- United States

- /

- Biotech

- /

- NasdaqGS:IRWD

Ironwood Pharmaceuticals, Inc. (NASDAQ:IRWD) Looks Inexpensive But Perhaps Not Attractive Enough

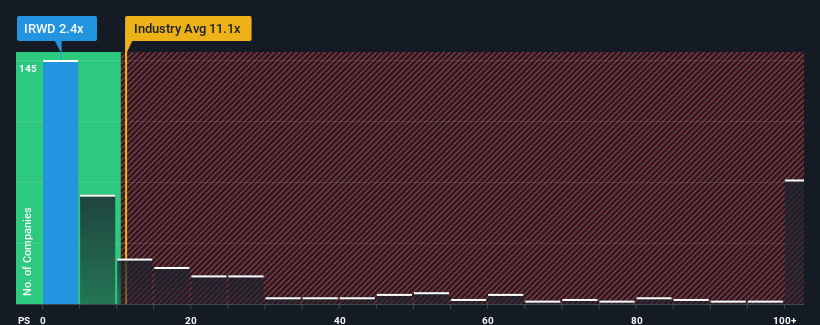

You may think that with a price-to-sales (or "P/S") ratio of 2.4x Ironwood Pharmaceuticals, Inc. (NASDAQ:IRWD) is definitely a stock worth checking out, seeing as almost half of all the Biotechs companies in the United States have P/S ratios greater than 11.1x and even P/S above 63x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Ironwood Pharmaceuticals

How Has Ironwood Pharmaceuticals Performed Recently?

Ironwood Pharmaceuticals could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Ironwood Pharmaceuticals will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Ironwood Pharmaceuticals?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Ironwood Pharmaceuticals' to be considered reasonable.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. The longer-term trend has been no better as the company has no revenue growth to show for over the last three years either. So it seems apparent to us that the company has struggled to grow revenue meaningfully over that time.

Turning to the outlook, the next three years should generate growth of 12% per year as estimated by the six analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 195% each year, which is noticeably more attractive.

With this in consideration, its clear as to why Ironwood Pharmaceuticals' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Ironwood Pharmaceuticals' P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As expected, our analysis of Ironwood Pharmaceuticals' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 3 warning signs for Ironwood Pharmaceuticals (1 is concerning!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IRWD

Ironwood Pharmaceuticals

A healthcare company, focuses on the development and commercialization of gastrointestinal (GI) products.

Undervalued with moderate growth potential.