- United States

- /

- IT

- /

- NYSE:DOCN

High Growth Tech Stocks in United States to Watch

Reviewed by Simply Wall St

The United States market has shown a positive trend, rising 1.2% over the last week and 24% over the past year, with earnings expected to grow by 15% annually. In this context of robust growth, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation potential and adaptability in an evolving market landscape.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 29.07% | 27.57% | ★★★★★★ |

| Ardelyx | 21.09% | 55.29% | ★★★★★★ |

| AVITA Medical | 29.48% | 53.36% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 30.33% | 61.73% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.83% | 59.08% | ★★★★★★ |

| Alvotech | 31.17% | 100.18% | ★★★★★★ |

| Lumentum Holdings | 21.25% | 118.58% | ★★★★★★ |

Click here to see the full list of 231 stocks from our US High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Mirum Pharmaceuticals (NasdaqGM:MIRM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mirum Pharmaceuticals, Inc. is a biopharmaceutical company dedicated to developing and commercializing innovative treatments for rare and orphan diseases, with a market cap of $2.40 billion.

Operations: Mirum Pharmaceuticals specializes in creating and marketing therapies for rare diseases, generating $307.03 million in revenue from its pharmaceutical segment.

Mirum Pharmaceuticals, amid a challenging biotech landscape, stands out with its robust projected revenue growth of 23.6% annually, surpassing the U.S. market average of 8.9%. This growth trajectory is complemented by an anticipated leap into profitability within three years, with earnings expected to surge by 59% per year. Recent corporate presentations and guidance underscore the company’s strategic direction, projecting net product sales to hit between $420 million and $435 million in 2025, reflecting both confidence and potential in its operational approach. Despite current unprofitability that complicates direct industry comparisons, Mirum's aggressive R&D initiatives position it as a promising entity in high-growth tech scenarios within biopharmaceuticals.

Krystal Biotech (NasdaqGS:KRYS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Krystal Biotech, Inc. is a commercial-stage biotechnology company focused on discovering, developing, and commercializing genetic medicines for rare diseases in the United States, with a market cap of approximately $4.41 billion.

Operations: Krystal Biotech generates revenue primarily from its business of developing and commercializing pharmaceuticals, amounting to $241.52 million. The company's focus is on genetic medicines for rare diseases in the United States.

Krystal Biotech, amidst a dynamic biotech sector, showcases significant growth with an annual revenue increase projected at 28.5% and earnings growth at 36.6%, outpacing the U.S. market averages of 8.9% and 14.5% respectively. The company's recent transition to profitability highlights its effective strategic execution, further evidenced by a robust Q4 net income surge to $45.48 million from $8.69 million year-over-year. Innovations like KB707 for lung cancer treatment underscore Krystal’s commitment to R&D, crucial in maintaining its competitive edge in high-growth tech scenarios within biopharmaceuticals.

- Take a closer look at Krystal Biotech's potential here in our health report.

Gain insights into Krystal Biotech's past trends and performance with our Past report.

DigitalOcean Holdings (NYSE:DOCN)

Simply Wall St Growth Rating: ★★★★☆☆

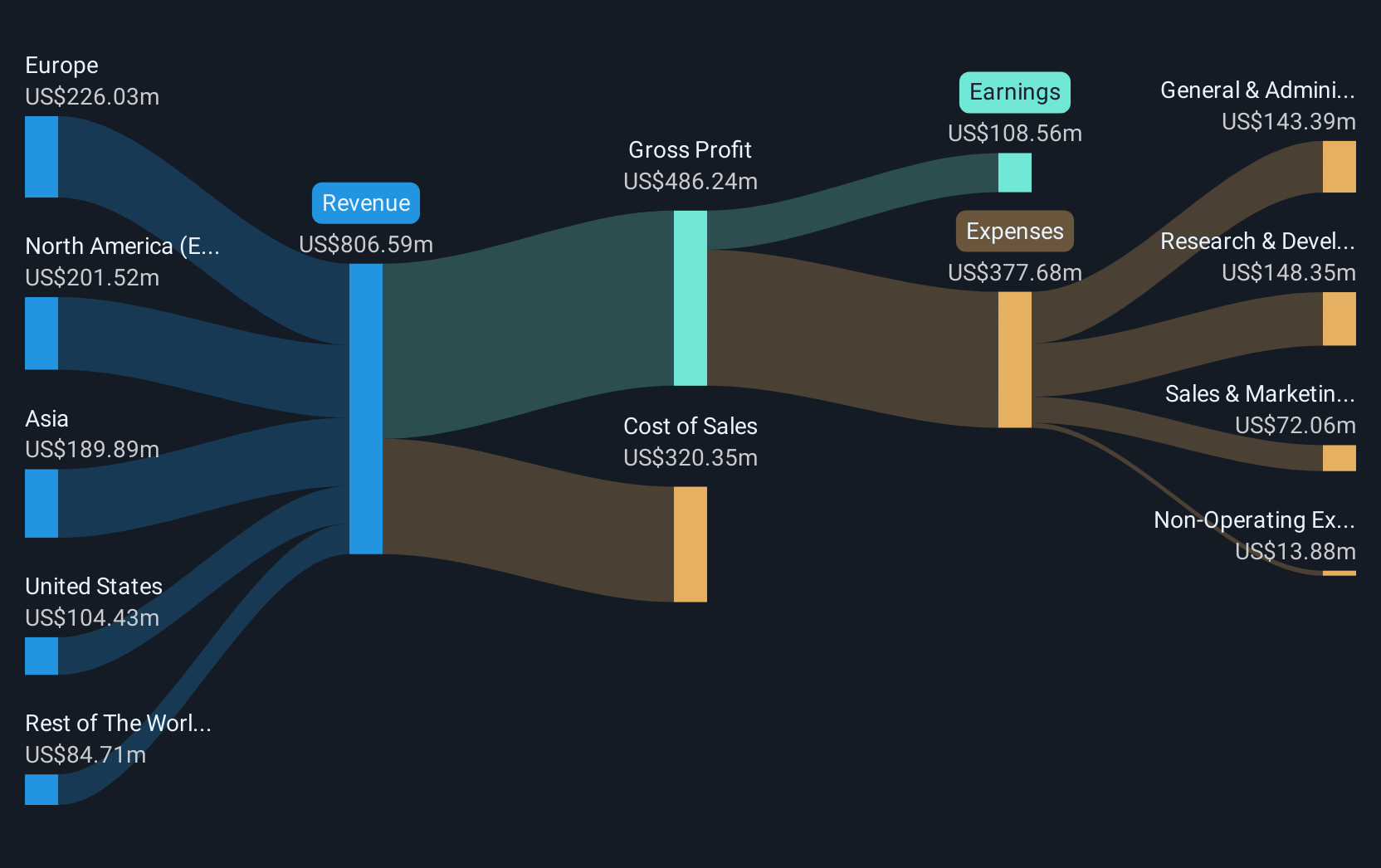

Overview: DigitalOcean Holdings, Inc. operates a cloud computing platform with international reach across North America, Europe, and Asia, and has a market capitalization of approximately $4.11 billion.

Operations: DigitalOcean Holdings generates revenue primarily from its Internet Software & Services segment, totaling $756.56 million. The company's operations are focused on providing cloud computing solutions globally.

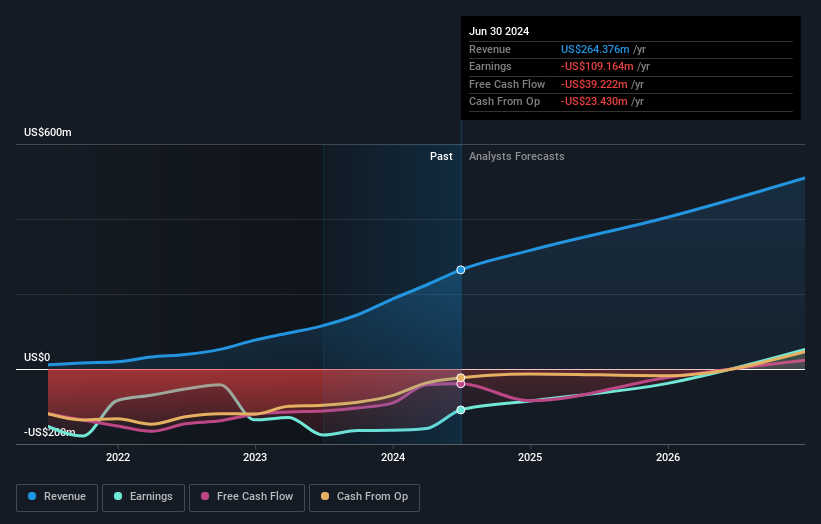

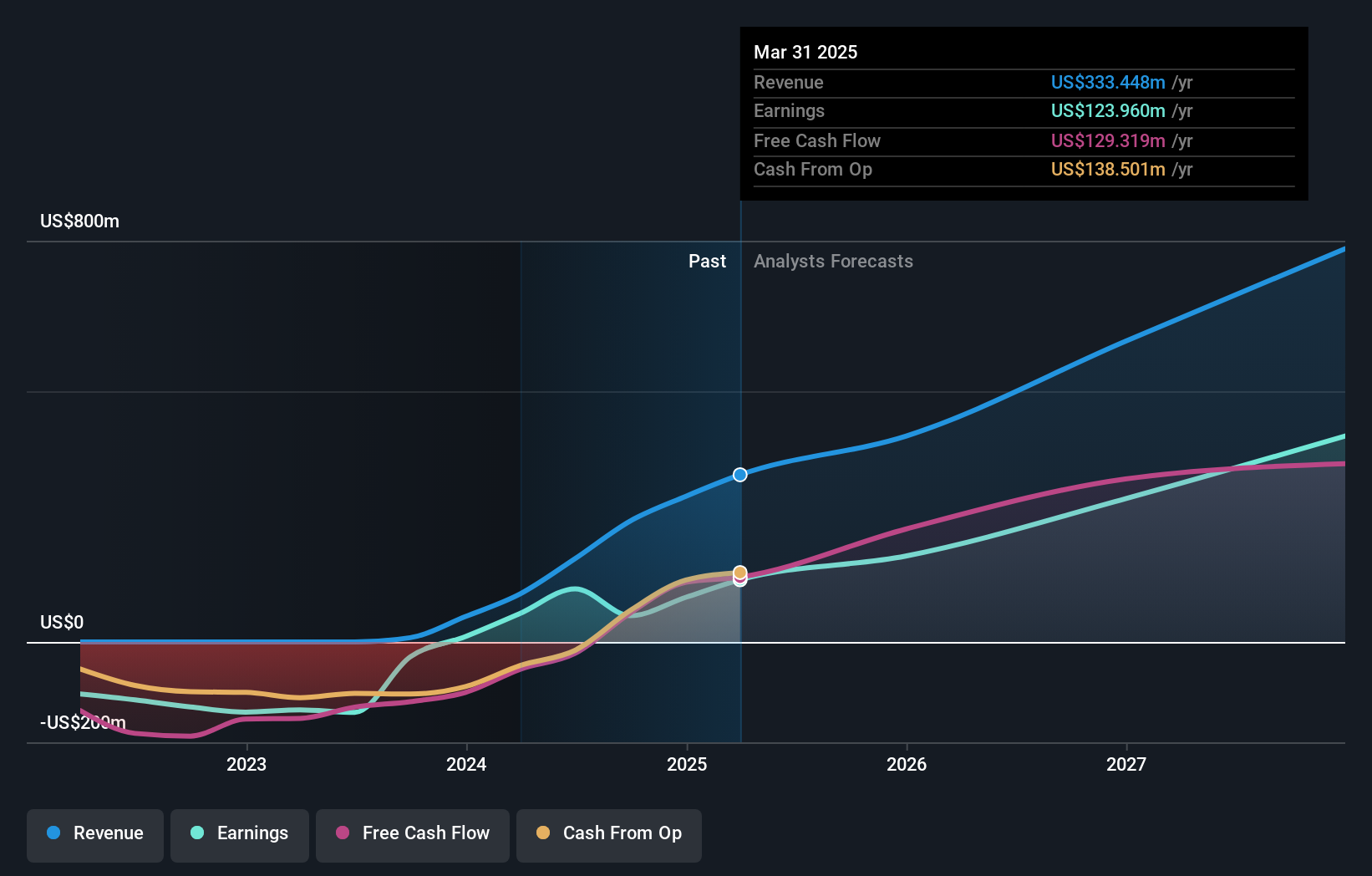

DigitalOcean Holdings has recently pivoted to profitability, a significant milestone underscored by an 18.1% forecast in annual earnings growth, surpassing the U.S. market average of 14.5%. This growth trajectory is complemented by a steady revenue increase at 12.5% annually, which also outstrips broader market trends. The introduction of its GenAI Platform and the launch of DigitalOcean Bare Metal GPUs highlight its strategic focus on enhancing AI capabilities and infrastructure solutions, positioning it well within the competitive tech landscape despite not being the fastest-growing in its sector. These developments not only expand DigitalOcean's product offerings but also cater to a diverse range of customer needs from AI novices to experts, potentially setting new industry standards in user-friendly yet powerful tech solutions.

- Delve into the full analysis health report here for a deeper understanding of DigitalOcean Holdings.

Assess DigitalOcean Holdings' past performance with our detailed historical performance reports.

Taking Advantage

- Get an in-depth perspective on all 231 US High Growth Tech and AI Stocks by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOCN

DigitalOcean Holdings

Through its subsidiaries, operates a cloud computing platform in North America, Europe, Asia, and internationally.

Reasonable growth potential low.

Similar Companies

Market Insights

Community Narratives