- United States

- /

- Biotech

- /

- NasdaqGS:NVAX

What Shah Capital’s Push for a Sale Means for Novavax Shares in 2025

Reviewed by Bailey Pemberton

Thinking of what to do with Novavax stock? You are definitely not alone. Whether you've held on through its wild swings or are eyeing it on this latest upswing, there is no shortage of heated opinions. Novavax's share price just closed at $8.91, and while that's a world away from its past heights, recent moves suggest something is stirring. Over the past month, shares have gained 10.3%, outpacing the market. The year-to-date return stands at a more modest 4.0%. Still, the longer-term picture is sobering, with the stock down 50.3% over three years and a staggering 90.2% over five.

So what is changing? News broke recently that Shah Capital, Novavax's second-largest shareholder, is urging the company’s board to consider a sale after continued underperformance of its COVID-19 vaccine rollout. This pushes the spotlight back onto Novavax’s strategic future and may help explain renewed interest and changes in risk perception surrounding the shares. While the market remains wary, some are clearly betting that a shake-up could unlock value.

And speaking of value, let’s dig deeper. Novavax currently scores a 3 on our value rating scale, which means it looks undervalued in three out of six key checks. This blend of discounted valuation and shifting investor sentiment raises some big questions: Is this a bargain, or simply a sign of persistent risk? Next, we will break down these valuation models and why each one matters. Stay tuned, because I will share an even smarter way to size up Novavax’s true value by the end of the article.

Why Novavax is lagging behind its peers

Approach 1: Novavax Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a valuation method that projects a company’s future free cash flows and discounts them back to today’s value, estimating what the business is fundamentally worth. For Novavax, this method factors in both analyst estimates for the next five years and extrapolated projections beyond that period.

Right now, Novavax has a last twelve months free cash flow (FCF) of -$668.4 million, placing it deep in the red. The outlook over the coming years is mixed. Analysts expect Novavax’s FCF to turn positive by 2026 at $76 million, before dipping negative again in 2027, then rebounding and fluctuating through 2035. All told, the ten-year FCF forecast shows inconsistent growth and illustrates the uncertainty around the company’s ability to consistently generate cash.

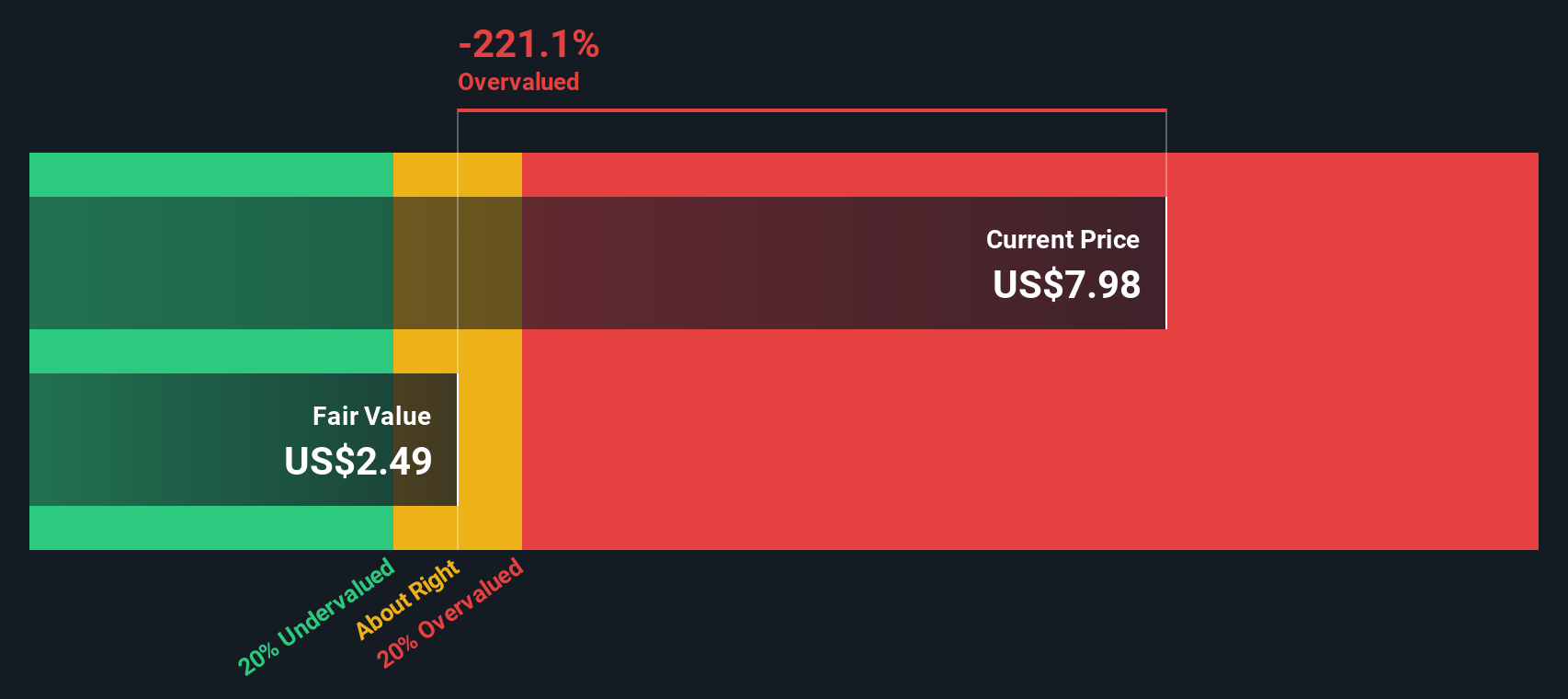

These volatile cash flows are then discounted back to arrive at an intrinsic value per share of $2.47, far below the current share price of $8.91. This means, according to the DCF model, Novavax shares are trading at a 261.2% premium to their projected fundamental value, making the stock look significantly overvalued using this approach.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Novavax may be overvalued by 261.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Novavax Price vs Earnings (PE)

For companies generating profit, the Price-to-Earnings (PE) ratio is often the go-to metric because it tells investors how much they are paying for each dollar of earnings. It is particularly suitable for profitable firms since it directly links the stock price to the company's ability to generate profit, a core driver of long-term value.

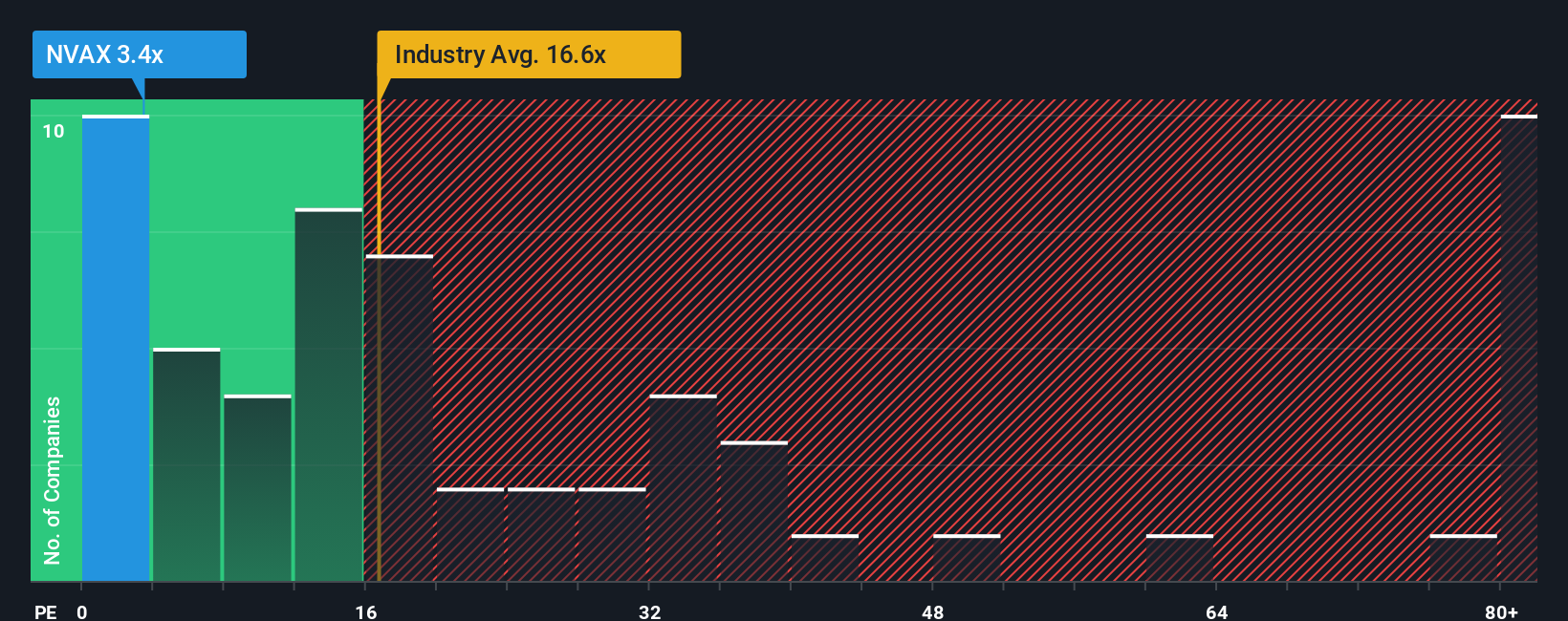

However, what qualifies as a "normal" or "fair" PE ratio varies. High-growth companies or those with lower risks tend to command higher PE ratios, while mature or riskier firms usually trade at lower multiples. The biotech sector, which Novavax is part of, currently averages a PE of 17.1x. Comparable peers average a much steeper 60.4x. Novavax stands out with an ultra-low PE of just 3.4x, suggesting that the market is skeptical about its future earnings or sees elevated risks.

To provide more nuance, Simply Wall St has developed a proprietary "Fair Ratio" for Novavax, set at 10.3x. This benchmark goes a step further than generic industry or peer comparisons by also factoring in the company's growth prospects, earnings quality, risks, margins, and even its market cap. Because it combines so many specifics, the Fair Ratio paints a truer picture of what multiple is justified right now for Novavax.

Comparing Novavax’s actual 3.4x PE with its Fair Ratio of 10.3x, the stock appears undervalued on this basis. This could imply the market is overlooking some upside potential if the company’s profits stabilize or improve from here.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Novavax Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal storyline about a company. It links what you believe about Novavax’s future (its strategy, risks, and potential) to concrete financial forecasts and a fair value estimate.

This approach is easy and accessible, and available to all investors on Simply Wall St’s Community page, where millions of users share their investment perspectives. Narratives help you move beyond simple ratios by letting you tie your investment thesis directly to numbers such as expected revenue, future profit margins, and fair value calculations.

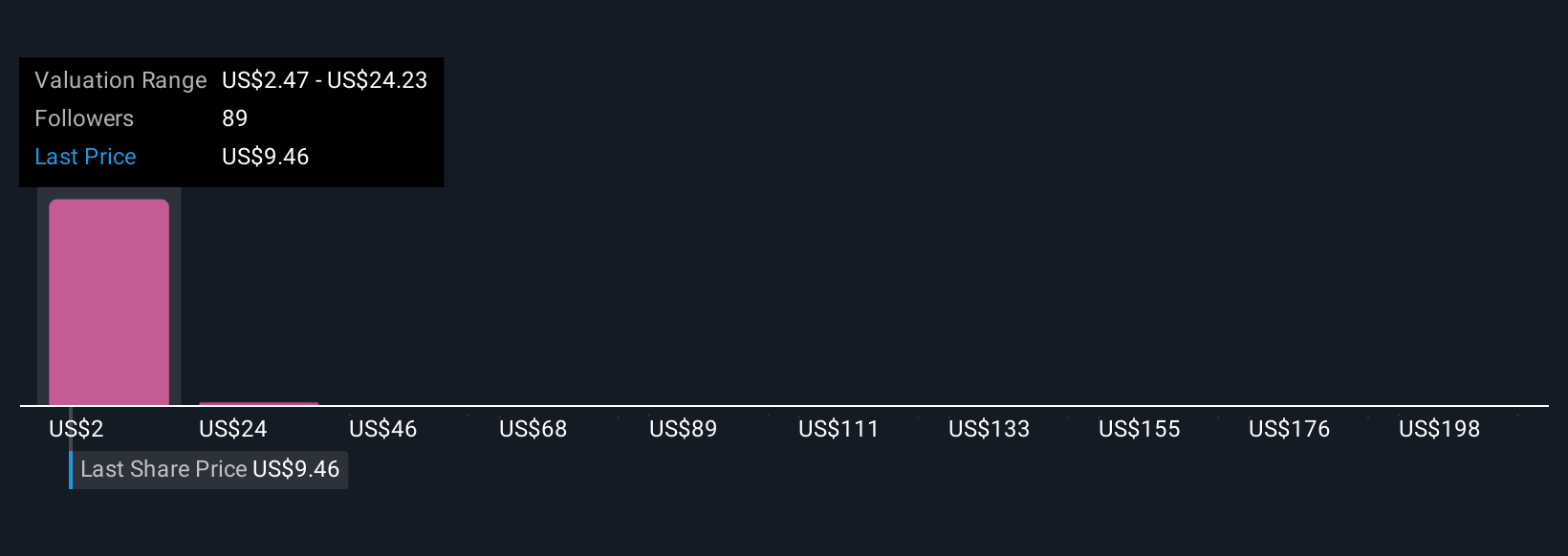

Here is how it works: You build your Narrative by expressing your assumptions about Novavax’s future. This forms a financial forecast that generates a fair value estimate. Comparing that fair value to today’s share price helps you decide if the stock is a buy, sell, or hold for your own situation because it shows the gap between what you believe the company is worth and what the market says.

Narratives are dynamic. They update automatically when key news, earnings, or regulatory updates come in. For example, some investors today believe Novavax could be worth as much as $25.00 if global vaccine demand accelerates and new partnerships deliver, while others see fair value as low as $6.00 if revenue and margin risks materialize. Narratives make these perspectives actionable by connecting your view to the numbers, empowering you to invest with confidence.

Do you think there's more to the story for Novavax? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novavax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVAX

Novavax

A biotechnology company, engages in the discovering, developing, and commercializing vaccines to protect against serious infectious diseases in the United States, Europe, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives