- United States

- /

- Media

- /

- NasdaqGS:MCHX

Discovering February 2025's Promising Penny Stocks On US Exchanges

Reviewed by Simply Wall St

As the S&P 500 hovers near record highs and Treasury yields drop following recent retail sales data, U.S. markets continue to capture investor attention with a mix of optimism and caution. In this context, penny stocks—often representing smaller or newer companies—remain an intriguing segment for those seeking unique investment opportunities. Despite the term's historical connotations, these stocks can offer hidden value when supported by strong financials and growth potential. This article will explore three such penny stocks that stand out for their balance sheet resilience and potential for future success.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.8964 | $6.3M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $131.87M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.81 | $46.67M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.84 | $86.14M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.395 | $46.2M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8977 | $80.89M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.40 | $24.65M | ★★★★★☆ |

| PHX Minerals (NYSE:PHX) | $4.17 | $154.8M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.61 | $382.26M | ★★★★☆☆ |

Click here to see the full list of 710 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Ikena Oncology (NasdaqGM:IKNA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ikena Oncology, Inc. is a U.S.-based oncology company focused on developing differentiated therapies targeting cancer growth, spread, and resistance, with a market cap of $70.46 million.

Operations: Ikena Oncology, Inc. currently does not report any revenue segments.

Market Cap: $70.46M

Ikena Oncology, with a market cap of US$70.46 million, is currently pre-revenue and unprofitable, lacking significant revenue streams. Despite this, it has a stable cash runway for over a year due to its strong short-term assets of US$141.5 million exceeding liabilities. The company is debt-free and recently announced a reverse merger with Inmagene Biopharmaceuticals, expected to close mid-2025, which could provide strategic opportunities. However, the management team has limited experience with an average tenure of 1.3 years and the company faces challenges in achieving profitability within the next three years.

- Click here and access our complete financial health analysis report to understand the dynamics of Ikena Oncology.

- Learn about Ikena Oncology's future growth trajectory here.

Marchex (NasdaqGS:MCHX)

Simply Wall St Financial Health Rating: ★★★★★★

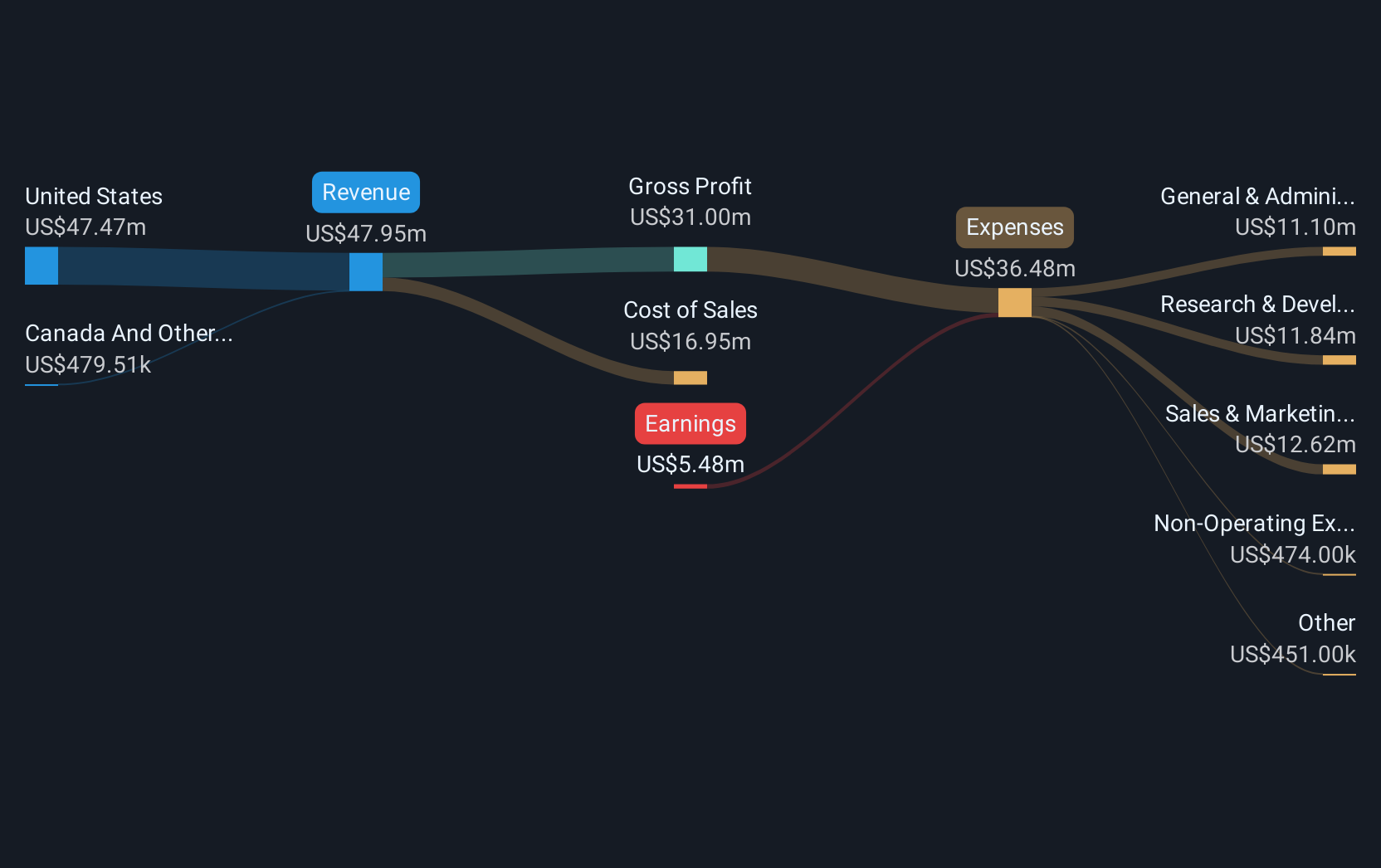

Overview: Marchex, Inc. is a conversation intelligence company offering conversational analytics and related solutions across the United States, Canada, and internationally with a market cap of $86.63 million.

Operations: The company generates revenue of $48.59 million from its Conversational Analytics and Related Solutions segment.

Market Cap: $86.63M

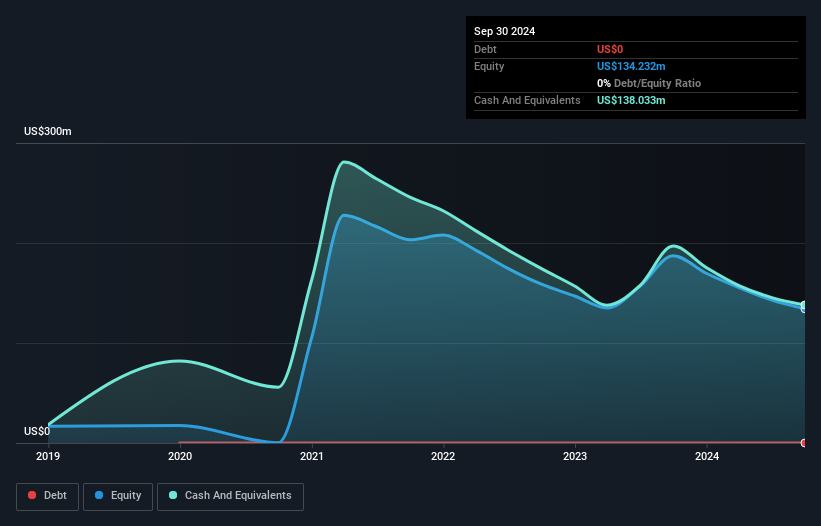

Marchex, Inc., with a market cap of US$86.63 million, is unprofitable but has reduced its losses by 31.3% annually over the past five years. The company benefits from strong short-term assets of US$21.8 million exceeding both its short and long-term liabilities, ensuring a stable cash runway for over three years without debt concerns. Recent inclusion in the Microsoft Cloud AI Partner Program could enhance visibility and sales channels through Azure Marketplace integration. However, earnings are expected to decline by 7.6% annually over the next three years, and profitability remains elusive despite operational improvements and strategic partnerships.

- Jump into the full analysis health report here for a deeper understanding of Marchex.

- Assess Marchex's future earnings estimates with our detailed growth reports.

Solid Power (NasdaqGS:SLDP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Solid Power, Inc. focuses on developing solid state battery technologies for electric vehicles and other markets in the United States, with a market cap of $241.72 million.

Operations: The company generates revenue from its Auto Parts & Accessories segment, amounting to $18.03 million.

Market Cap: $241.72M

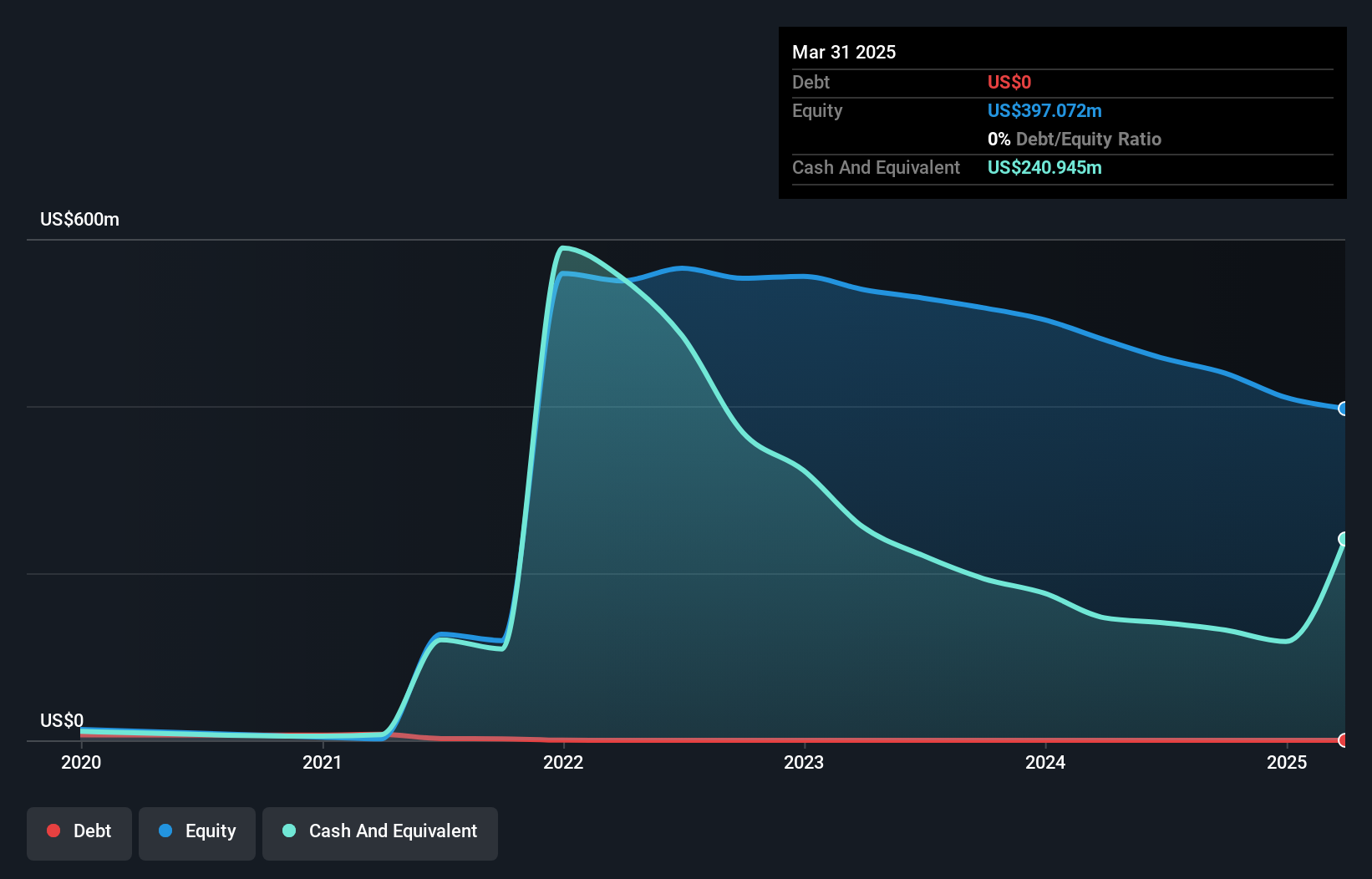

Solid Power, Inc., with a market cap of US$241.72 million, is focused on developing solid-state battery technologies and generates US$18.03 million in revenue from its Auto Parts & Accessories segment. Despite being debt-free and having short-term assets of US$139.9 million exceeding both short and long-term liabilities, the company remains unprofitable with a negative return on equity of -19.33%. Management is relatively new with an average tenure of 1.5 years, while the board has more experience at three years average tenure. Recent executive changes include the resignation of COO Derek Johnson effective February 2025.

- Take a closer look at Solid Power's potential here in our financial health report.

- Gain insights into Solid Power's future direction by reviewing our growth report.

Summing It All Up

- Access the full spectrum of 710 US Penny Stocks by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MCHX

Marchex

A conversation intelligence company, provides conversational analytics and related solutions in the United States, Canada, and internationally.

Flawless balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives