- United States

- /

- Semiconductors

- /

- NasdaqGS:GSIT

3 Promising Penny Stocks On US Exchanges In January 2025

Reviewed by Simply Wall St

As of January 2025, the U.S. stock market is experiencing a surge, with major indices like the S&P 500 and Dow Jones Industrial Average posting their best weekly gains in two months, driven by a rally in big-tech stocks. For investors looking beyond established giants, penny stocks—often representing smaller or newer companies—continue to hold potential despite being considered an outdated term. These stocks can offer affordability and growth potential when paired with strong financials; here we explore three penny stocks that stand out for their financial strength and resilience.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $108.36M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.89 | $6.46M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.91 | $11.73M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.73 | $2.08B | ★★★★☆☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.275 | $10.12M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.57 | $61.94M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.13 | $20.04M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8937 | $80.38M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.42 | $365.18M | ★★★★☆☆ |

Click here to see the full list of 709 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

GSI Technology (NasdaqGS:GSIT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: GSI Technology, Inc. designs, develops, and markets semiconductor memory solutions for various sectors including networking, industrial, medical, aerospace, and military across multiple countries with a market cap of approximately $100.67 million.

Operations: The company generates revenue of $19.69 million from the design, development, and sale of integrated circuits.

Market Cap: $100.67M

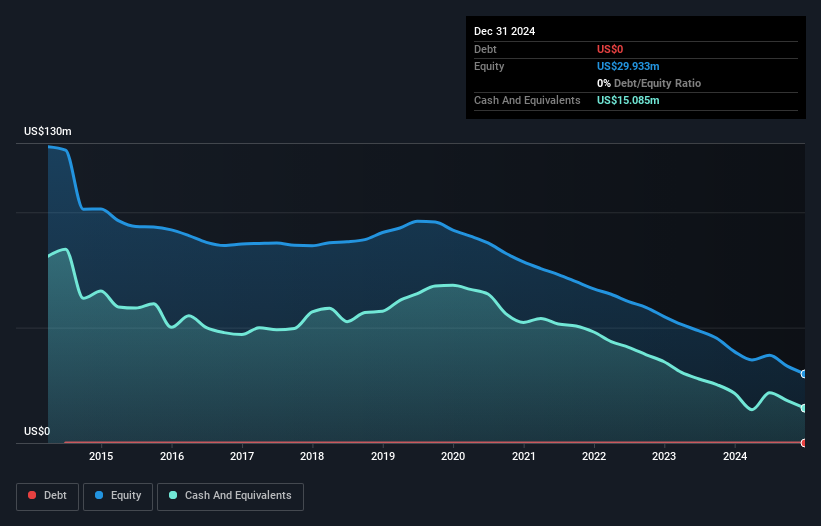

GSI Technology, Inc. faces challenges typical of penny stocks, with increasing losses over the past five years and a negative return on equity. The company is unprofitable and has less than a year of cash runway, although its short-term assets exceed both short- and long-term liabilities. Despite high volatility in its share price, GSI's recent selection by the U.S. Army for an SBIR contract highlights potential growth avenues through its innovative Gemini-II technology for edge computing AI solutions. This opportunity may bolster future prospects in military applications and dual-use markets such as autonomous vehicles and mobile data computation.

- Get an in-depth perspective on GSI Technology's performance by reading our balance sheet health report here.

- Assess GSI Technology's previous results with our detailed historical performance reports.

Dingdong (Cayman) (NYSE:DDL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Dingdong (Cayman) Limited is an e-commerce company in China with a market capitalization of approximately $732.37 million.

Operations: The company's revenue segment consists of Online Retailers, generating CN¥22.15 billion.

Market Cap: $732.37M

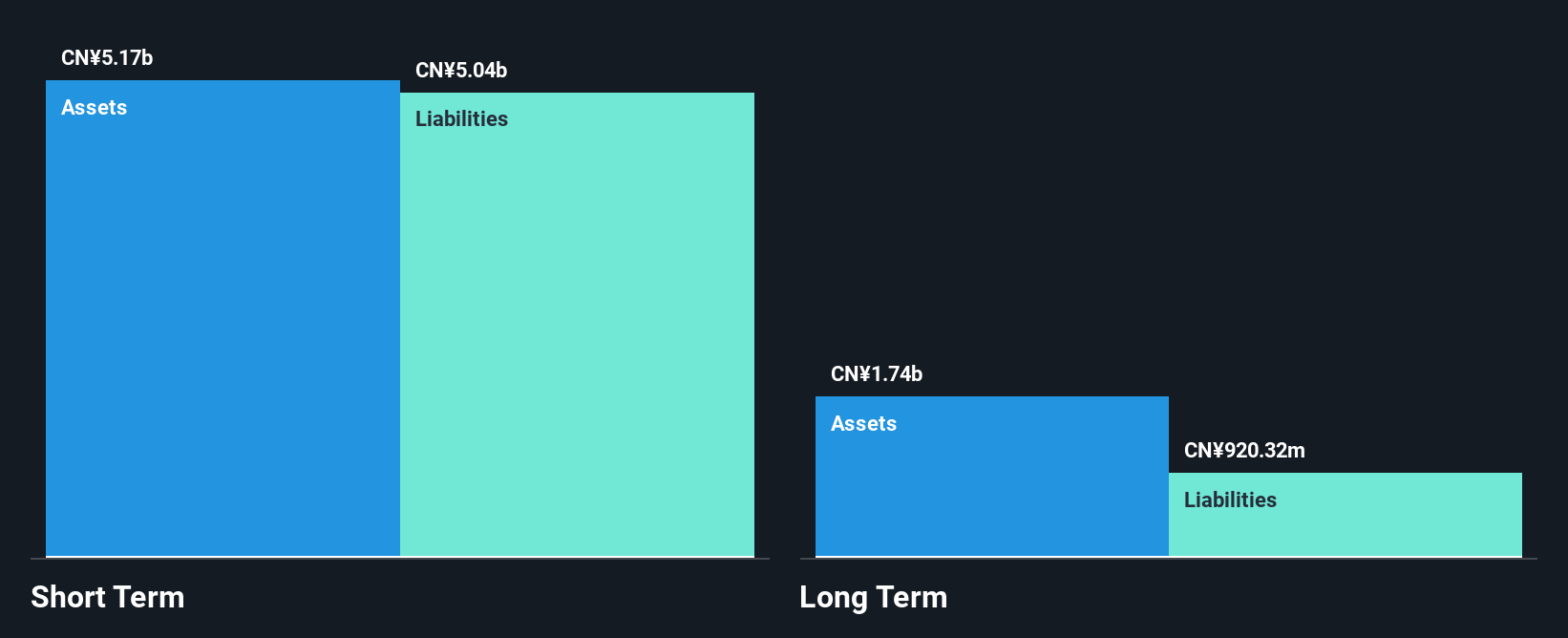

Dingdong (Cayman) Limited, a penny stock, has shown significant growth potential with recent profitability and revenue increases. The company reported third-quarter revenue of CN¥6.54 billion, up from CN¥5.14 billion the previous year, and net income surged to CN¥133.41 million from CN¥2.1 million. Dingdong's strong cash position exceeds its total debt, supporting financial stability despite high share price volatility. Management's average tenure of 3.2 years reflects experienced leadership guiding strategic shifts like executive role reassignments to enhance operational efficiency. With raised financial guidance for 2024 and anticipated GAAP profits, the company aims for continued expansion in the e-commerce sector.

- Click to explore a detailed breakdown of our findings in Dingdong (Cayman)'s financial health report.

- Examine Dingdong (Cayman)'s earnings growth report to understand how analysts expect it to perform.

Qudian (NYSE:QD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Qudian Inc. is a consumer-oriented technology company based in the People's Republic of China, with a market cap of $541.70 million.

Operations: The company's revenue is primarily generated from its Installment Credit Services, amounting to CN¥227.99 million.

Market Cap: $541.7M

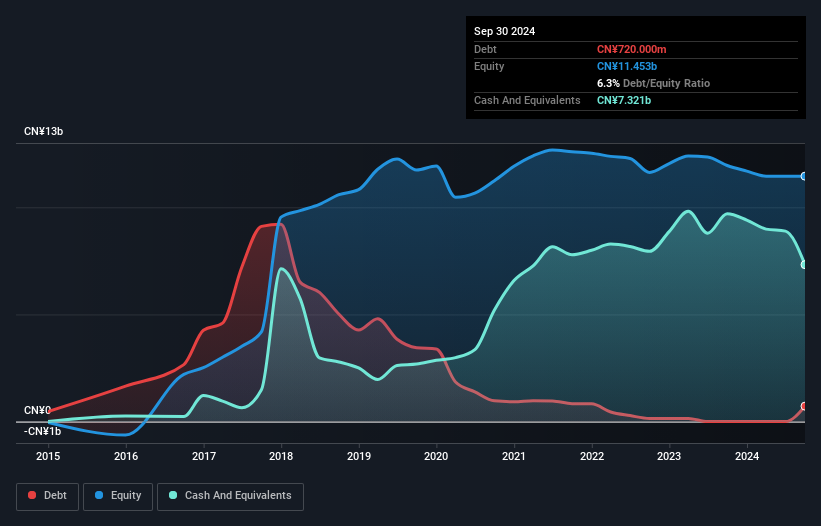

Qudian Inc., with a market cap of $541.70 million, has seen its earnings turnaround in the latest quarter, reporting net income of CN¥131.91 million compared to a loss last year. The company completed a buyback of 12.1 million shares, enhancing shareholder value without meaningful dilution over the past year. Despite high share price volatility and low return on equity at 0.4%, Qudian's financials are bolstered by more cash than total debt and strong short-term asset coverage against liabilities. However, negative earnings growth over five years and declining profit margins raise concerns about long-term profitability sustainability in the consumer finance sector.

- Dive into the specifics of Qudian here with our thorough balance sheet health report.

- Examine Qudian's past performance report to understand how it has performed in prior years.

Summing It All Up

- Click here to access our complete index of 709 US Penny Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GSIT

GSI Technology

Designs, develops, and markets semiconductor memory solutions to networking, industrial, medical, aerospace, and military customers in the United States, China, Singapore, Germany, the Netherlands, and internationally.

Adequate balance sheet slight.

Similar Companies

Market Insights

Community Narratives