- United States

- /

- Biotech

- /

- NasdaqGS:NVAX

Novavax (NVAX): Revisiting Valuation After Prolonged Share Price Weakness and Mixed Fair Value Signals

Reviewed by Simply Wall St

Novavax (NVAX) has quietly slipped in the past month, extending a rough past 3 months for shareholders, even as the company continues pushing its protein based vaccine platform and malaria partnership story to investors.

See our latest analysis for Novavax.

At around $6.86 per share, Novavax’s 30 day share price return of minus 8.66 percent sits within a much steeper year to date decline. The 3 year total shareholder return of minus 60.39 percent shows that momentum has been fading for some time.

If you are weighing Novavax’s risk reward trade off, it can also help to compare it with other specialised healthcare names using our curated screen of healthcare stocks.

With shares still down heavily over three and five years but trading at a steep discount to analyst targets, is Novavax a beaten down vaccine player set for a rebound, or is the market already discounting its future growth?

Most Popular Narrative Narrative: 48% Undervalued

With Novavax last closing at $6.86 against a narrative fair value near $13, the story hinges on how quickly licensing revenues can scale.

The global vaccine market is expected to increase significantly, driven by factors such as aging populations and emerging infectious diseases, expanding Novavax's addressable market and supporting long-term revenue growth. Partnership with Sanofi has de risked commercial execution for Nuvaxovid and opened doors for future milestone and royalty streams, particularly as Sanofi develops and commercializes COVID influenza combination vaccines, which could meaningfully boost Novavax's recurring revenue and net margins.

Curious how shrinking revenues can still justify a richer future earnings multiple and higher fair value than today’s price suggests? The narrative’s forecasts might surprise you.

Result: Fair Value of $13.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps by partners or a faster than expected drop in COVID vaccine demand could quickly undermine the licensing-led earnings story.

Find out about the key risks to this Novavax narrative.

Another View: Cash Flows Tell A Tougher Story

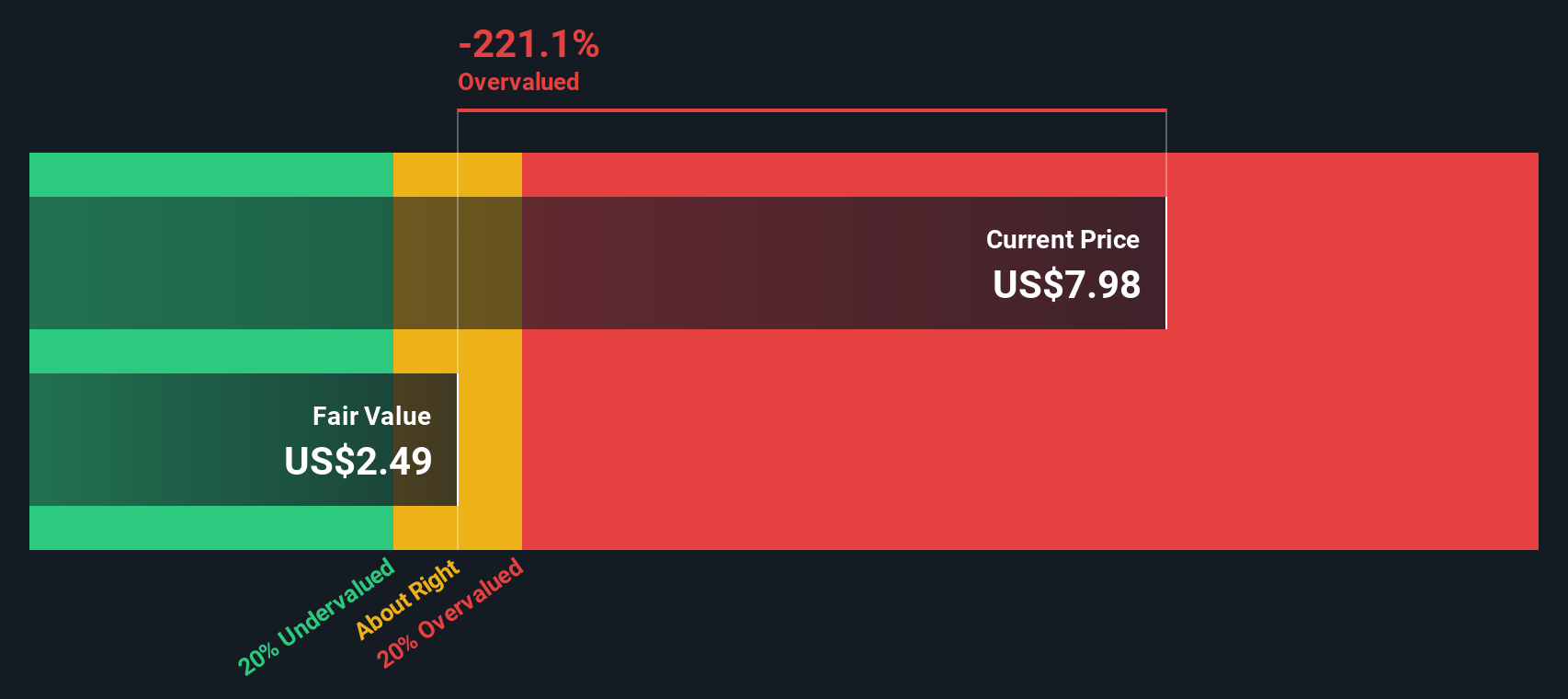

While analyst narratives and target prices point to upside, our DCF model paints a more cautious picture, with NVAX trading above an estimated fair value of about $4.61. If future cash flows do not materialize as hoped, could today’s low earnings multiple be a value trap rather than an opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Novavax for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 912 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Novavax Narrative

If you see Novavax’s story differently, or want to dig into the numbers yourself, you can build a custom narrative in minutes: Do it your way.

A great starting point for your Novavax research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in an edge by scanning fresh opportunities across themes, sectors, and strategies that could complement or even outperform your Novavax position.

- Capture potential mispricing by targeting quality companies trading below intrinsic value with these 912 undervalued stocks based on cash flows that highlight compelling cash flow upside.

- Ride structural trends in intelligent automation by focusing on innovators powering next generation medical breakthroughs through these 30 healthcare AI stocks.

- Position yourself early in the evolution of digital finance by assessing listed leaders and enablers of blockchain adoption via these 81 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Novavax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVAX

Novavax

A biotechnology company, engages in the discovering, developing, and commercializing vaccines to protect against serious infectious diseases in the United States, Europe, and internationally.

Fair value with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)