- United States

- /

- IT

- /

- NasdaqGS:WIX

3 US Stocks Including Advanced Energy Industries That May Be Priced Below Estimated Value

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of fluctuating indices and economic data that has investors closely watching interest rate trends, opportunities may arise for discerning investors to identify stocks priced below their estimated value. In this environment, understanding fundamental metrics and market conditions can be key in recognizing undervalued stocks such as Advanced Energy Industries and others that might offer potential value propositions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Clear Secure (NYSE:YOU) | $26.94 | $53.02 | 49.2% |

| CareTrust REIT (NYSE:CTRE) | $26.42 | $51.17 | 48.4% |

| Camden National (NasdaqGS:CAC) | $42.01 | $83.84 | 49.9% |

| Afya (NasdaqGS:AFYA) | $15.03 | $29.34 | 48.8% |

| Ally Financial (NYSE:ALLY) | $35.78 | $69.58 | 48.6% |

| HealthEquity (NasdaqGS:HQY) | $98.69 | $189.22 | 47.8% |

| Constellium (NYSE:CSTM) | $10.47 | $20.81 | 49.7% |

| TeraWulf (NasdaqCM:WULF) | $6.13 | $11.77 | 47.9% |

| South Atlantic Bancshares (OTCPK:SABK) | $15.60 | $30.73 | 49.2% |

| Zillow Group (NasdaqGS:ZG) | $69.67 | $136.02 | 48.8% |

Let's review some notable picks from our screened stocks.

Advanced Energy Industries (NasdaqGS:AEIS)

Overview: Advanced Energy Industries, Inc. offers precision power conversion, measurement, and control solutions both in the United States and internationally, with a market cap of approximately $4.57 billion.

Operations: The company generates revenue primarily from its Power Electronics Conversion Products segment, which amounts to $1.47 billion.

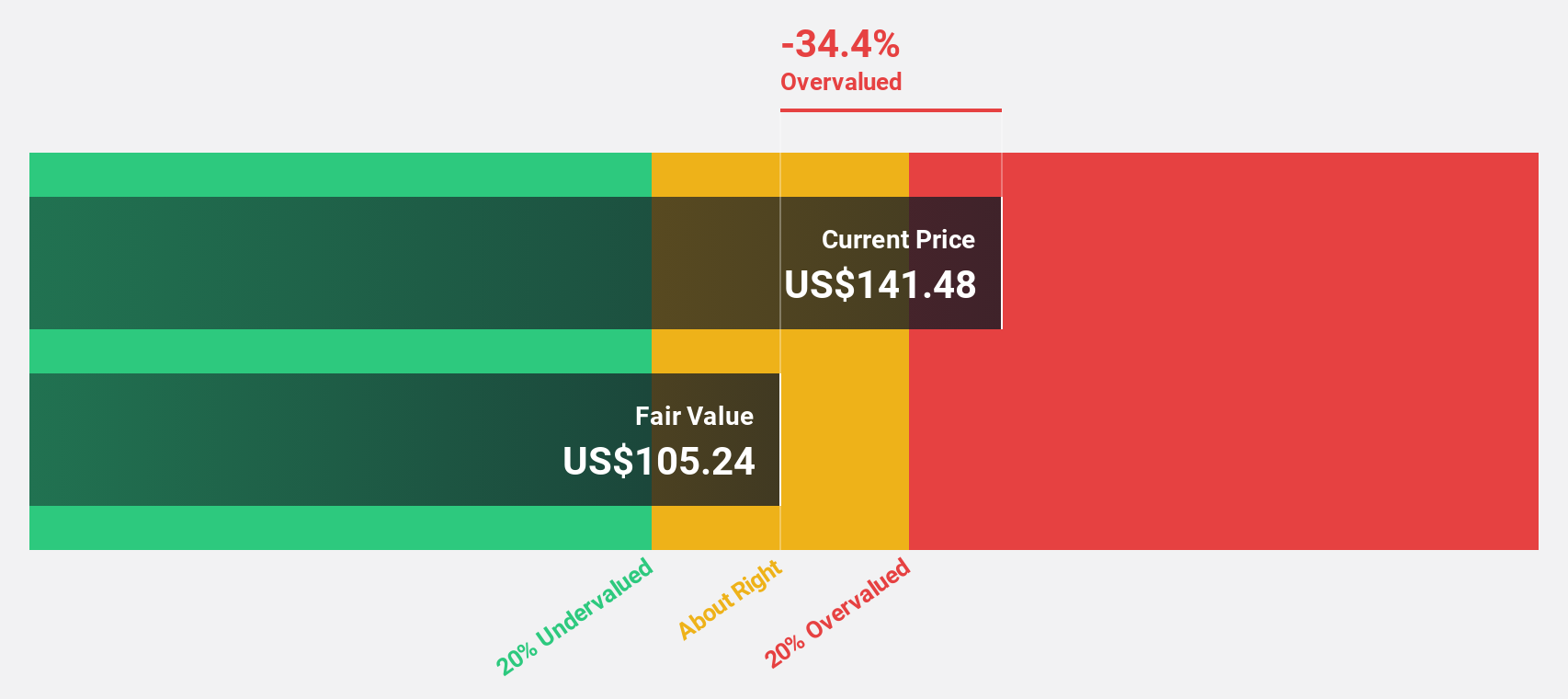

Estimated Discount To Fair Value: 43.1%

Advanced Energy Industries appears significantly undervalued, trading at US$125.23, notably below its estimated fair value of US$219.96. Despite recent financial challenges, including a net loss of US$14.91 million in Q3 2024 and decreased profit margins from 7.9% to 3.1%, the company forecasts strong earnings growth of 72.1% annually over the next three years, outpacing the broader market's expectations and suggesting potential for future cash flow improvements as markets recover.

- In light of our recent growth report, it seems possible that Advanced Energy Industries' financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Advanced Energy Industries stock in this financial health report.

Repligen (NasdaqGS:RGEN)

Overview: Repligen Corporation develops and commercializes bioprocessing technologies and systems for biological drug manufacturing globally, with a market cap of $8.63 billion.

Operations: The company's revenue primarily comes from its Medical Products segment, which generated $633.51 million.

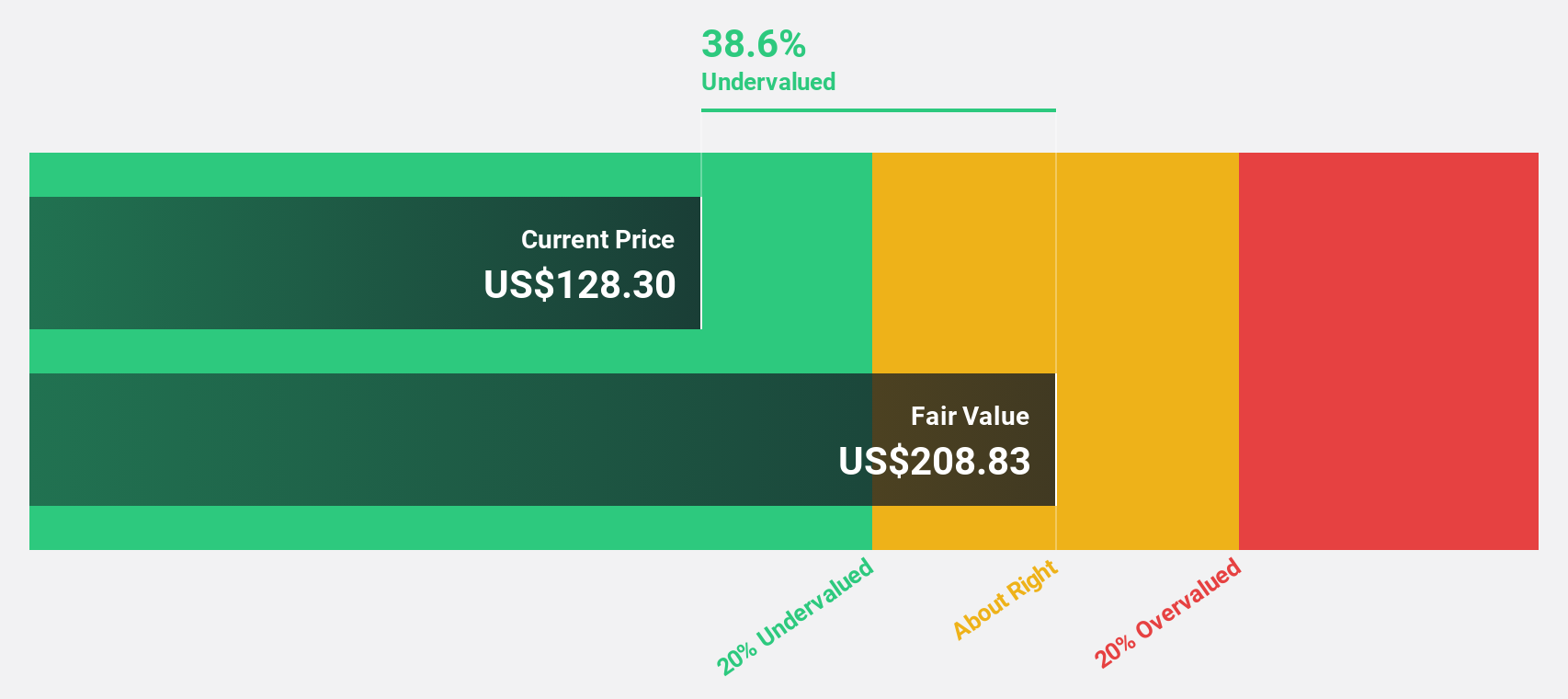

Estimated Discount To Fair Value: 45.4%

Repligen is trading at US$153.50, significantly below its estimated fair value of US$281.28, highlighting potential undervaluation based on cash flows. Despite a recent net loss of US$0.653 million in Q3 2024, Repligen's revenue is forecast to grow at 13.7% annually, surpassing the broader market rate of 9.1%. Recent product launches like the SoloVPE PLUS System enhance its portfolio and could drive future growth as the company continues strategic acquisitions to bolster its offerings.

- Our earnings growth report unveils the potential for significant increases in Repligen's future results.

- Dive into the specifics of Repligen here with our thorough financial health report.

Wix.com (NasdaqGS:WIX)

Overview: Wix.com Ltd. operates as a cloud-based web development platform for registered users and creators globally, with a market cap of approximately $12.70 billion.

Operations: The company's revenue is primarily derived from its Internet Software & Services segment, totaling $1.70 billion.

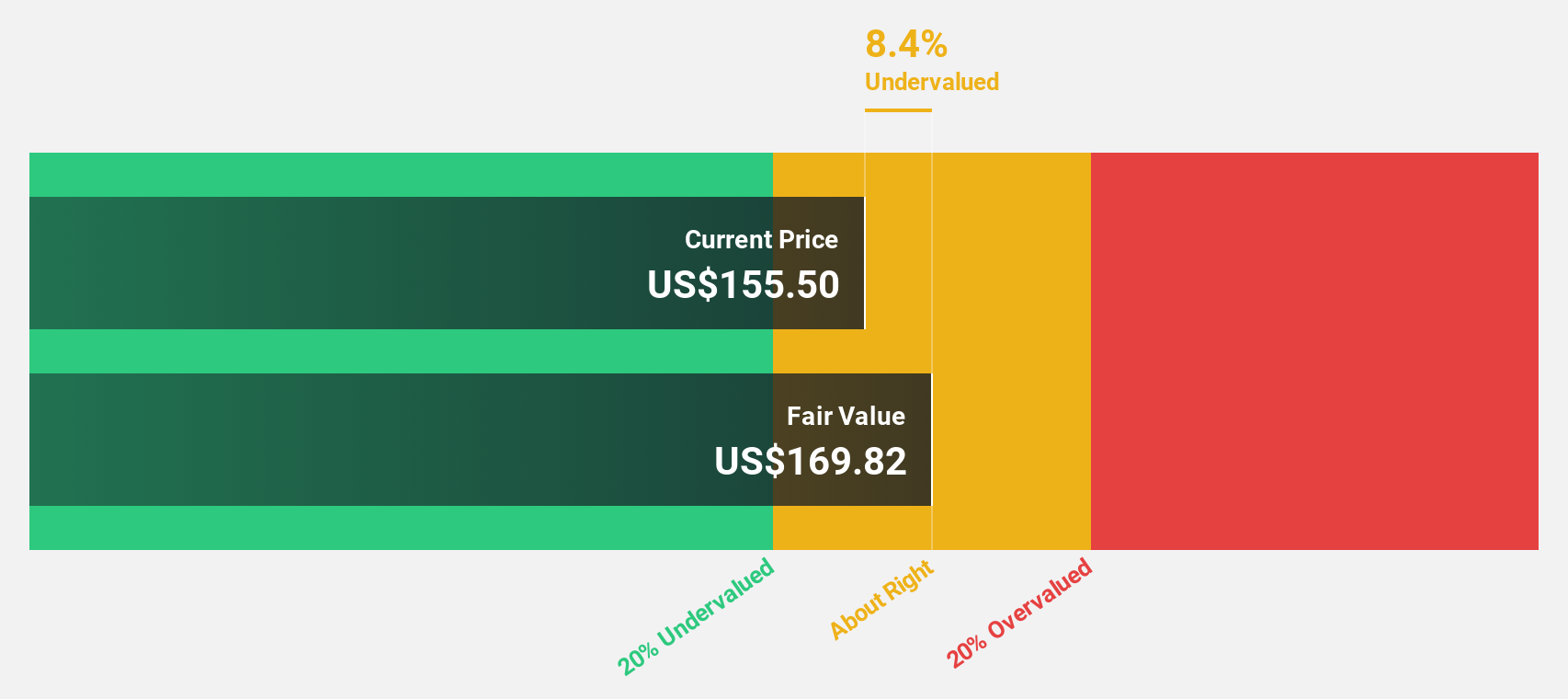

Estimated Discount To Fair Value: 20.7%

Wix.com, trading at US$220.71, is significantly below its estimated fair value of US$278.4, indicating potential undervaluation based on cash flows. The company's earnings are expected to grow 32.1% annually over the next three years, outpacing the broader US market's growth rate of 15.1%. Recent product innovations like AI Site-Chat and strategic alliances with Pantone enhance Wix's offerings and could support its revenue growth forecast of 11.9% per year despite high debt levels.

- According our earnings growth report, there's an indication that Wix.com might be ready to expand.

- Get an in-depth perspective on Wix.com's balance sheet by reading our health report here.

Next Steps

- Explore the 166 names from our Undervalued US Stocks Based On Cash Flows screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wix.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WIX

Wix.com

Operates a cloud-based web development platform for registered users and creators worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives