- United States

- /

- Biotech

- /

- NasdaqGS:MRNA

Moderna (NasdaqGS:MRNA) Drops 13% Following Weak 2024 Earnings Outlook

Reviewed by Simply Wall St

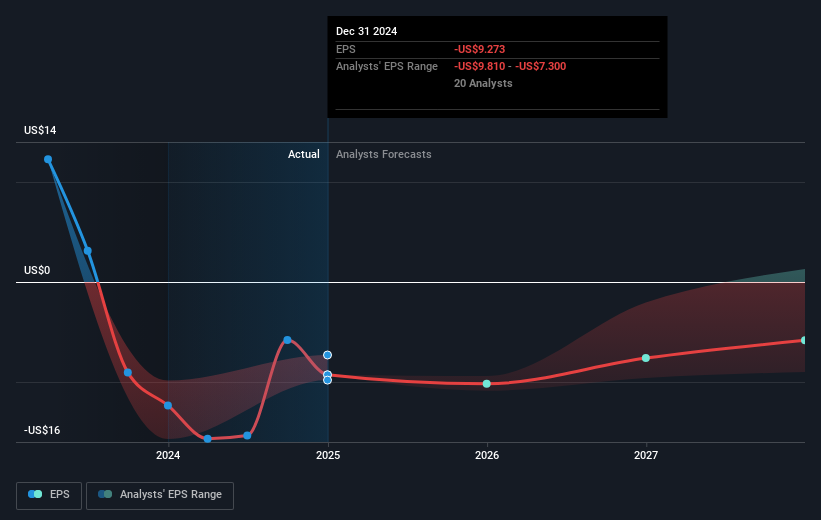

Moderna (NasdaqGS:MRNA) recently announced a significant decrease in fourth-quarter revenue and profits for 2024, alongside setting a conservative revenue projection for 2025. The company's share price experienced a 13% decline over the past week, a movement that aligns with the broader market's recent trends and uncertainties. Despite a notable rise in major stock indexes driven by positive inflation data, Moderna's decline was pronounced—likely a result of investor reactions to the substantial drop in its quarterly revenue and net income. Meanwhile, the technology-heavy Nasdaq index saw a 3.5% drop this week amid mixed market performance and economic concerns. The overall market exhibited a 1.4% downturn over the same period. Moderna's results and future guidance highlighted ongoing challenges, setting it apart from broader market excitement over easing inflation, which had initially buoyed technology and growth stocks.

Click here and access our complete analysis report to understand the dynamics of Moderna.

Over the past five years, Moderna’s total shareholder return was 4.56%. Despite growth initiatives and partnerships, the company experienced significant financial challenges. The volatile performance can be partly attributed to increased losses at a rate of 20.2% per year over this period, highlighting profitability hurdles. Additionally, a substantial revenue drop in Q4 2024 from US$2.81 billion to US$966 million impacted investor confidence, aligning with the company's continued struggle to achieve profitability. These factors underline the challenges faced in maintaining consistent growth during the pandemic and its aftermath.

Throughout the last year, Moderna's shares have underperformed the US Biotechs industry, which saw a 6.9% decline, and the broader US Market, which grew 15.3%. The removal from the NASDAQ-100 Index in December 2024 further affected market perception, influencing investment sentiment. Despite product approvals and new partnerships, like the collaboration with Mitsubishi Tanabe Pharma, these strides were overshadowed by financial setbacks and legal issues surrounding patent infringement.

- Discover whether Moderna is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Assess the potential risks impacting Moderna's growth trajectory—explore our risk evaluation report.

- Have a stake in Moderna? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Moderna, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRNA

Moderna

A biotechnology company, provides messenger RNA medicines in the United States, Europe, and internationally.

Flawless balance sheet and slightly overvalued.