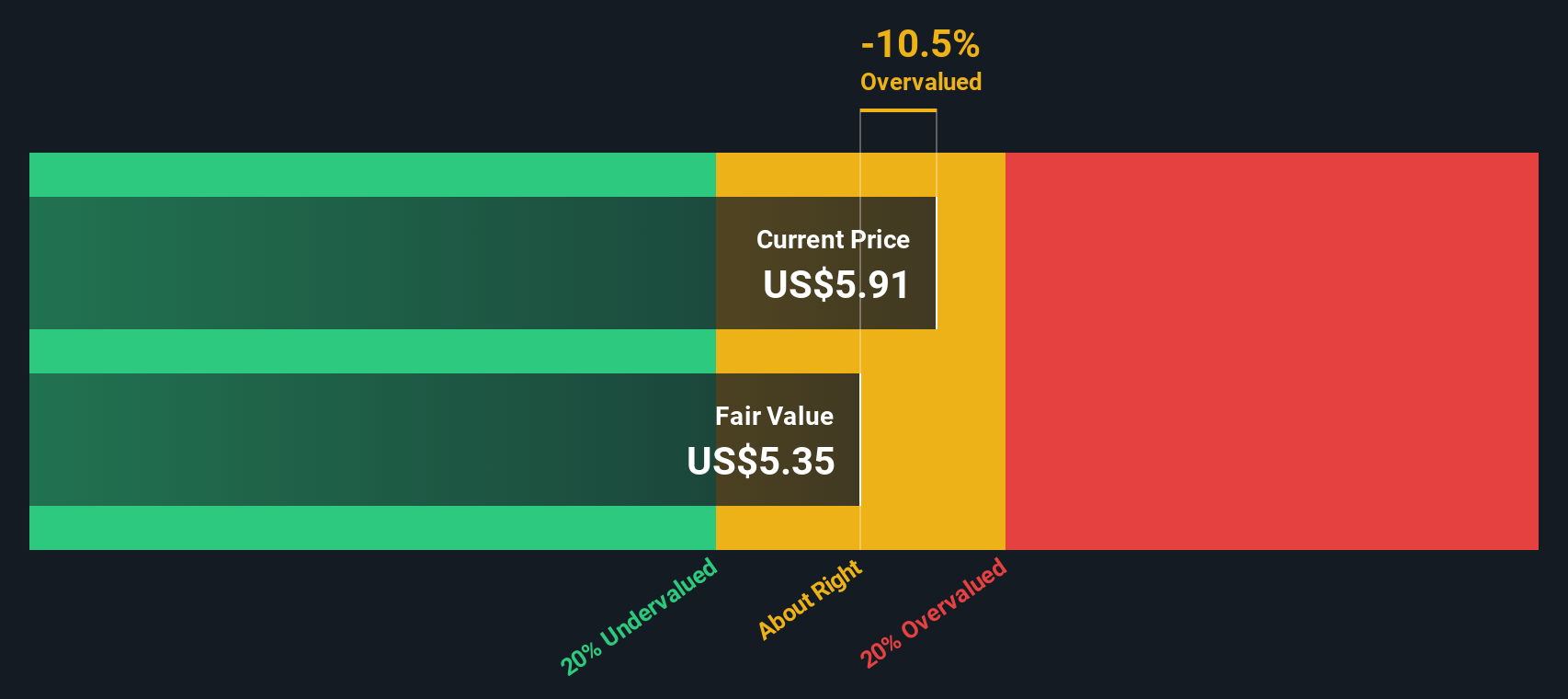

Based on this cash flow outlook, the DCF model estimates Recursion’s fair intrinsic value at $5.43 per share. With the stock currently trading at $4.72, this suggests the share price is about 13.2% below fair value, indicating the stock may be undervalued based on long-run cash projections.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Recursion Pharmaceuticals.

Approach 2: Recursion Pharmaceuticals Price vs Sales

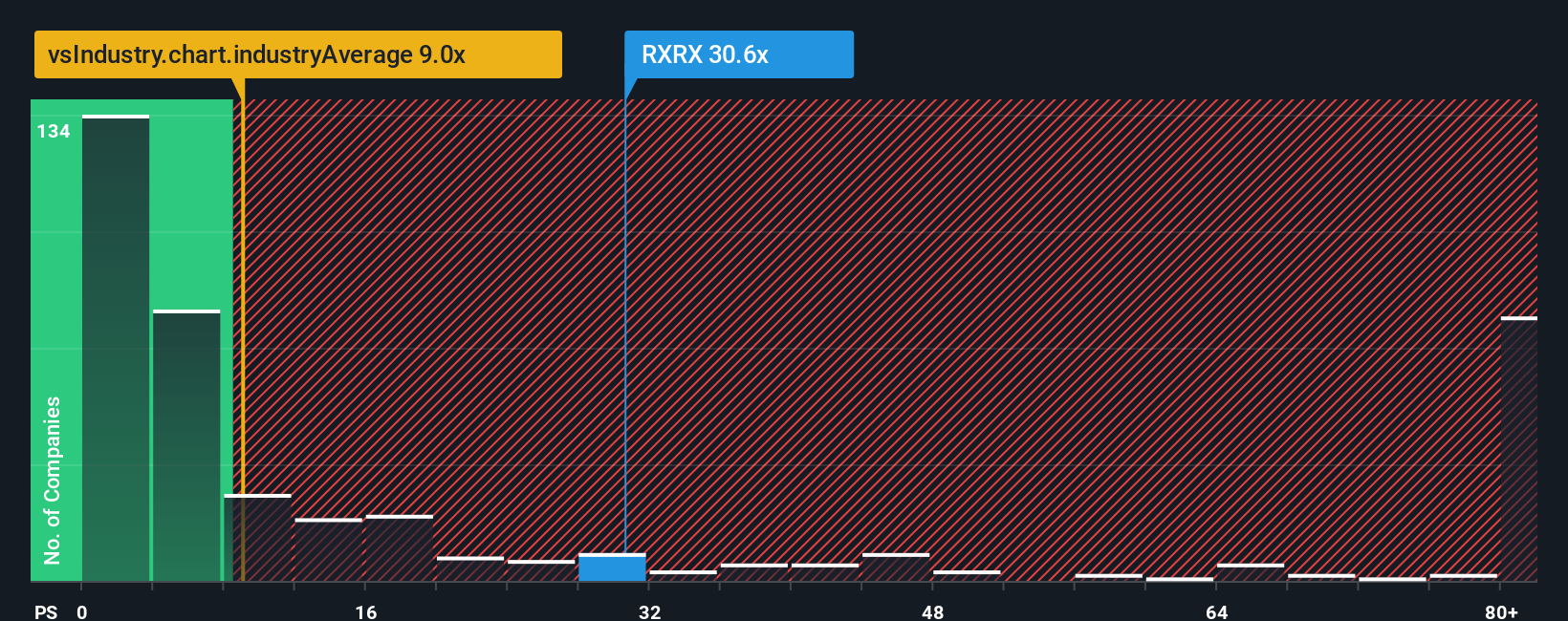

The Price-to-Sales (P/S) ratio is a common way to value companies that are not yet profitable, as it focuses on revenue rather than earnings. This makes it a particularly useful metric for biotech firms like Recursion Pharmaceuticals, which are still in investment and development stages and may not have positive earnings for several years.

When comparing P/S ratios, investors generally look for a number that reflects a balance between growth expectations and perceived risks. High-growth industries like biotech can support higher P/S ratios, but risks associated with drug development and market uncertainty also play a major role in determining what multiple is considered fair.

Recursion currently trades at a P/S ratio of 31.94x. For context, the average for biotech peers is 13.83x, and the broader industry average is 9.86x. However, Simply Wall St’s proprietary “Fair Ratio,” which adjusts for factors such as Recursion’s growth outlook, risks, profit margins, industry, and market capitalisation, stands at just 0.003x. This Fair Ratio provides a more holistic perspective than a simple peer or industry comparison because it reflects the company’s unique fundamentals rather than broad averages.

Given that Recursion’s actual P/S multiple is much higher than its Fair Ratio, the stock appears significantly overvalued when viewed through this lens.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Recursion Pharmaceuticals Narrative

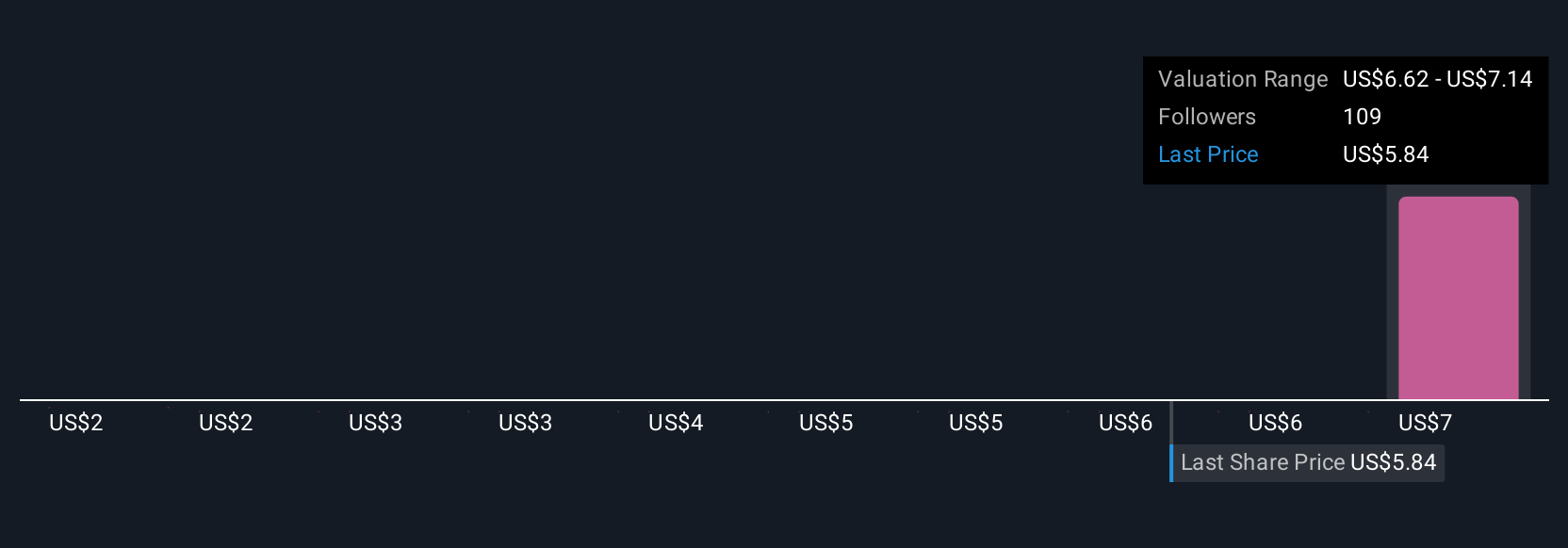

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple but powerful tool that connects your view of a company's story, such as product breakthroughs, leadership, or risks, to real numbers like future revenue, earnings, margins, and fair value. Think of Narratives as a bridge between what you believe will drive Recursion’s future and how that translates into a concrete investment decision.

Available on Simply Wall St’s Community page, Narratives make it easy for anyone to outline their forecast, calculate fair value, and compare it to the current price, all within a few clicks. When news breaks or earnings come in, Narratives update instantly, ensuring your analysis always reflects the latest information.

For example, within the Community, you might see the most optimistic investor expecting Recursion’s share price to climb as high as $10, believing that AI-driven breakthroughs will unlock rapid revenue growth. Meanwhile, a cautious investor may set a price target of just $3, concerned about cash burn, competition, and pipeline risks. By comparing your own Narrative fair value to the market price, and seeing how peers are thinking, you can decide when you would buy, sell, or hold, using a process that is as dynamic and personal as your beliefs about Recursion Pharmaceuticals.

Do you think there's more to the story for Recursion Pharmaceuticals? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RXRX

Recursion Pharmaceuticals

Operates as a clinical-stage biotechnology company, engages in the decoding biology and chemistry by integrating technological innovations across biology, chemistry, automation, data science, and engineering to industrialize drug discovery in the United States.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives