Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Illumina, Inc. (NASDAQ:ILMN) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Illumina

What Is Illumina's Debt?

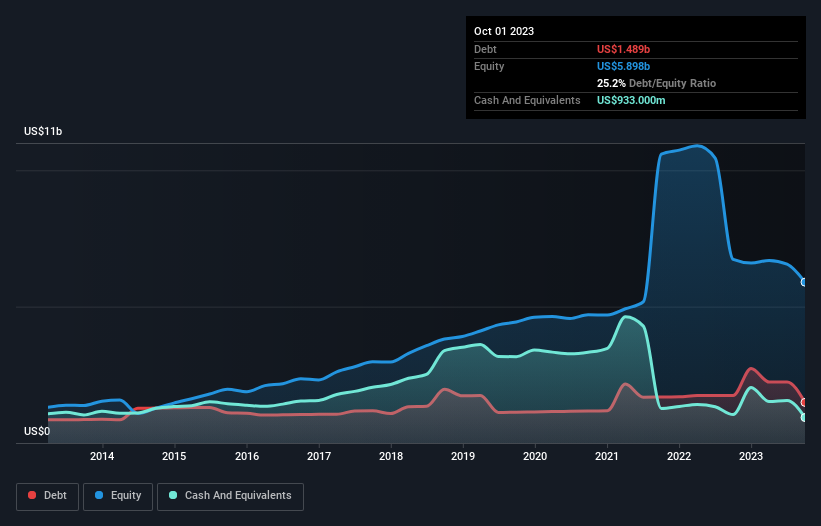

You can click the graphic below for the historical numbers, but it shows that Illumina had US$1.49b of debt in October 2023, down from US$1.74b, one year before. On the flip side, it has US$933.0m in cash leading to net debt of about US$556.0m.

How Healthy Is Illumina's Balance Sheet?

We can see from the most recent balance sheet that Illumina had liabilities of US$1.48b falling due within a year, and liabilities of US$2.74b due beyond that. Offsetting this, it had US$933.0m in cash and US$709.0m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$2.58b.

Of course, Illumina has a titanic market capitalization of US$22.4b, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Illumina can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Illumina had a loss before interest and tax, and actually shrunk its revenue by 5.0%, to US$4.5b. That's not what we would hope to see.

Caveat Emptor

Over the last twelve months Illumina produced an earnings before interest and tax (EBIT) loss. To be specific the EBIT loss came in at US$112m. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. We would feel better if it turned its trailing twelve month loss of US$1.1b into a profit. So we do think this stock is quite risky. When I consider a company to be a bit risky, I think it is responsible to check out whether insiders have been reporting any share sales. Luckily, you can click here ito see our graphic depicting Illumina insider transactions.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ILMN

Illumina

Offers sequencing- and array-based solutions for genetic and genomic analysis in the United States, Singapore, the United Kingdom, and internationally.

Moderate growth potential with mediocre balance sheet.