- United States

- /

- Biotech

- /

- NasdaqCM:IMTX

Pinning Down Immatics N.V.'s (NASDAQ:IMTX) P/S Is Difficult Right Now

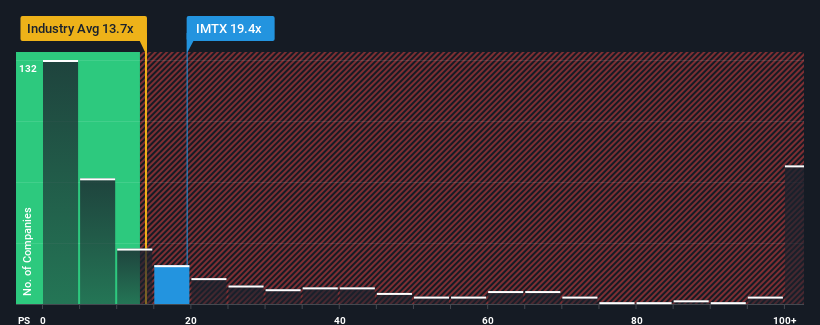

You may think that with a price-to-sales (or "P/S") ratio of 19.4x Immatics N.V. (NASDAQ:IMTX) is a stock to potentially avoid, seeing as almost half of all the Biotechs companies in the United States have P/S ratios under 13.7x and even P/S lower than 4x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Immatics

What Does Immatics' Recent Performance Look Like?

While the industry has experienced revenue growth lately, Immatics' revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Immatics.How Is Immatics' Revenue Growth Trending?

In order to justify its P/S ratio, Immatics would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 69%. Even so, admirably revenue has lifted 73% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to slump, contracting by 2.6% each year during the coming three years according to the seven analysts following the company. That's not great when the rest of the industry is expected to grow by 157% per year.

With this in mind, we find it intriguing that Immatics' P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

The Bottom Line On Immatics' P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

For a company with revenues that are set to decline in the context of a growing industry, Immatics' P/S is much higher than we would've anticipated. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. Unless these conditions improve markedly, it'll be a challenging time for shareholders.

Before you take the next step, you should know about the 3 warning signs for Immatics (1 can't be ignored!) that we have uncovered.

If you're unsure about the strength of Immatics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:IMTX

Immatics

A clinical-stage biopharmaceutical company, focuses on the research and development of potential T cell redirecting immunotherapies for the treatment of cancer in the United States.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives