- United States

- /

- Biotech

- /

- NasdaqGM:IOVA

First FDA Approval for T-Cell Therapy Might Change the Case for Investing in Iovance (IOVA)

Reviewed by Sasha Jovanovic

- Earlier this year, Iovance Biotherapeutics became the first to secure FDA approval for an immune cell/T-cell therapy, and continues to report promising results from 12 additional trials for its flagship drug and nine related tumor-infiltrating lymphocyte programs.

- This regulatory milestone puts Iovance at the forefront of cell therapy innovation but raises debate over sustainability due to the resource-intensive nature of its treatments and ongoing market skepticism.

- We'll examine how Iovance's FDA approval as the first T-cell therapy maker could reshape its investment narrative and industry positioning.

Find companies with promising cash flow potential yet trading below their fair value.

Iovance Biotherapeutics Investment Narrative Recap

For shareholders, the central conviction around Iovance Biotherapeutics hinges on the commercial growth and broader adoption of its pioneering T-cell therapy, Amtagvi, despite intense scrutiny of its high costs and complex manufacturing. The FDA approval is an important inflection point, but doesn't diminish the imperative to rapidly ramp up real-world adoption and address the critical challenge of sustaining healthy margins as the most immediate catalyst, and risk, remains patient uptake versus manufacturing costs.

Of Iovance's recent announcements, the August 2025 Health Canada approval for Amtagvi stands out as a timely advance. This regulatory win shows momentum for diversifying revenue beyond the US and taps into a new patient pool, reinforcing near-term catalysts linked to international expansion while highlighting that reliance on a single therapy introduces execution risk if uptake or reimbursement encounters delays.

Yet, amid early approval achievements, investors should also be alert to the evolving cost pressures and margin risks that come with scaling such personalized treatments, especially as...

Read the full narrative on Iovance Biotherapeutics (it's free!)

Iovance Biotherapeutics' outlook anticipates $744.8 million in revenue and $35.6 million in earnings by 2028. This scenario is based on a forecasted annual revenue growth rate of 45.6%, and represents an earnings increase of $425.5 million from current earnings of -$389.9 million.

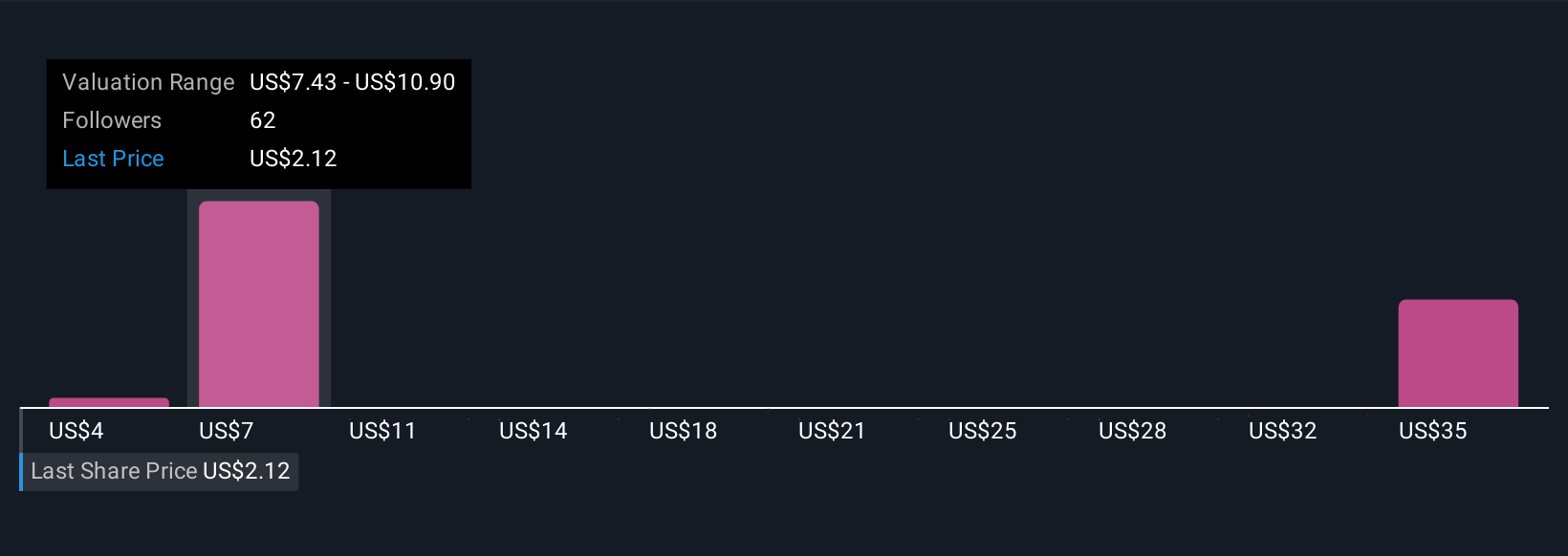

Uncover how Iovance Biotherapeutics' forecasts yield a $9.10 fair value, a 306% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered 12 fair value estimates for Iovance Biotherapeutics, ranging from US$3.97 to US$38.61 per share. As many anticipate new international market entries following the recent Canadian approval, be aware that perspectives on risk and future growth can vary widely, explore diverse viewpoints to understand these implications.

Explore 12 other fair value estimates on Iovance Biotherapeutics - why the stock might be worth just $3.97!

Build Your Own Iovance Biotherapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Iovance Biotherapeutics research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Iovance Biotherapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Iovance Biotherapeutics' overall financial health at a glance.

No Opportunity In Iovance Biotherapeutics?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 39 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:IOVA

Iovance Biotherapeutics

A commercial-stage biopharmaceutical company, develops and commercializes cell therapies using autologous tumor infiltrating lymphocyte for the treatment of metastatic melanoma and other solid tumor cancers in the United States.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives