As the United States market experiences a surge, with major indices like the S&P 500 and Dow Jones Industrial Average posting their best weekly gains in months, investors are exploring a variety of opportunities beyond big-tech stocks. Penny stocks, often representing smaller or newer companies, offer an intriguing area for those seeking growth potential at lower price points. Despite being considered somewhat outdated as a term, penny stocks remain relevant by offering surprising value and potential stability when supported by strong financial fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $108.36M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.89 | $6.46M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.91 | $11.73M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.73 | $2.08B | ★★★★☆☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.275 | $10.12M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.57 | $61.94M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.13 | $20.04M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8937 | $80.38M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.42 | $365.18M | ★★★★☆☆ |

Click here to see the full list of 709 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

Tigo Energy (NasdaqCM:TYGO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tigo Energy, Inc. offers solar and energy storage solutions for the solar industry and has a market cap of $58.86 million.

Operations: The company's revenue is derived entirely from its Electronic Components & Parts segment, totaling $45.99 million.

Market Cap: $58.86M

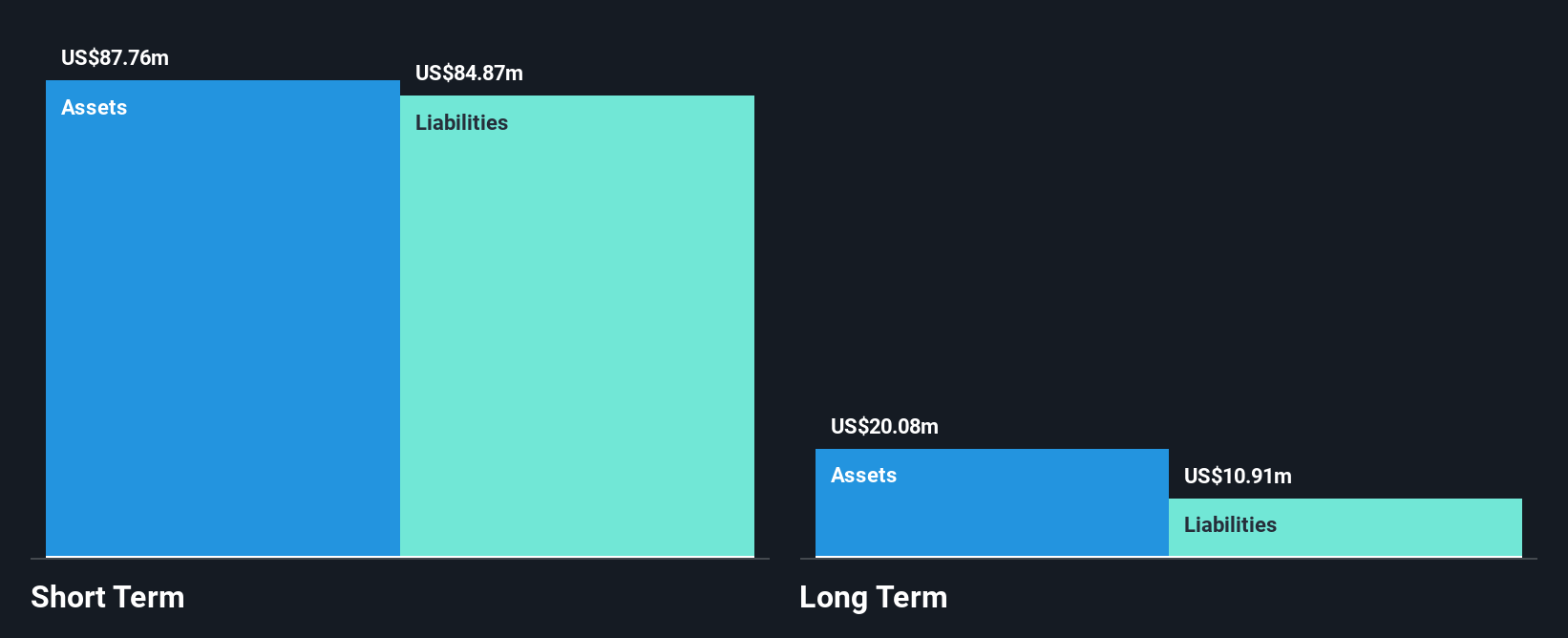

Tigo Energy, Inc., with a market cap of US$58.86 million, is navigating the challenges typical of penny stocks. The company reported declining sales and increased net losses in recent quarters, highlighting financial instability. Despite this, Tigo's strategic initiatives in solar energy markets like Hawaii and Brazil demonstrate potential for growth through innovative products such as their MLPE devices and EI inverters. While the company remains unprofitable with high debt levels and a relatively inexperienced board, its ability to cover liabilities with short-term assets provides some financial cushion as it seeks to expand its market presence.

- Click here and access our complete financial health analysis report to understand the dynamics of Tigo Energy.

- Examine Tigo Energy's earnings growth report to understand how analysts expect it to perform.

Yalla Group (NYSE:YALA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Yalla Group Limited operates a social networking and gaming platform primarily in the Middle East and North Africa region, with a market cap of approximately $632.30 million.

Operations: The company's revenue is derived from its social networking and entertainment platform, totaling $329.77 million.

Market Cap: $632.3M

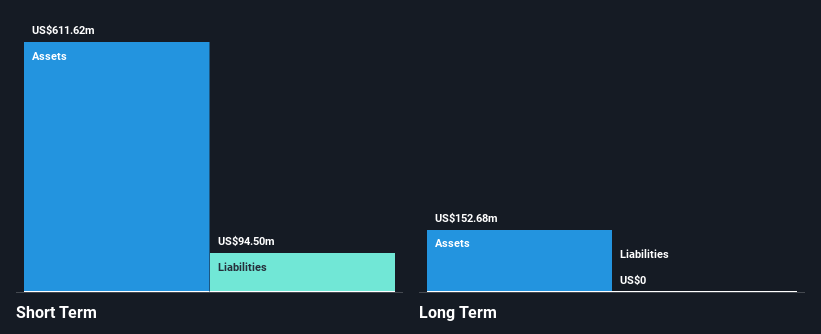

Yalla Group Limited, with a market cap of US$632.30 million, shows a mixed picture typical of penny stocks. The company has no debt and strong short-term assets of US$611.6 million against liabilities of US$94.5 million, indicating financial stability. Recent earnings growth outpaced the industry significantly, and profit margins improved to 40.7% from 32.4% last year, reflecting high-quality earnings despite a slowdown in growth compared to its five-year average. Yalla's ongoing share buyback program suggests confidence in its valuation as it trades well below estimated fair value while maintaining an experienced board with an average tenure of 4.3 years.

- Navigate through the intricacies of Yalla Group with our comprehensive balance sheet health report here.

- Assess Yalla Group's future earnings estimates with our detailed growth reports.

Zhihu (NYSE:ZH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Zhihu Inc. operates an online content community in the People’s Republic of China with a market cap of $282.96 million.

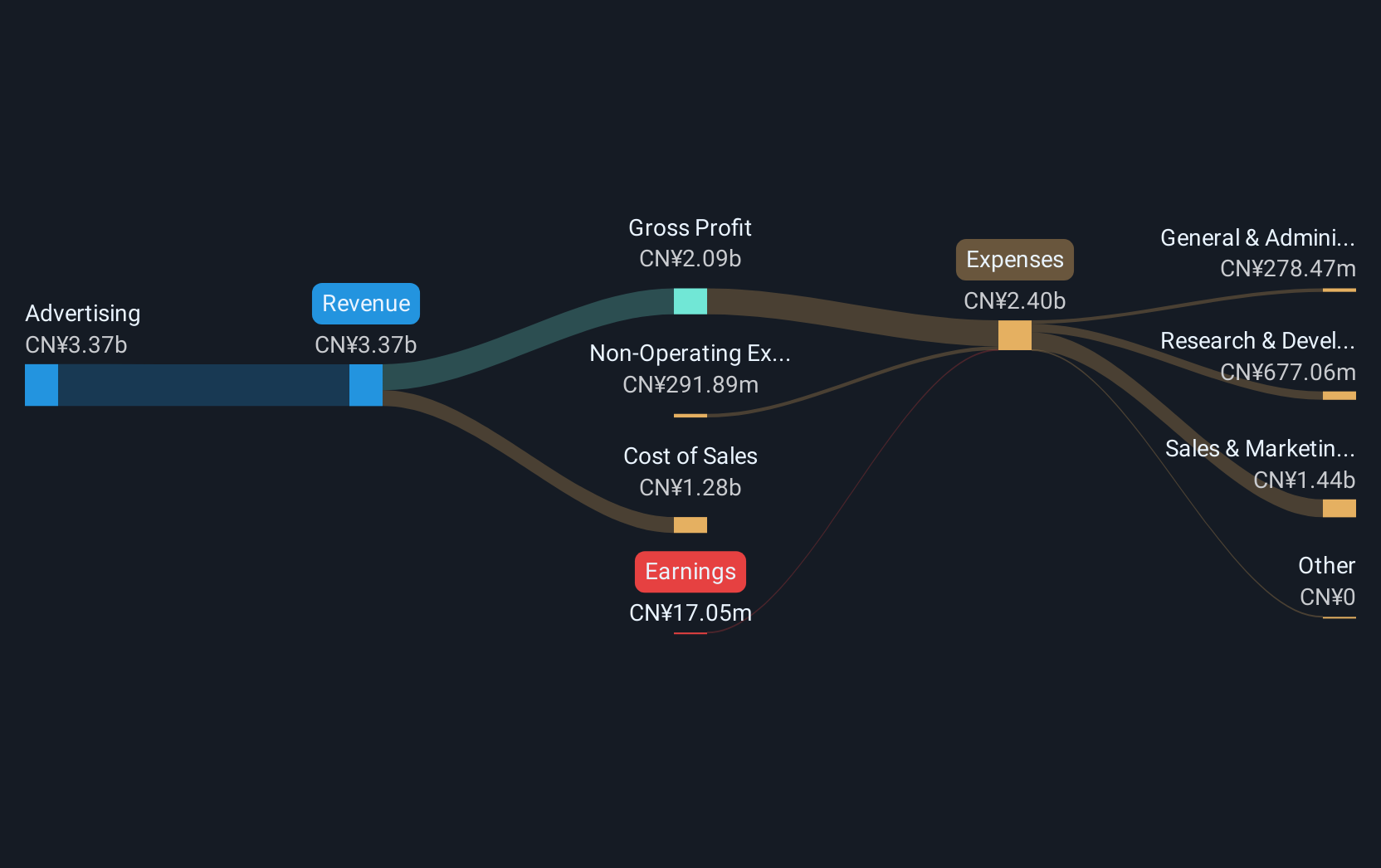

Operations: The company's revenue is derived from advertising, amounting to CN¥3.88 billion.

Market Cap: $282.96M

Zhihu Inc., with a market cap of US$282.96 million, presents characteristics typical of penny stocks. The company is unprofitable but has reduced its losses over the past five years by 15.2% annually, showing potential for improvement. Zhihu's short-term assets significantly exceed both its short and long-term liabilities, indicating solid financial footing despite ongoing losses. Its management team is relatively new with an average tenure of 0.9 years, which may impact strategic direction. While trading at a substantial discount to estimated fair value and analysts predicting price appreciation, Zhihu's future performance remains uncertain amidst industry challenges.

- Dive into the specifics of Zhihu here with our thorough balance sheet health report.

- Gain insights into Zhihu's future direction by reviewing our growth report.

Make It Happen

- Explore the 709 names from our US Penny Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhihu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZH

Zhihu

Operates an online content community in the People’s Republic of China.

Good value with adequate balance sheet.

Market Insights

Community Narratives