- United States

- /

- Software

- /

- NasdaqCM:BTDR

US High Growth Tech Stocks With Promising Potential

Reviewed by Simply Wall St

The United States market has shown a positive trend, rising 1.8% over the last week and 10% over the past year, with earnings projected to grow by 14% annually. In this environment, identifying high growth tech stocks involves looking for companies that not only capitalize on current technological advancements but also demonstrate strong potential for sustained revenue and profit growth in alignment with these market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.44% | 29.79% | ★★★★★★ |

| TG Therapeutics | 26.18% | 37.61% | ★★★★★★ |

| Travere Therapeutics | 28.43% | 65.01% | ★★★★★★ |

| AVITA Medical | 27.74% | 55.36% | ★★★★★★ |

| TKO Group Holdings | 22.48% | 25.17% | ★★★★★★ |

| Clene | 60.99% | 62.85% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.76% | 58.40% | ★★★★★★ |

| Blueprint Medicines | 22.42% | 56.06% | ★★★★★★ |

| Lumentum Holdings | 21.55% | 119.67% | ★★★★★★ |

| Ascendis Pharma | 32.36% | 59.79% | ★★★★★★ |

Click here to see the full list of 236 stocks from our US High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Bitdeer Technologies Group (NasdaqCM:BTDR)

Simply Wall St Growth Rating: ★★★★★★

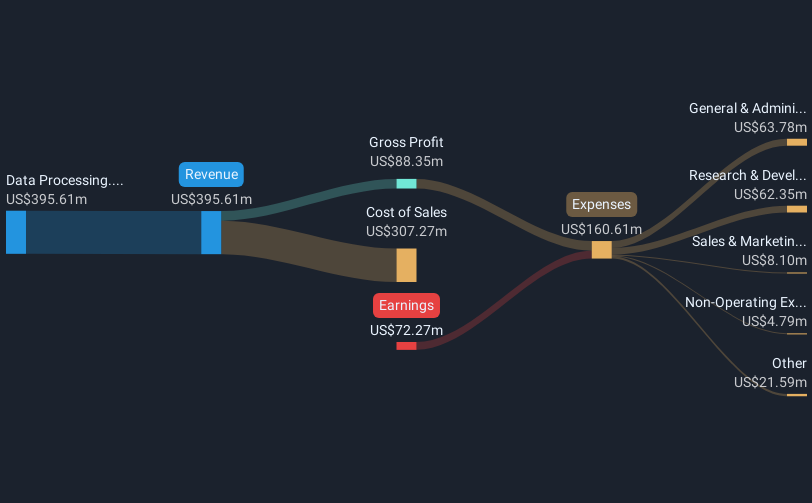

Overview: Bitdeer Technologies Group is a technology company focusing on blockchain and computing, with a market cap of approximately $1.93 billion.

Operations: The company generates revenue primarily from data processing, totaling $349.78 million.

Despite recent challenges, Bitdeer Technologies Group is positioning itself for significant advancements in the cryptocurrency mining sector. With a robust annual revenue growth forecast at 44.9% and earnings expected to soar by 126.9%, the company's strategic focus on innovation is evident from its R&D commitment, which aligns with its latest product developments like the SEAL03 chip. This chip, developed in partnership with TSMC, showcases leading-edge efficiency and is set to enhance Bitdeer's competitive edge in a rapidly evolving industry. Moreover, the company has actively repurchased shares worth $10 million to bolster shareholder value, reflecting confidence in its financial strategy and future prospects.

- Navigate through the intricacies of Bitdeer Technologies Group with our comprehensive health report here.

Gain insights into Bitdeer Technologies Group's past trends and performance with our Past report.

Veracyte (NasdaqGM:VCYT)

Simply Wall St Growth Rating: ★★★★☆☆

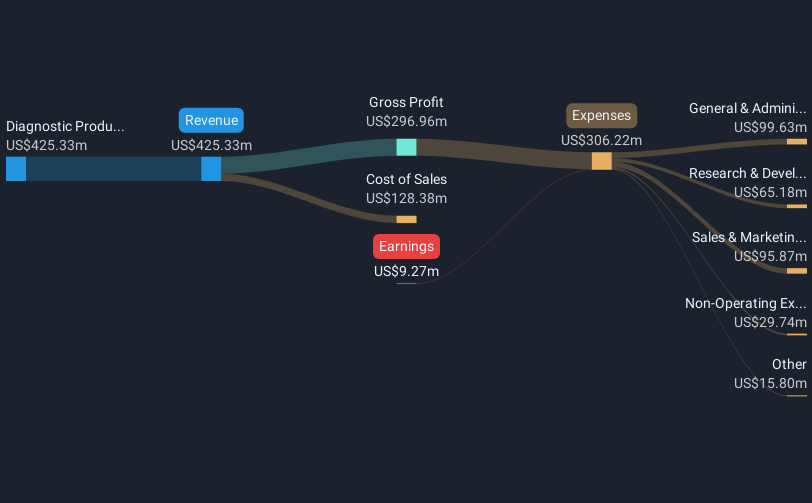

Overview: Veracyte, Inc. is a diagnostics company that operates both in the United States and internationally, with a market capitalization of approximately $2.48 billion.

Operations: Veracyte generates revenue primarily through its diagnostic products, which contributed $445.76 million.

Veracyte's recent pivot towards enhancing its genomic testing platforms, particularly in prostate and bladder cancer, underscores its commitment to precision medicine. With a notable 8.5% projected annual revenue growth outpacing the US market average of 8.4%, and an impressive forecast of 29.2% in earnings growth per year, the company is strategically positioned for robust expansion. The firm's R&D focus is evident from the $10.6 million one-off loss absorbed last year to fuel innovations like its Decipher tests, which are gaining traction in clinical settings as demonstrated at major conferences such as EAU25 and ASCO GU. This approach not only solidifies Veracyte's standing in oncological diagnostics but also aligns with broader industry shifts towards targeted therapeutic interventions, potentially setting new standards in patient care efficiency and outcomes.

- Delve into the full analysis health report here for a deeper understanding of Veracyte.

Examine Veracyte's past performance report to understand how it has performed in the past.

Krystal Biotech (NasdaqGS:KRYS)

Simply Wall St Growth Rating: ★★★★★☆

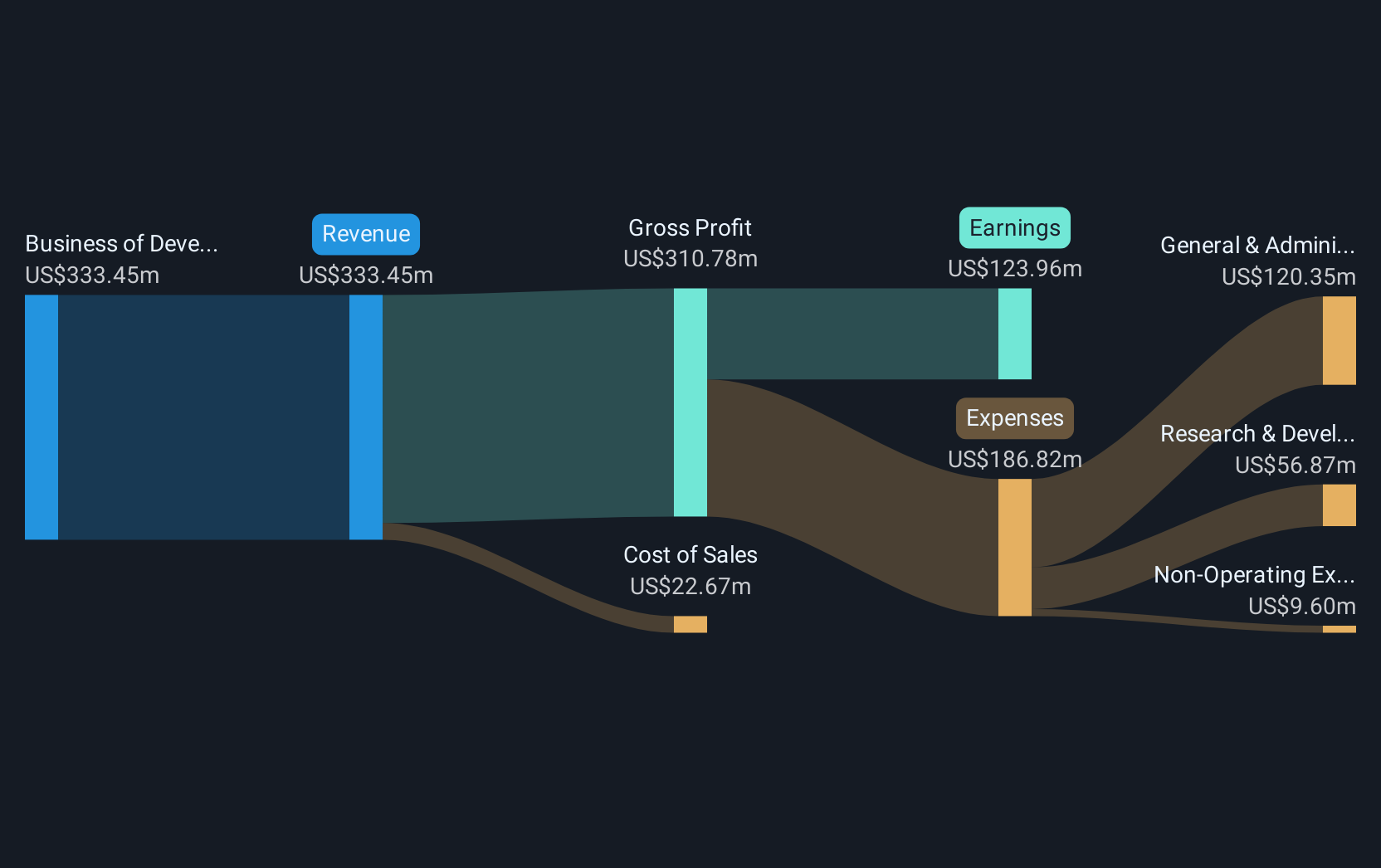

Overview: Krystal Biotech, Inc. is a commercial-stage biotechnology company focused on discovering, developing, manufacturing, and commercializing genetic medicines to address diseases with high unmet medical needs in the United States, with a market cap of approximately $5.39 billion.

Operations: Krystal Biotech generates revenue primarily from its business of developing and commercializing pharmaceuticals, amounting to $290.52 million. The company is focused on addressing diseases with high unmet medical needs through genetic medicines in the United States.

Krystal Biotech's recent advancements and financial performance underscore its potential within the biotech sector. With a staggering 715.6% earnings growth over the past year and an anticipated annual revenue increase of 25.7%, Krystal outpaces both its industry and broader market expectations, which stand at 40.2% and 8.4% respectively. The company's commitment to innovation is evident in its R&D efforts, marked by a significant one-off loss of $37.5 million, underscoring its focus on developing groundbreaking therapies such as VYJUVEK® for treating dystrophic epidermolysis bullosa—a product that has recently garnered positive feedback from the European Medicines Agency. This blend of robust financial growth and strategic product development positions Krystal Biotech as a compelling entity in high-growth biotechnology, navigating through clinical successes and expanding market reach effectively.

- Click to explore a detailed breakdown of our findings in Krystal Biotech's health report.

Review our historical performance report to gain insights into Krystal Biotech's's past performance.

Next Steps

- Reveal the 236 hidden gems among our US High Growth Tech and AI Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bitdeer Technologies Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BTDR

Bitdeer Technologies Group

Operates as a technology company for blockchain and computing.

Exceptional growth potential and fair value.

Similar Companies

Market Insights

Community Narratives