- United States

- /

- Diversified Financial

- /

- NYSE:PAY

US Growth Companies With High Insider Ownership In January 2025

Reviewed by Simply Wall St

As the U.S. markets continue to rally, buoyed by President Trump's recent executive actions and a positive economic outlook, investors are increasingly focused on growth companies with solid fundamentals. In this environment, stocks with high insider ownership can be particularly appealing as they often signal confidence from those closest to the company's operations and strategic direction.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.8% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 48% |

| Smith Micro Software (NasdaqCM:SMSI) | 23.1% | 85.4% |

| CarGurus (NasdaqGS:CARG) | 16.9% | 42.4% |

| Similarweb (NYSE:SMWB) | 25.4% | 126.3% |

Let's dive into some prime choices out of the screener.

Krystal Biotech (NasdaqGS:KRYS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Krystal Biotech, Inc. is a commercial-stage biotechnology company focused on discovering, developing, and commercializing genetic medicines for rare diseases in the United States, with a market cap of approximately $4.27 billion.

Operations: The company's revenue is derived from its business of developing and commercializing pharmaceuticals, amounting to $241.52 million.

Insider Ownership: 10.4%

Earnings Growth Forecast: 36.6% p.a.

Krystal Biotech is trading significantly below its estimated fair value, with earnings projected to grow substantially at 36.6% annually, outpacing the US market. The company recently reported promising clinical results from its KYANITE-1 study for lung cancer treatment and continues advancing its genetic medicine programs. Despite a recent dip in quarterly net income to US$27.18 million, Krystal's innovative therapies like VYJUVEK® highlight strong growth potential amidst high insider ownership.

- Delve into the full analysis future growth report here for a deeper understanding of Krystal Biotech.

- The valuation report we've compiled suggests that Krystal Biotech's current price could be quite moderate.

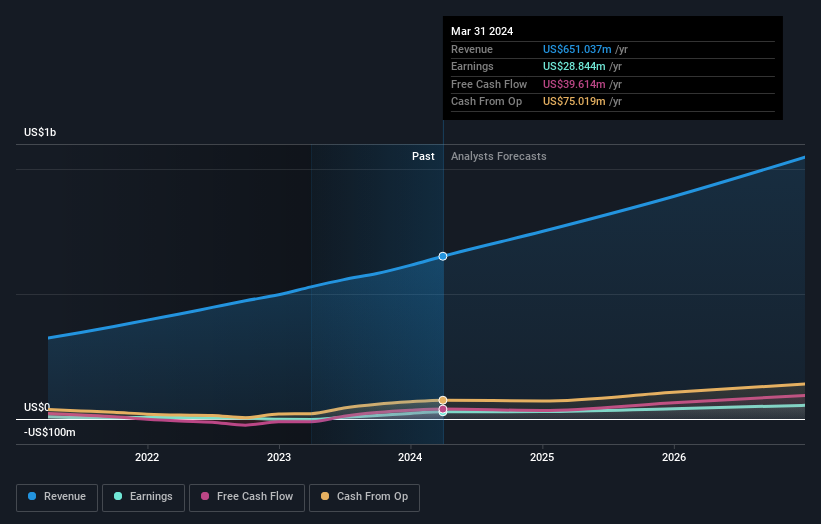

VNET Group (NasdaqGS:VNET)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: VNET Group, Inc. is an investment holding company that offers hosting and related services in China, with a market cap of approximately $1.50 billion.

Operations: The company's revenue is primarily derived from hosting and related services, totaling CN¥7.91 billion.

Insider Ownership: 10.6%

Earnings Growth Forecast: 67.9% p.a.

VNET Group is trading at a significant discount to its estimated fair value, with earnings expected to grow substantially as it aims for profitability within three years. The company recently formed a strategic alliance with Dajia Investment Holding to invest in hyperscale data centers in China, enhancing its growth potential. Despite high share price volatility and limited cash runway, VNET's revenue growth surpasses the US market average, supported by increased full-year revenue guidance.

- Dive into the specifics of VNET Group here with our thorough growth forecast report.

- The analysis detailed in our VNET Group valuation report hints at an deflated share price compared to its estimated value.

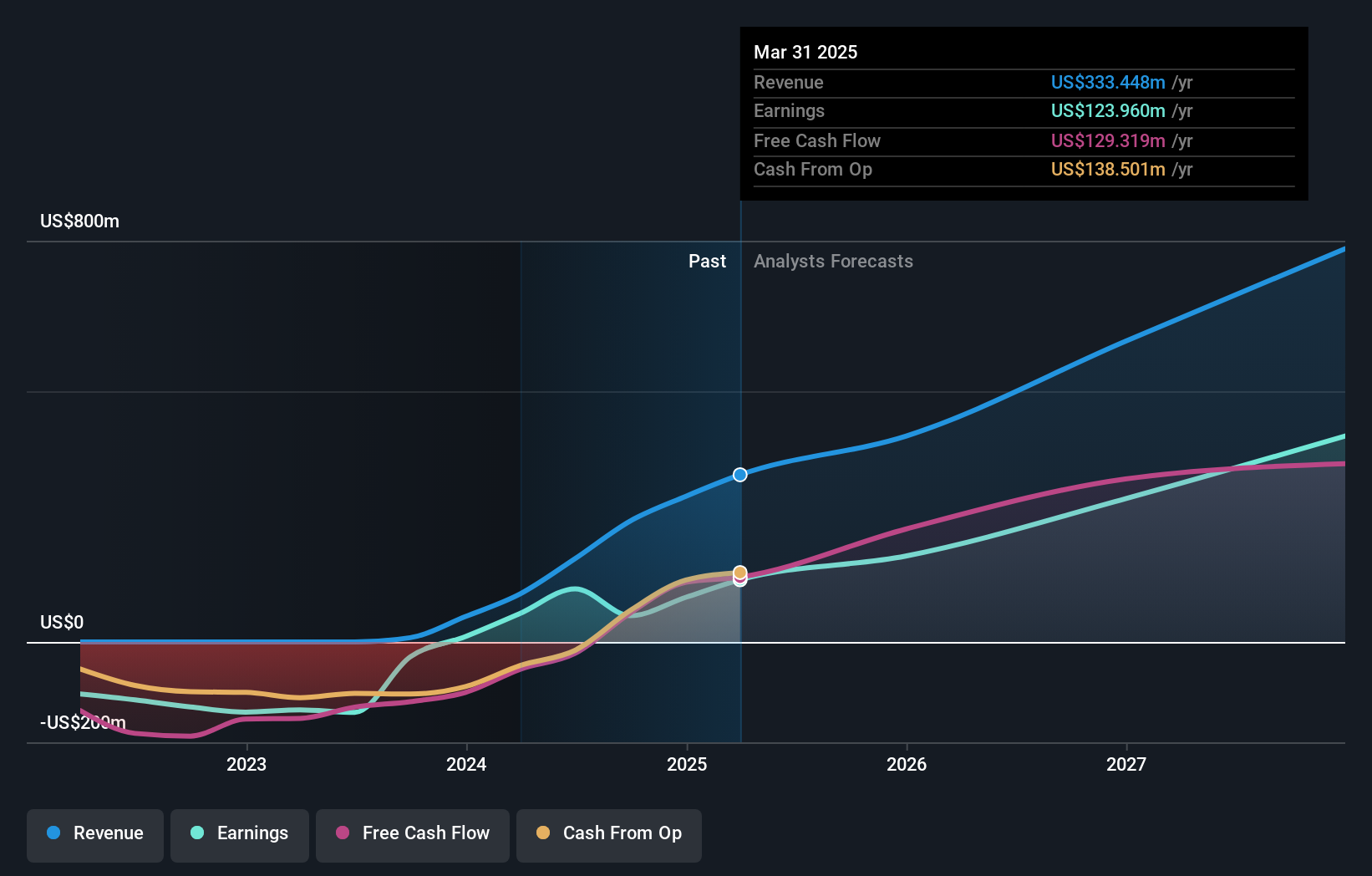

Paymentus Holdings (NYSE:PAY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Paymentus Holdings, Inc. offers cloud-based bill payment technology and solutions both in the United States and internationally, with a market cap of approximately $3.76 billion.

Operations: The company generates revenue from providing services to financial companies, amounting to $778.67 million.

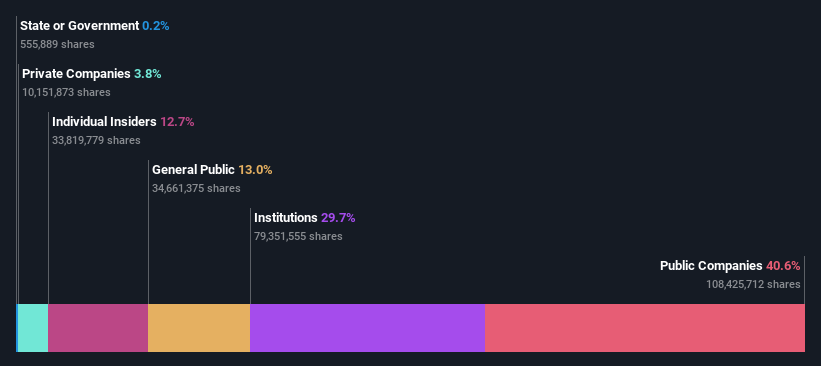

Insider Ownership: 20.1%

Earnings Growth Forecast: 22.5% p.a.

Paymentus Holdings shows promising growth prospects with earnings expected to rise significantly, outpacing the US market. Despite recent substantial insider selling, its revenue is forecast to grow faster than the market average. The company reported strong third-quarter results with sales of US$231.57 million and net income of US$14.43 million. Paymentus has been active in investor conferences and provided guidance for 2024, expecting annual revenue between US$829 million and US$834 million.

- Click to explore a detailed breakdown of our findings in Paymentus Holdings' earnings growth report.

- The valuation report we've compiled suggests that Paymentus Holdings' current price could be inflated.

Where To Now?

- Navigate through the entire inventory of 206 Fast Growing US Companies With High Insider Ownership here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PAY

Paymentus Holdings

Provides cloud-based bill payment technology and solutions in the United States and internationally.

Flawless balance sheet with solid track record.