- United States

- /

- Biotech

- /

- NasdaqGM:IOVA

Iovance Biotherapeutics (NasdaqGM:IOVA) Faces Legal Action Amid Revenue Guidance Cut

Reviewed by Simply Wall St

Iovance Biotherapeutics (NasdaqGM:IOVA) faced a challenging week, experiencing a share price decrease of 45% following the release of disappointing Q1 2025 financial results and a significant downward revision of its full-year revenue guidance. This downturn was compounded by the filing of a class action lawsuit alleging misleading statements about the company's business operations. These developments contrasted sharply with broader market trends, where major indexes like the S&P 500 and Dow Jones advanced, reflecting investor optimism boosted by eased U.S.-China trade tensions. The market's upward momentum stood in stark contrast to Iovance's struggles.

We've identified 3 risks for Iovance Biotherapeutics that you should be aware of.

The recent developments surrounding Iovance Biotherapeutics, including disappointing financial results and legal challenges, have introduced significant uncertainties to its growth narrative. These events may hinder the anticipated boost in revenue and market share from the U.S. launch of Amtagvi and international expansion plans. Furthermore, the company's already substantial cash burn could intensify if manufacturing capabilities or regulatory hurdles slow down their expansion efforts.

Over the past year, Iovance's total shareholder return was a substantial 83.13% decline, indicating a challenging period for the company. Comparatively, Iovance underperformed the broader market, including the S&P 500 and Dow Jones indexes, which saw positive momentum due to investor optimism. Additionally, within the U.S. Biotechs industry, Iovance also lagged behind, with the industry declining 16.2% during the same timeframe.

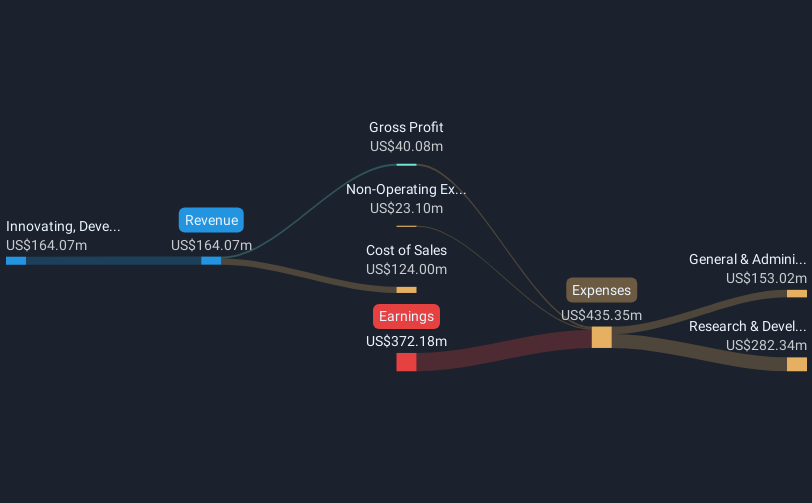

The drastic share price decrease reflects investor skepticism toward Iovance meeting its ambitious revenue and earnings forecasts. Current analyst projections of earnings reaching US$139.8 million by 2028 may face downward revisions if growth catalysts falter. With the share price at US$3.56, it trades significantly below the consensus analyst price target of US$20.08, which assumes substantial future growth and improved profit margins. This discrepancy underscores the market's caution about Iovance's ability to realize its projected growth trajectory, given the recent setbacks and ongoing challenges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:IOVA

Iovance Biotherapeutics

A commercial-stage biopharmaceutical company, develops and commercializes cell therapies using autologous tumor infiltrating lymphocyte for the treatment of metastatic melanoma and other solid tumor cancers in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives