- United States

- /

- Biotech

- /

- NasdaqGS:NTRA

Natera (NasdaqGS:NTRA) Climbs 11% in One Week

Reviewed by Simply Wall St

Natera (NasdaqGS:NTRA) experienced a 10.58% increase over the past week, following a set of recent developments. While there were no specific notable events directly influencing the company, the rise aligns with broader market trends, as the overall market climbed 5.4% in the same period. Given that earnings are expected to grow annually by 14%, investor sentiment may have been buoyed by positive market conditions. Without significant news from Natera, the price movement could largely mirror the general market optimism rather than company-specific actions, with any period events potentially supporting these broader market gains.

Natera has 1 risk we think you should know about.

Over the past five years, Natera's total shareholder return was 339.81%, a very large increase indicating strong long-term performance. In contrast, during the past year, Natera outpaced both the US Biotechs industry and the US market, which saw returns of -12% and 3.6% respectively. This suggests that while recent gains may align with broader market trends, Natera's performance has stood out over the longer term.

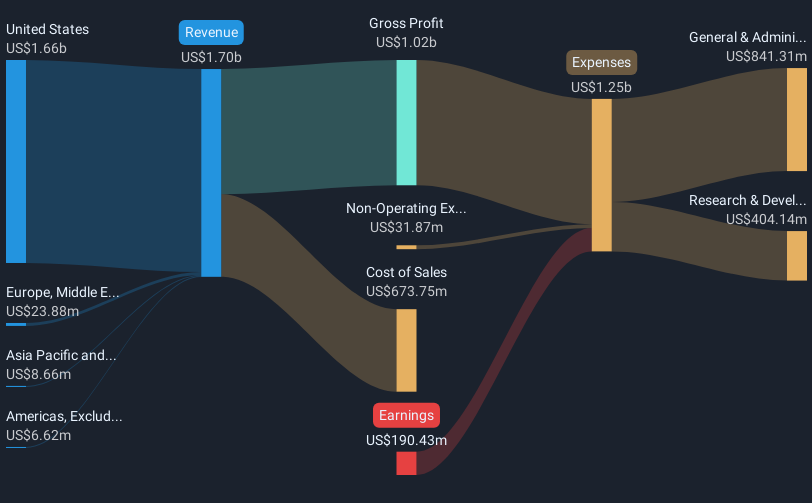

The company's recent share price momentum, coupled with expected annual earnings growth of 14%, could signal continued investor confidence. While no major events directly impacted Natera recently, their consistent revenue increase, with 2024 revenue reaching US$1.70 billion and a reduction in net losses to US$190.43 million, might positively influence ongoing earnings forecasts. Current revenue guidance for 2025 of US$1.87 billion to US$1.95 billion supports this optimistic outlook.

The share price currently trades at a discount relative to the consensus analyst target price of US$187.72, which suggests potential room for upside. However, the stock is considered expensive based on its Price-To-Sales Ratio of 11.8x compared to industry peers. This valuation context is essential for understanding the potential alignment with analyst expectations despite recent gains.

Review our historical performance report to gain insights into Natera's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Natera, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Natera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTRA

Natera

A diagnostics company, provides molecular testing services worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives