- United States

- /

- Biotech

- /

- NasdaqGS:LYEL

Analysts' Revenue Estimates For Lyell Immunopharma, Inc. (NASDAQ:LYEL) Are Surging Higher

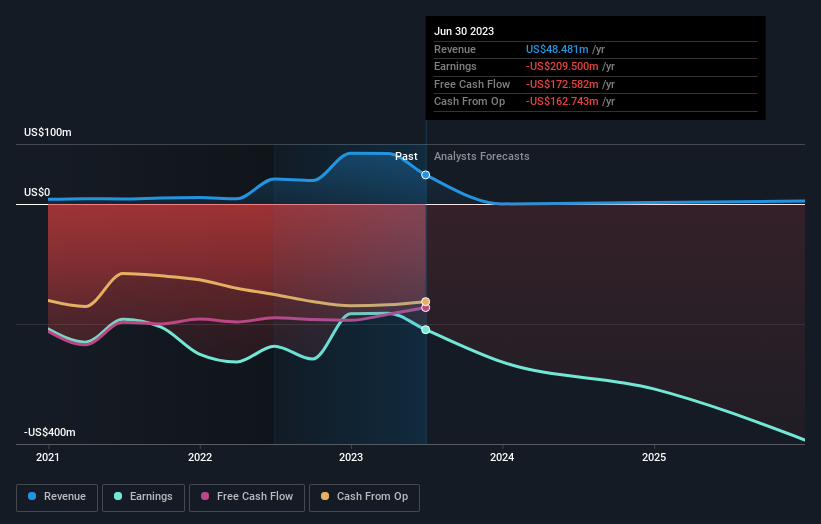

Lyell Immunopharma, Inc. (NASDAQ:LYEL) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's forecasts. The revenue forecast for this year has experienced a facelift, with the analysts now much more optimistic on its sales pipeline.

Following the latest upgrade, the four analysts covering Lyell Immunopharma provided consensus estimates of US$115k revenue in 2023, which would reflect a concerning 100% decline on its sales over the past 12 months. Losses are supposed to balloon 26% to US$1.05 per share. Yet prior to the latest estimates, the analysts had been forecasting revenues of US$92k and losses of US$1.06 per share in 2023. So there's definitely been a change in sentiment in this update, with the analysts upgrading this year's revenue estimates, while at the same time holding losses per share steady.

Check out our latest analysis for Lyell Immunopharma

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Lyell Immunopharma's past performance and to peers in the same industry. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 100% by the end of 2023. This indicates a significant reduction from annual growth of 16% over the last year. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 15% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Lyell Immunopharma is expected to lag the wider industry.

The Bottom Line

The highlight for us was that the consensus reduced its estimated losses this year, perhaps suggesting Lyell Immunopharma is moving incrementally towards profitability. Pleasantly, analysts also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow slower than the wider market. Seeing the dramatic upgrade to this year's forecasts, it might be time to take another look at Lyell Immunopharma.

These earnings upgrades look like a sterling endorsement, but before diving in - you should know that we've spotted 4 potential risks with Lyell Immunopharma, including recent substantial insider selling. For more information, you can click through to our platform to learn more about this and the 3 other risks we've identified .

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LYEL

Lyell Immunopharma

A clinical-stage cell therapy company, develops chimeric antigen receptor (CAR) T-cell product candidates for patients with hematologic malignancies and solid tumors.

Flawless balance sheet with medium-low risk.

Market Insights

Community Narratives