- United States

- /

- Consumer Finance

- /

- NasdaqGS:LX

Relmada Therapeutics Leads These 3 Promising Penny Stocks

Reviewed by Simply Wall St

On November 4, 2025, major U.S. stock indexes closed sharply lower, with tech stocks leading the decline and Bitcoin experiencing a notable drop. In such volatile market conditions, investors often seek out opportunities that might offer both affordability and growth potential. Penny stocks, though sometimes seen as relics of past market eras, continue to represent viable investment areas for those willing to explore smaller or newer companies with strong financial foundations.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.76 | $381.46M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.67 | $625.68M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.9832 | $176.15M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $4.35 | $784.11M | ✅ 4 ⚠️ 2 View Analysis > |

| Global Self Storage (SELF) | $4.98 | $56.69M | ✅ 5 ⚠️ 1 View Analysis > |

| Puma Biotechnology (PBYI) | $4.90 | $253.87M | ✅ 3 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $2.03 | $26.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.9125 | $6.68M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $2.98 | $68.65M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 371 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Relmada Therapeutics (RLMD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Relmada Therapeutics, Inc. is a clinical-stage biotechnology company based in the United States with a market cap of $73.02 million.

Operations: Relmada Therapeutics, Inc. currently does not report any revenue segments.

Market Cap: $73.02M

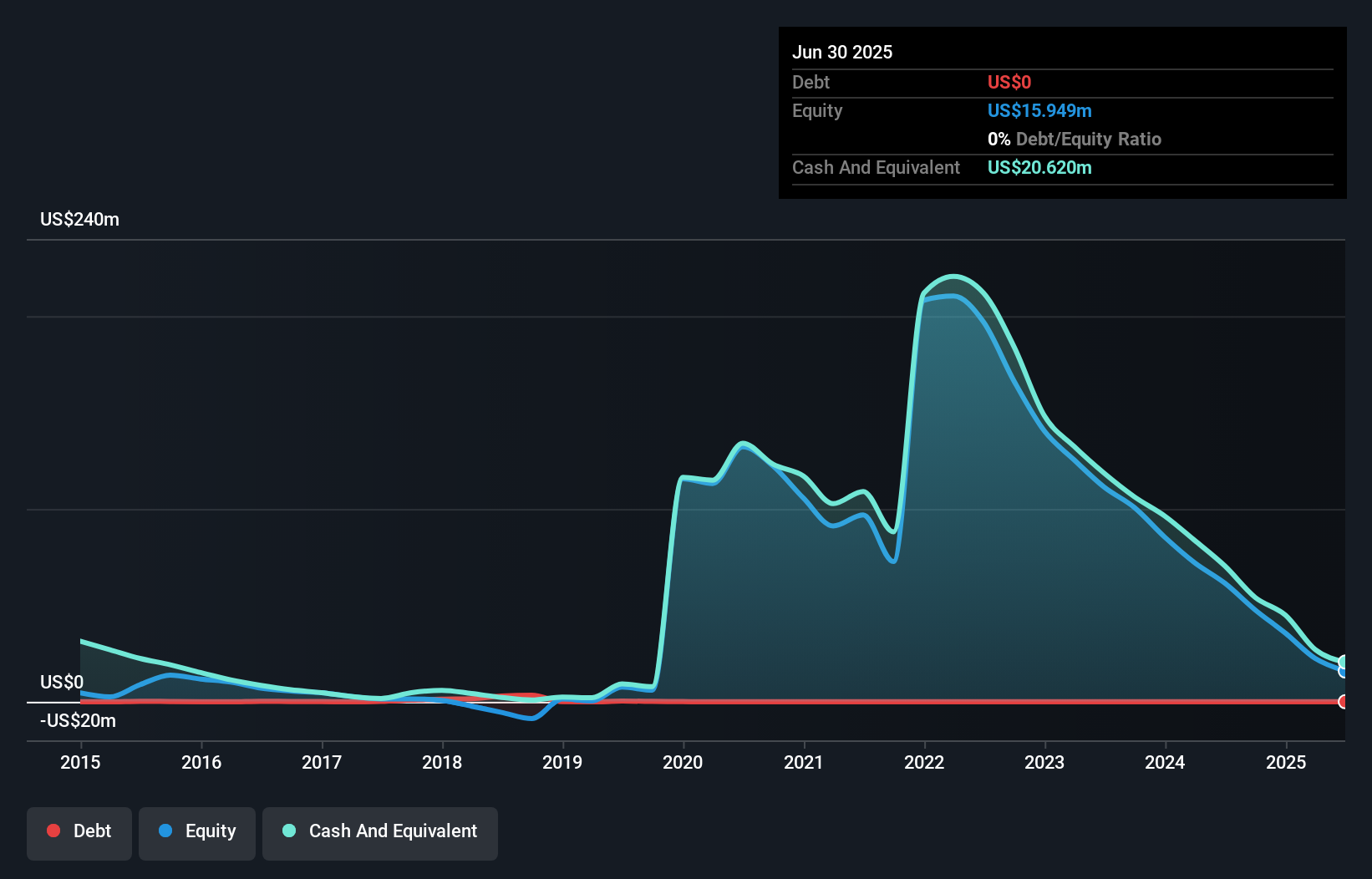

Relmada Therapeutics, Inc., with a market cap of US$73.02 million, is a pre-revenue clinical-stage biotech firm. The company has recently bolstered its financial position by completing a US$100 million follow-on equity offering. Despite being debt-free and having short-term assets exceeding liabilities, Relmada's cash runway remains limited to five months based on free cash flow estimates. Its management and board are seasoned, averaging over five years of tenure each. However, the company's share price is highly volatile and earnings are forecasted to decline in the coming years as it remains unprofitable without significant revenue streams.

- Take a closer look at Relmada Therapeutics' potential here in our financial health report.

- Gain insights into Relmada Therapeutics' future direction by reviewing our growth report.

Connect Biopharma Holdings (CNTB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Connect Biopharma Holdings Limited is a clinical-stage biopharmaceutical company focused on developing therapies for inflammatory diseases in the United States, with a market cap of $91.94 million.

Operations: Connect Biopharma Holdings generates revenue of $1.97 million from its biotechnology startups segment.

Market Cap: $91.94M

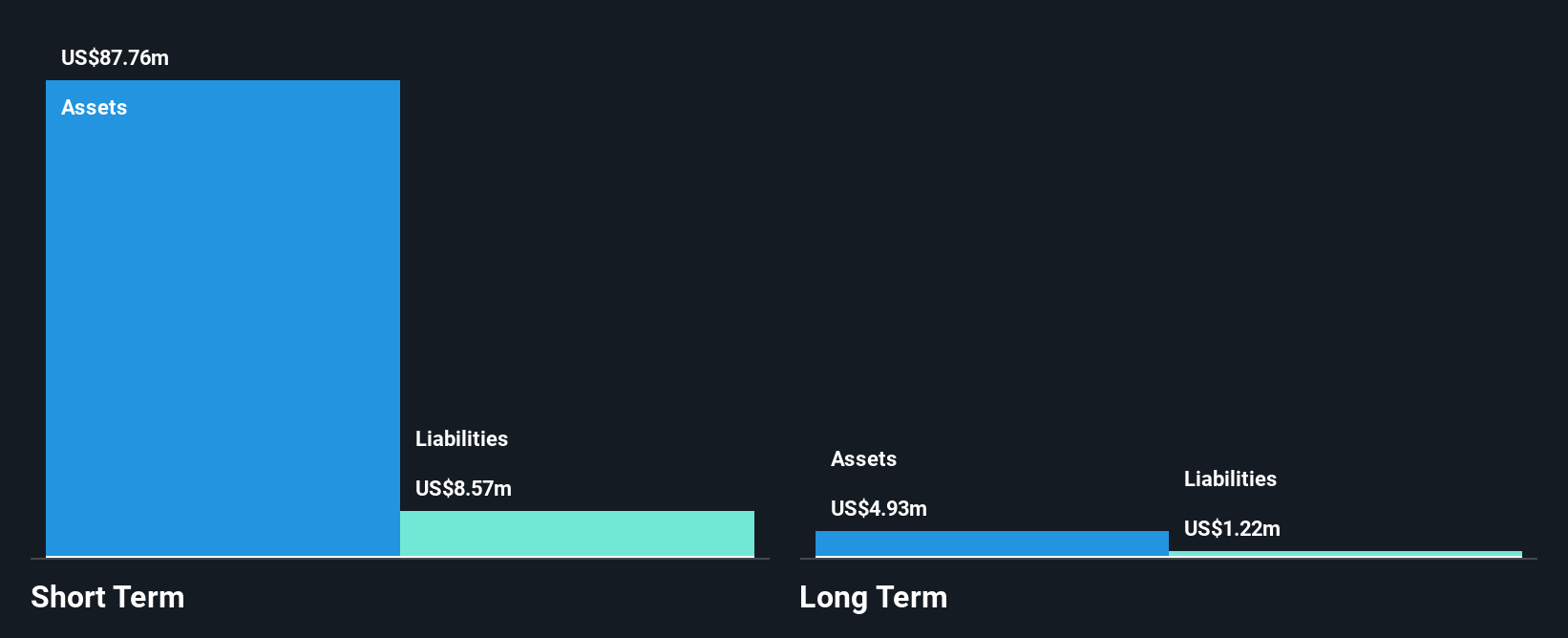

Connect Biopharma Holdings, with a market cap of US$91.94 million, focuses on developing therapies for inflammatory diseases and faces challenges typical of penny stocks. Despite being debt-free and having short-term assets exceeding liabilities, the company is unprofitable with minimal revenue streams (US$1.97 million). Its cash runway extends over a year if free cash flow grows as historically observed. Recent presentations at prominent conferences highlight its commitment to advancing biologic therapies for severe respiratory conditions. However, the share price remains highly volatile and profitability isn't anticipated in the near term despite forecasts of significant revenue growth annually.

- Unlock comprehensive insights into our analysis of Connect Biopharma Holdings stock in this financial health report.

- Evaluate Connect Biopharma Holdings' prospects by accessing our earnings growth report.

LexinFintech Holdings (LX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: LexinFintech Holdings Ltd. operates in the People's Republic of China, providing online direct sales and consumer finance services, with a market cap of approximately $784.11 million.

Operations: The company generates revenue primarily from its online retail operations, amounting to CN¥14.01 billion.

Market Cap: $784.11M

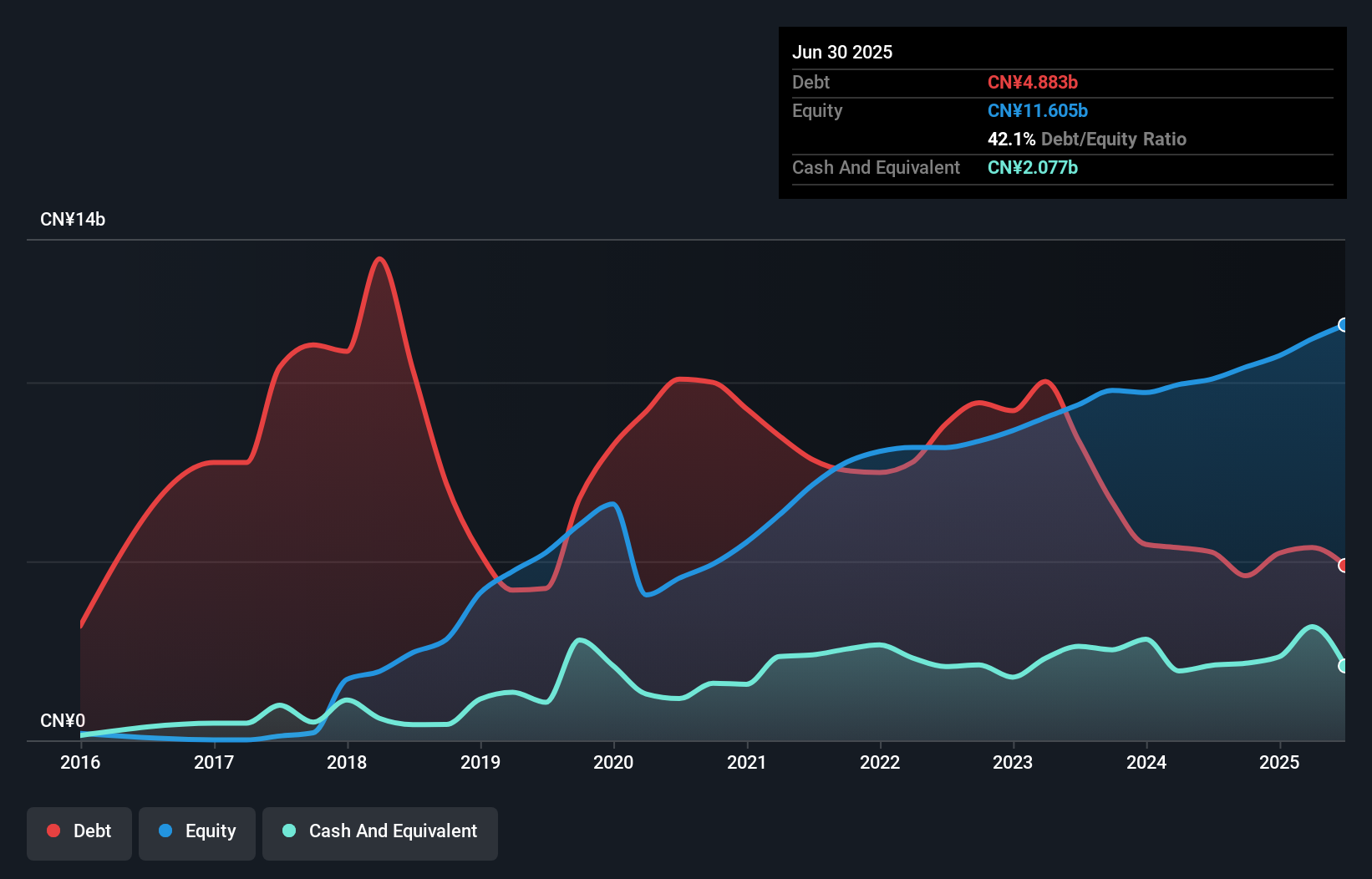

LexinFintech Holdings, with a market cap of approximately US$784.11 million, demonstrates characteristics appealing to penny stock investors. The company has shown significant earnings growth of 99% over the past year, outperforming the Consumer Finance industry average. It maintains a strong financial position with short-term assets exceeding both short and long-term liabilities, and its debt is well covered by operating cash flow. Despite a volatile share price recently, LexinFintech's management team is experienced and its board seasoned. However, investors should be cautious as it has an unstable dividend track record and low return on equity at 13.9%.

- Dive into the specifics of LexinFintech Holdings here with our thorough balance sheet health report.

- Learn about LexinFintech Holdings' future growth trajectory here.

Next Steps

- Unlock our comprehensive list of 371 US Penny Stocks by clicking here.

- Ready To Venture Into Other Investment Styles? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LX

LexinFintech Holdings

Offers online direct sales and online consumer finance services in the People’s Republic of China.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives