- United States

- /

- Marine and Shipping

- /

- NasdaqCM:PANL

3 Growth Companies With Insider Ownership Up To 19%

Reviewed by Simply Wall St

As the U.S. stock market navigates a landscape marked by fluctuating indices and rising Treasury yields, investors are closely monitoring legislative developments that could impact economic growth. In such an environment, growth companies with high insider ownership can offer unique advantages, as they often align management's interests with those of shareholders and may signal confidence in the company's future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 25.3% | 39.1% |

| Duolingo (NasdaqGS:DUOL) | 14.3% | 39.9% |

| AST SpaceMobile (NasdaqGS:ASTS) | 13.4% | 67.1% |

| FTC Solar (NasdaqCM:FTCI) | 27.9% | 61.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.1% | 65.1% |

| Astera Labs (NasdaqGS:ALAB) | 15.2% | 44.6% |

| BBB Foods (NYSE:TBBB) | 16.2% | 30.2% |

| Enovix (NasdaqGS:ENVX) | 12.1% | 58.4% |

| Upstart Holdings (NasdaqGS:UPST) | 12.5% | 102.6% |

| Silence Therapeutics (NasdaqGM:SLN) | 33.2% | 37.3% |

Below we spotlight a couple of our favorites from our exclusive screener.

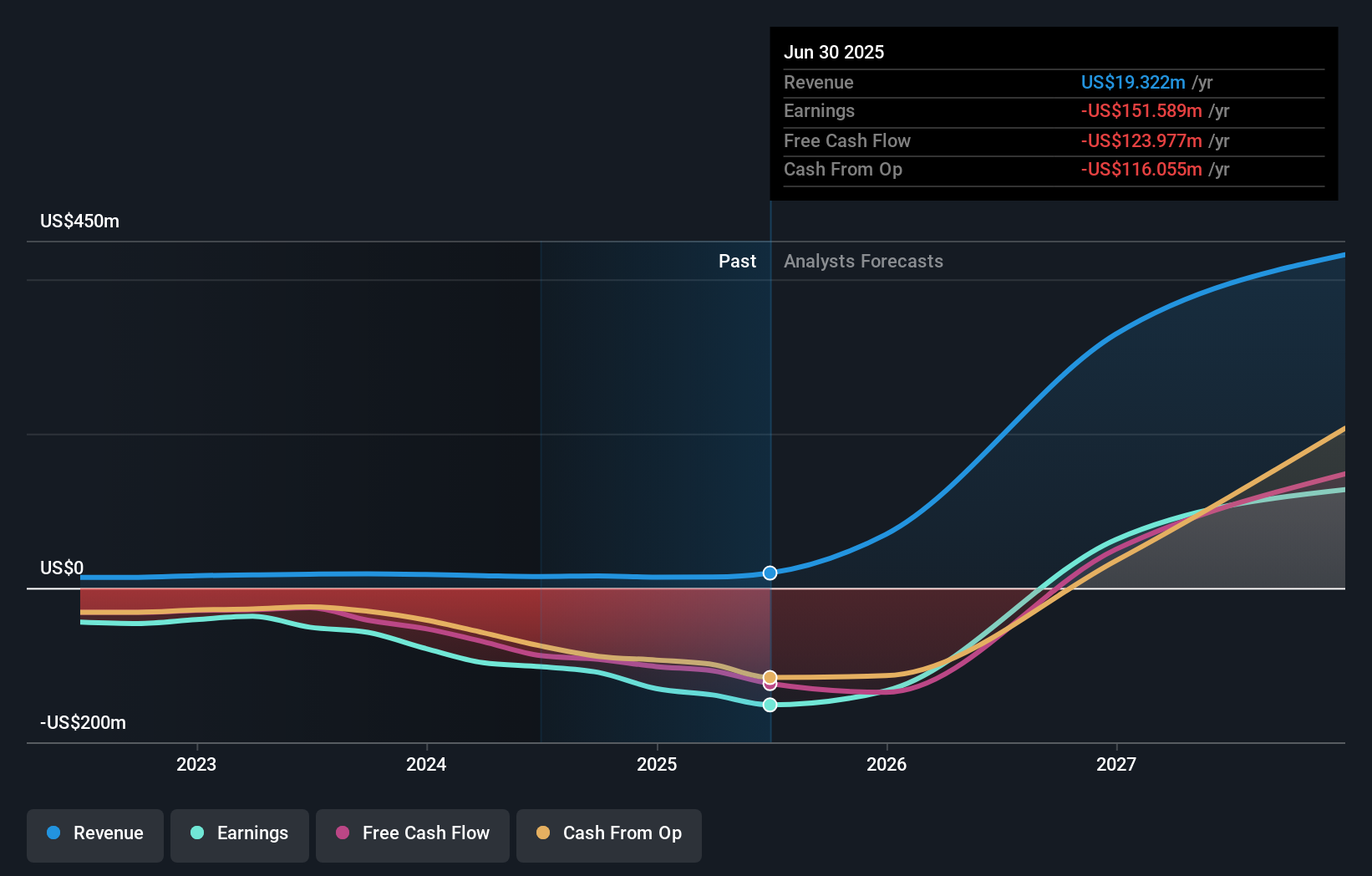

Liquidia (NasdaqCM:LQDA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Liquidia Corporation is a biopharmaceutical company that develops, manufactures, and commercializes products for unmet patient needs in the United States, with a market cap of approximately $1.46 billion.

Operations: The company generates revenue from its pharmaceuticals segment, amounting to $14.14 million.

Insider Ownership: 10.6%

Liquidia Corporation, with high insider ownership, is poised for significant growth. Despite recent legal challenges from United Therapeutics over patent issues related to YUTREPIA, Liquidia's revenue is projected to grow at 45.2% annually, outpacing the broader U.S. market. Although currently unprofitable with a net loss of US$38.37 million in Q1 2025, the company is expected to achieve profitability within three years while trading significantly below its estimated fair value.

- Dive into the specifics of Liquidia here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of Liquidia shares in the market.

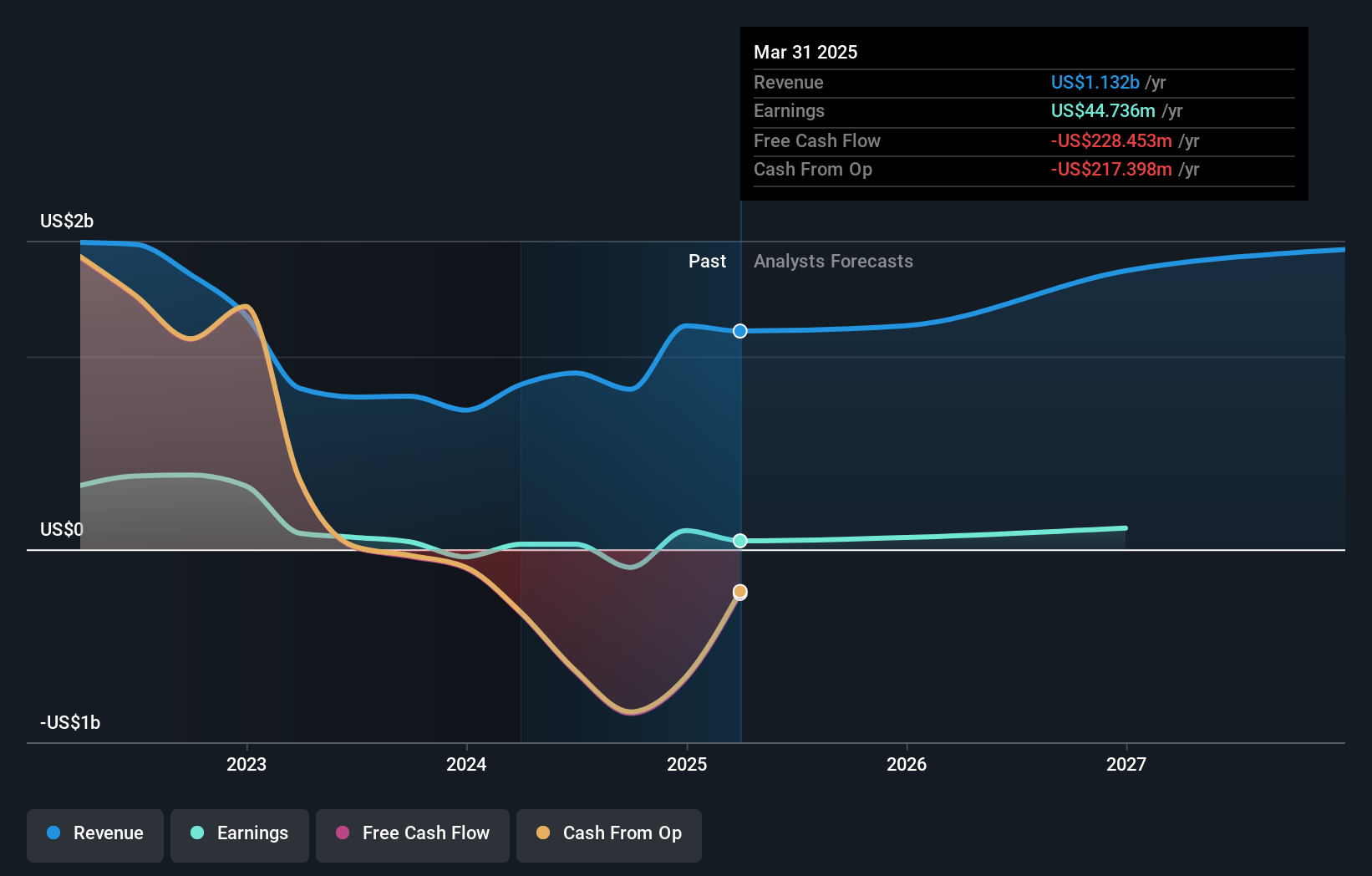

Pangaea Logistics Solutions (NasdaqCM:PANL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pangaea Logistics Solutions, Ltd. and its subsidiaries offer seaborne dry bulk logistics and transportation services to industrial clients globally, with a market cap of approximately $290.05 million.

Operations: The company generates revenue primarily from its shipping segment, amounting to $541.06 million.

Insider Ownership: 19.4%

Pangaea Logistics Solutions, with substantial insider ownership, is positioned for significant earnings growth at 65.3% annually, surpassing the U.S. market average of 14.3%. Despite recent challenges including a net loss of US$1.98 million in Q1 2025 and reduced profit margins from last year, the company trades significantly below its fair value estimate and has initiated a US$15 million share repurchase program to enhance shareholder value amidst slower revenue growth forecasts.

- Navigate through the intricacies of Pangaea Logistics Solutions with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Pangaea Logistics Solutions is priced lower than what may be justified by its financials.

Guild Holdings (NYSE:GHLD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guild Holdings Company, with a market cap of $815.58 million, operates in the United States through its subsidiary by originating, selling, and servicing residential mortgage loans.

Operations: The company's revenue segments include $828.98 million from origination and $153.36 million from servicing residential mortgage loans in the United States.

Insider Ownership: 11.4%

Guild Holdings, with high insider ownership, is poised for significant earnings growth at 49.5% annually, outpacing the U.S. market average of 14.3%. Despite a challenging Q1 2025 with a net loss of US$23.9 million and declining revenue to US$198.49 million from the previous year, the company has completed a substantial share buyback program valued at US$10.06 million and declared a special dividend to enhance shareholder value amidst slower revenue growth forecasts.

- Get an in-depth perspective on Guild Holdings' performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Guild Holdings' share price might be on the expensive side.

Summing It All Up

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 190 more companies for you to explore.Click here to unveil our expertly curated list of 193 Fast Growing US Companies With High Insider Ownership.

- Ready To Venture Into Other Investment Styles? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Pangaea Logistics Solutions, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PANL

Pangaea Logistics Solutions

Provides seaborne dry bulk logistics and transportation services to industrial customers worldwide.

Reasonable growth potential slight.

Similar Companies

Market Insights

Community Narratives