- United States

- /

- Biotech

- /

- NasdaqCM:ORGO

Insider-Favored Growth Companies Including Organogenesis Holdings And Two More

Reviewed by Simply Wall St

As the U.S. stock market grapples with volatility driven by escalating trade tensions and significant index declines, investors are increasingly seeking stability amid uncertainty. In this climate, growth companies with high insider ownership can offer a unique appeal, as they often indicate confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 14.2% | 29.8% |

| Duolingo (NasdaqGS:DUOL) | 14.4% | 37.3% |

| Hims & Hers Health (NYSE:HIMS) | 13.2% | 21.8% |

| Coastal Financial (NasdaqGS:CCB) | 14.5% | 46.3% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.4% | 64.8% |

| Astera Labs (NasdaqGS:ALAB) | 15.9% | 61.3% |

| FTC Solar (NasdaqCM:FTCI) | 31.6% | 62.2% |

| BBB Foods (NYSE:TBBB) | 16.2% | 34.6% |

| Upstart Holdings (NasdaqGS:UPST) | 12.7% | 100.1% |

| Credit Acceptance (NasdaqGS:CACC) | 14.4% | 33.9% |

We'll examine a selection from our screener results.

Organogenesis Holdings (NasdaqCM:ORGO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Organogenesis Holdings Inc. is a regenerative medicine company that develops, manufactures, and commercializes products for advanced wound care and surgical and sports medicine markets in the United States, with a market cap of $551.70 million.

Operations: The company's revenue is primarily generated from its regenerative medicine segment, which amounted to $482.04 million.

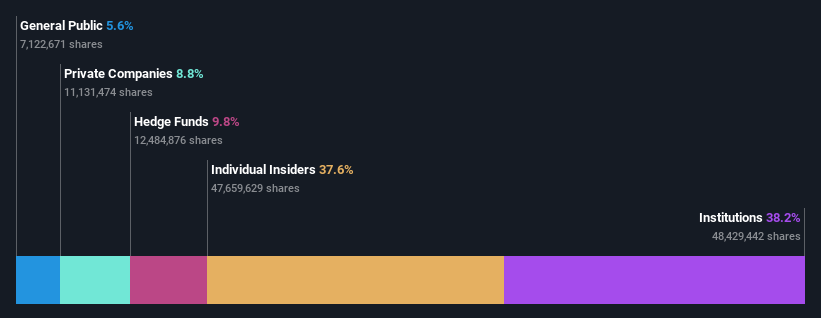

Insider Ownership: 37.6%

Earnings Growth Forecast: 71.8% p.a.

Organogenesis Holdings, recently added to the S&P Biotechnology Select Industry Index, is trading at a good value compared to peers and industry. The company forecasts revenue growth of 9.2% annually, surpassing the US market average of 8.3%, with earnings expected to grow significantly by 71.83% per year. Despite recent insider selling and share price volatility, analysts agree on a potential stock price rise of 47.4%.

- Click here and access our complete growth analysis report to understand the dynamics of Organogenesis Holdings.

- The analysis detailed in our Organogenesis Holdings valuation report hints at an deflated share price compared to its estimated value.

Canadian Solar (NasdaqGS:CSIQ)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Canadian Solar Inc., with a market cap of $599.44 million, operates globally by offering solar energy and battery storage products and solutions across Asia, the Americas, Europe, and other international markets.

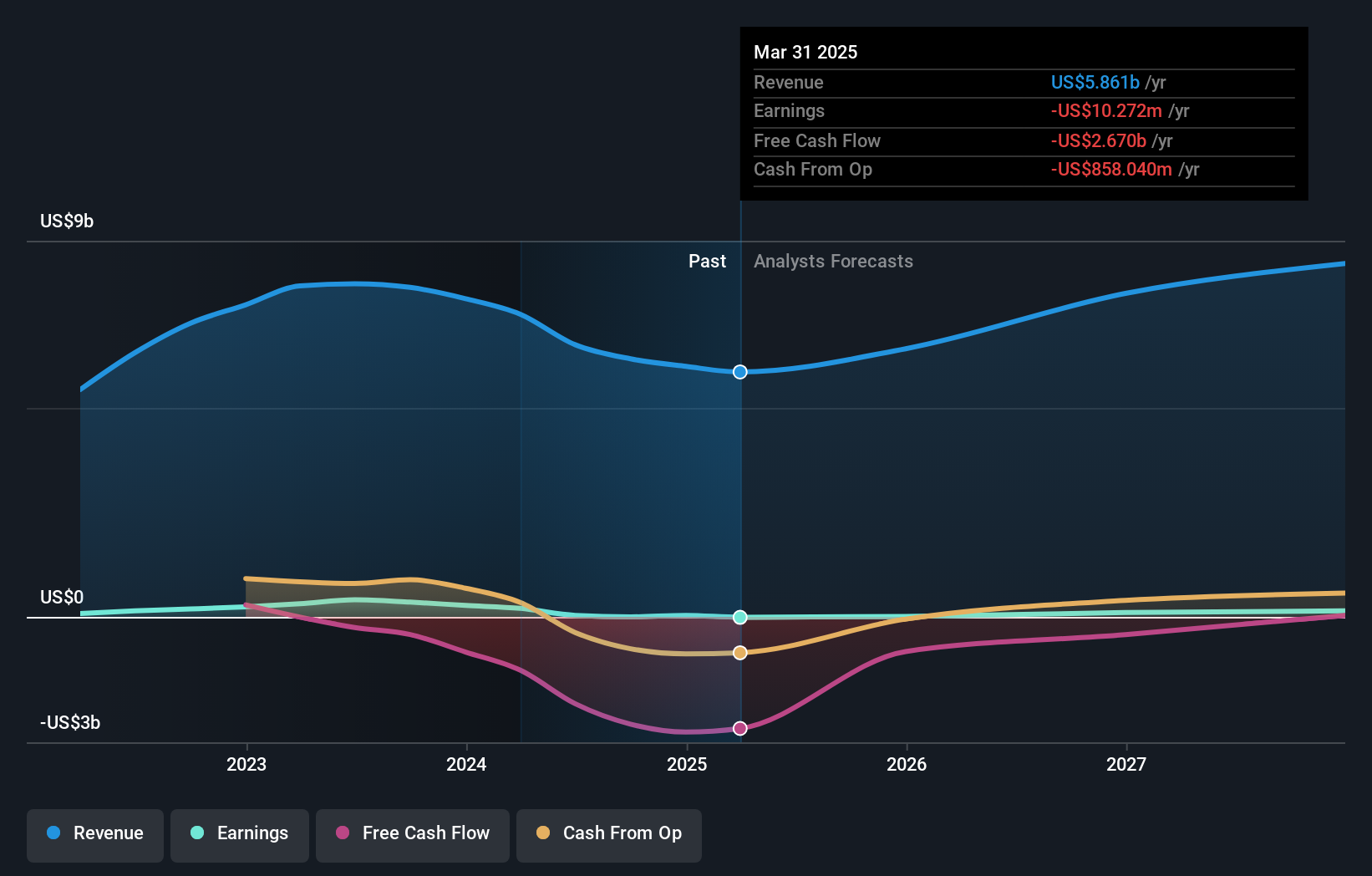

Operations: Canadian Solar Inc. generates revenue through the provision of solar energy products and battery storage solutions across Asia, the Americas, Europe, and other international regions.

Insider Ownership: 21.2%

Earnings Growth Forecast: 64% p.a.

Canadian Solar, with strong insider ownership, is positioned for growth despite recent financial challenges. The company reported a revenue decline to US$5.99 billion in 2024 from US$7.61 billion the previous year, and net income dropped significantly. However, it anticipates revenues between US$7.3 billion and US$8.3 billion for 2025, driven by its expansive solar and battery storage projects globally. Analysts project earnings growth of 64% annually over the next three years, outpacing the broader market expectations.

- Unlock comprehensive insights into our analysis of Canadian Solar stock in this growth report.

- Upon reviewing our latest valuation report, Canadian Solar's share price might be too pessimistic.

Similarweb (NYSE:SMWB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Similarweb Ltd. offers digital data and analytics services to facilitate crucial business decisions globally, with a market cap of $681.67 million.

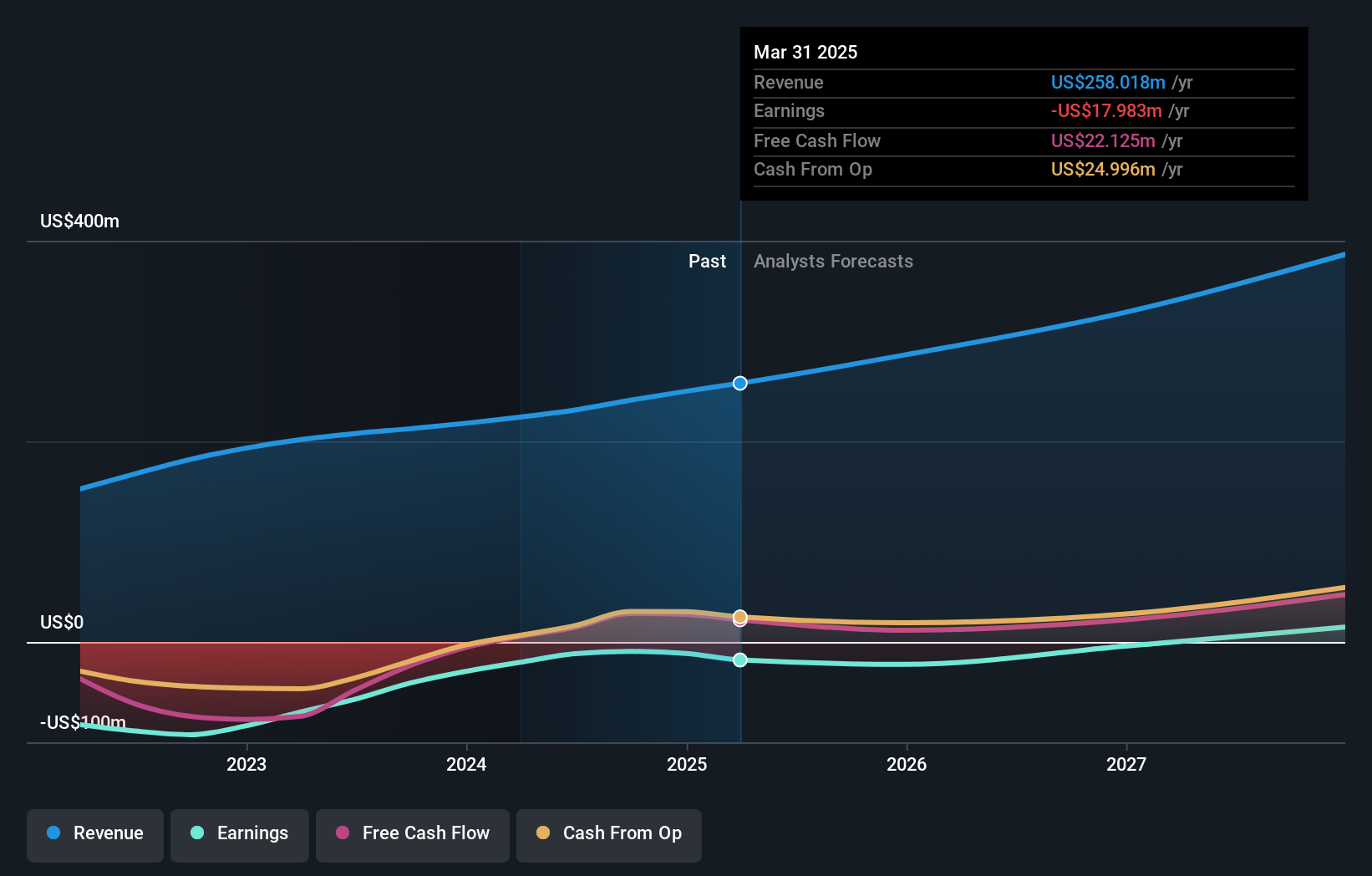

Operations: The company generates revenue of $249.91 million from its online financial information provider segment.

Insider Ownership: 15%

Earnings Growth Forecast: 61.5% p.a.

Similarweb, with significant insider ownership, is poised for growth amidst financial fluctuations. The company's earnings are forecast to grow 61.55% annually, and it is expected to become profitable within three years. Recent advancements include the launch of App Intelligence, enhancing digital analytics capabilities through integration with 42matters. Despite a volatile share price and trading below estimated fair value by 56.5%, analysts agree on a potential stock price increase of over 100%.

- Navigate through the intricacies of Similarweb with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Similarweb's shares may be trading at a discount.

Turning Ideas Into Actions

- Embark on your investment journey to our 201 Fast Growing US Companies With High Insider Ownership selection here.

- Contemplating Other Strategies? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ORGO

Organogenesis Holdings

A regenerative medicine company, develops, manufactures, and commercializes products for the advanced wound care, and surgical and sports medicine markets in the United States.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives