- United States

- /

- Chemicals

- /

- NasdaqCM:ALTO

Alto Ingredients And 2 Other US Penny Stocks To Watch

Reviewed by Simply Wall St

As of February 2025, the U.S. stock market has been showing resilience, with major indexes like the S&P 500 closing just shy of record highs and posting weekly gains. This environment sets a stage where investors might look beyond well-known names to explore opportunities in lesser-known areas such as penny stocks. Although often seen as remnants of a bygone era, these stocks represent smaller or newer companies that can offer affordability and growth potential when backed by strong financials. In this article, we will explore three noteworthy penny stocks in the U.S., including Alto Ingredients, that stand out for their financial strength and potential for significant returns.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $127.27M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.88 | $6.39M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.79 | $84.63M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.249 | $9.16M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.41 | $46.53M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.39 | $24.65M | ★★★★★☆ |

| PHX Minerals (NYSE:PHX) | $4.13 | $154.8M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8718 | $78.41M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.59 | $383.33M | ★★★★☆☆ |

Click here to see the full list of 702 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Alto Ingredients (NasdaqCM:ALTO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Alto Ingredients, Inc. is a company that produces, distributes, and markets specialty alcohols, renewable fuel, and essential ingredients in the United States with a market cap of $121.10 million.

Operations: The company's revenue is primarily derived from Pekin Campus Production ($606.10 million), Marketing and Distribution ($237.13 million), and Western Production ($159.33 million).

Market Cap: $121.1M

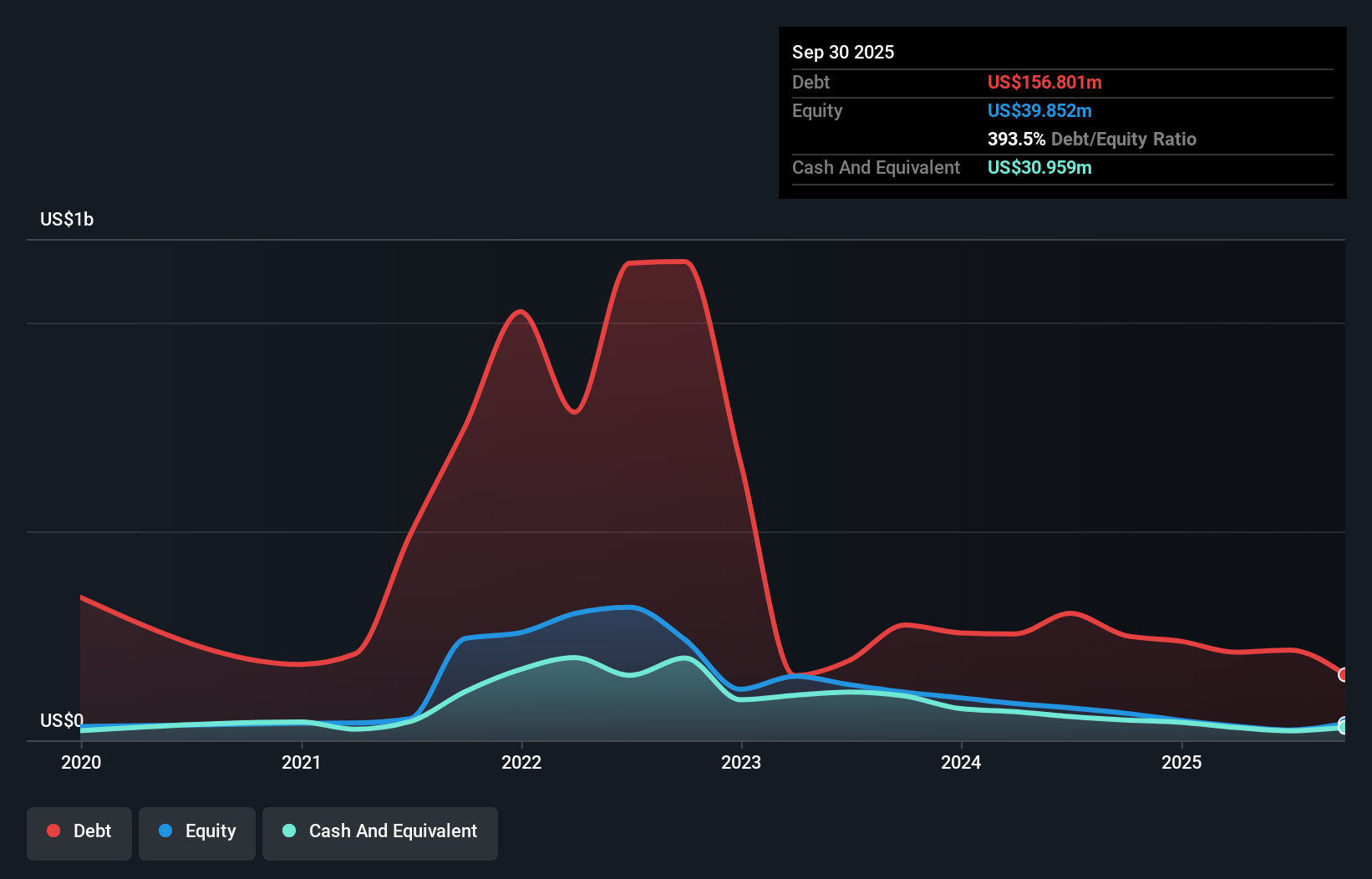

Alto Ingredients, Inc. has a market cap of US$121.10 million and generates significant revenue from its Pekin Campus Production, Marketing and Distribution, and Western Production segments. Despite being unprofitable, the company has reduced losses by 14.3% annually over the past five years and maintains a satisfactory net debt to equity ratio of 18.9%. It trades at good value compared to peers and is estimated to be 73.4% below fair value. Recent business reorganization includes cold idling its Magic Valley facility while continuing terminal services there, reflecting strategic adjustments amid operational challenges.

- Get an in-depth perspective on Alto Ingredients' performance by reading our balance sheet health report here.

- Gain insights into Alto Ingredients' outlook and expected performance with our report on the company's earnings estimates.

Metagenomi (NasdaqGS:MGX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Metagenomi, Inc. is a genetic medicines company in the United States that develops therapeutics using a metagenomics-derived genome editing toolbox, with a market cap of approximately $97.68 million.

Operations: The company's revenue is primarily derived from developing next-generation gene-editing technologies and therapies, amounting to $55.08 million.

Market Cap: $97.68M

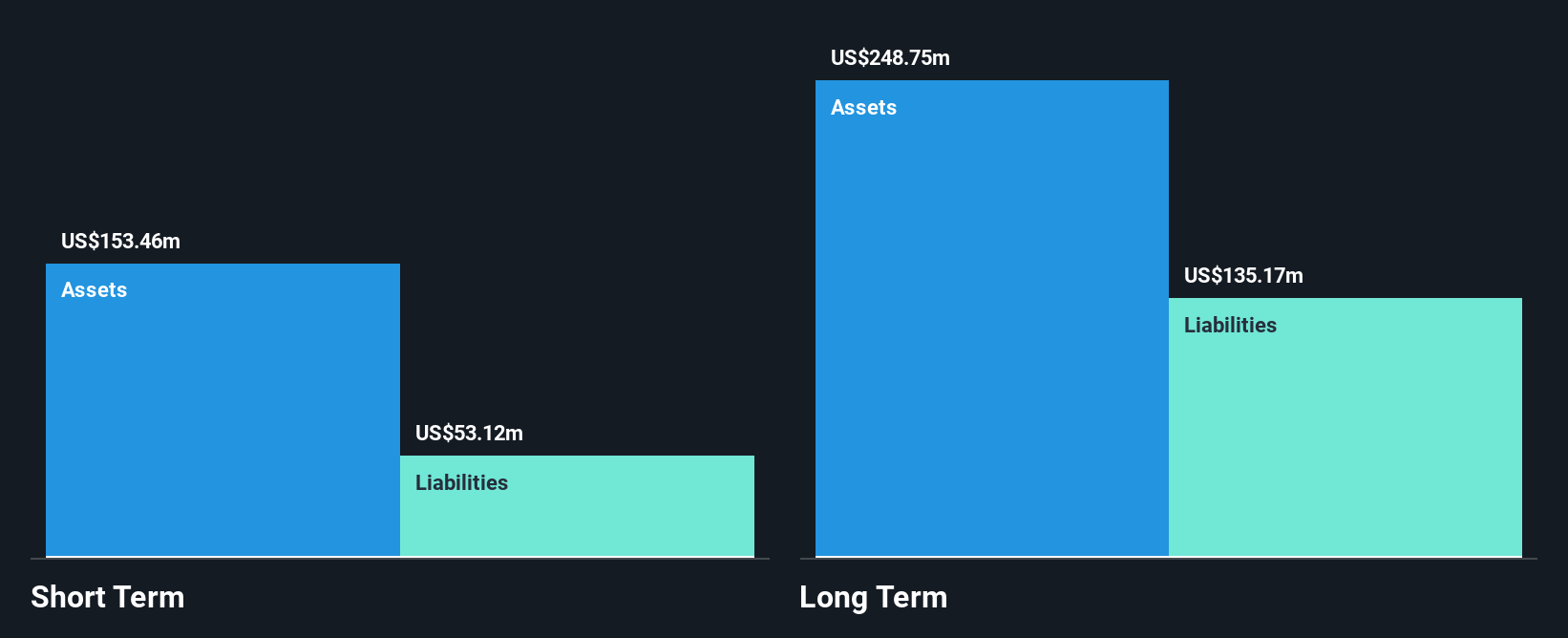

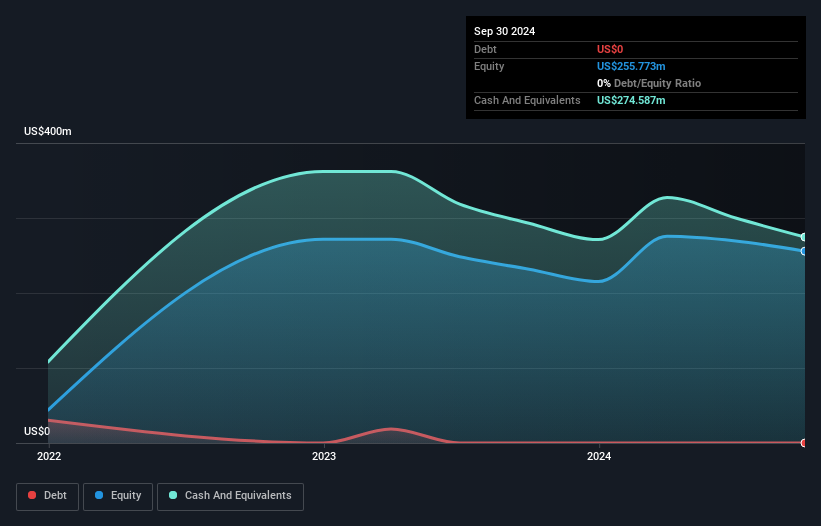

Metagenomi, Inc. has a market cap of US$97.68 million and is pre-revenue, focusing on developing next-generation gene-editing technologies. Despite being unprofitable, its revenue grew by 45.1% last year, and it holds sufficient cash to cover liabilities with short-term assets totaling US$282.3 million against liabilities of US$102.6 million combined. The company recently expanded its board by appointing Eric Bjerkholt as a director, enhancing governance with his extensive financial expertise in biotech firms like Mirum Pharmaceuticals and Chinook Therapeutics. Metagenomi's innovative genome editing tools demonstrate potential for advancing therapeutic applications significantly.

- Click here and access our complete financial health analysis report to understand the dynamics of Metagenomi.

- Understand Metagenomi's earnings outlook by examining our growth report.

Offerpad Solutions (NYSE:OPAD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Offerpad Solutions Inc. offers technology-driven solutions for the U.S. residential real estate market and has a market cap of approximately $67.02 million.

Operations: The company generates revenue primarily through its Real Estate Operations & Development segment, which accounted for $985.01 million.

Market Cap: $67.02M

Offerpad Solutions Inc., with a market cap of US$67.02 million, is navigating the U.S. residential real estate market through technology-driven solutions. Despite being unprofitable and experiencing increased losses over the past five years, its revenue from Real Estate Operations & Development hit US$985.01 million, with forecasts suggesting 17.09% annual growth in revenue. The company recently launched PriceLock to enhance seller confidence by securing final selling prices upfront, amidst its high net debt to equity ratio of 312.7%. Offerpad's short-term assets surpass both short- and long-term liabilities, providing some financial stability despite volatility concerns.

- Click here to discover the nuances of Offerpad Solutions with our detailed analytical financial health report.

- Gain insights into Offerpad Solutions' future direction by reviewing our growth report.

Where To Now?

- Unlock more gems! Our US Penny Stocks screener has unearthed 699 more companies for you to explore.Click here to unveil our expertly curated list of 702 US Penny Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ALTO

Alto Ingredients

Produces, distributes, and markets specialty alcohols, renewable fuel, and essential ingredients in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives