- United States

- /

- Biotech

- /

- NasdaqGS:RIGL

Little Excitement Around Rigel Pharmaceuticals, Inc.'s (NASDAQ:RIGL) Revenues As Shares Take 29% Pounding

Rigel Pharmaceuticals, Inc. (NASDAQ:RIGL) shareholders won't be pleased to see that the share price has had a very rough month, dropping 29% and undoing the prior period's positive performance. Longer-term shareholders would now have taken a real hit with the stock declining 7.9% in the last year.

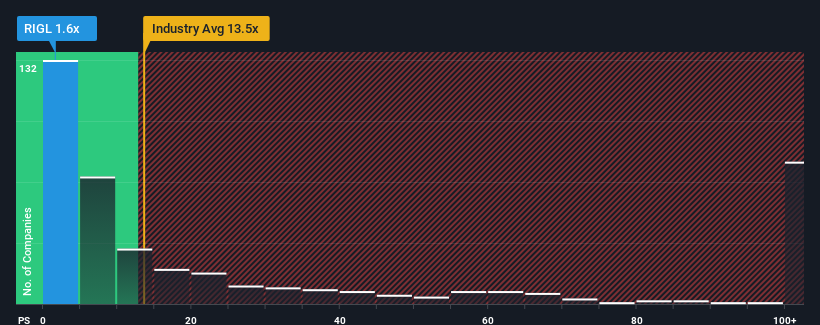

Since its price has dipped substantially, Rigel Pharmaceuticals' price-to-sales (or "P/S") ratio of 1.6x might make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 13.5x and even P/S above 63x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Rigel Pharmaceuticals

What Does Rigel Pharmaceuticals' Recent Performance Look Like?

Recent times haven't been great for Rigel Pharmaceuticals as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Rigel Pharmaceuticals.How Is Rigel Pharmaceuticals' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as Rigel Pharmaceuticals' is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Regardless, revenue has managed to lift by a handy 6.6% in aggregate from three years ago, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 25% per year during the coming three years according to the six analysts following the company. With the industry predicted to deliver 165% growth each year, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Rigel Pharmaceuticals' P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Rigel Pharmaceuticals' P/S?

Shares in Rigel Pharmaceuticals have plummeted and its P/S has followed suit. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of Rigel Pharmaceuticals' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - Rigel Pharmaceuticals has 2 warning signs (and 1 which is a bit concerning) we think you should know about.

If you're unsure about the strength of Rigel Pharmaceuticals' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RIGL

Rigel Pharmaceuticals

A biotechnology company, engages in discovering, developing, and providing therapies that enhance the lives of patients with hematologic disorders and cancer.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives