- United States

- /

- Biotech

- /

- NasdaqGS:IFRX

US Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

As the U.S. stock market heads into the Christmas break, optimism is in the air with major indices like the Nasdaq Composite and S&P 500 posting gains, sparking hopes for a Santa Claus rally to close out 2024. Penny stocks may be considered a throwback term, yet they continue to offer intriguing opportunities for those looking beyond well-known names. Often representing smaller or newer companies, these stocks can provide growth potential at lower price points when supported by strong financial fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $99.16M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.21 | $1.91B | ★★★★☆☆ |

| BAB (OTCPK:BABB) | $0.8849 | $6.46M | ★★★★★★ |

| Pangaea Logistics Solutions (NasdaqCM:PANL) | $4.95 | $227.01M | ★★★★★☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.24 | $7.76M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.36 | $45.54M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.74 | $142.05M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.26 | $17.19M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.80 | $70.15M | ★★★★★☆ |

Click here to see the full list of 742 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

Atea Pharmaceuticals (NasdaqGS:AVIR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Atea Pharmaceuticals, Inc. is a clinical-stage biopharmaceutical company focused on discovering, developing, and commercializing antiviral therapeutics for viral infections, with a market cap of $269.44 million.

Operations: Atea Pharmaceuticals, Inc. has not reported any revenue segments.

Market Cap: $269.44M

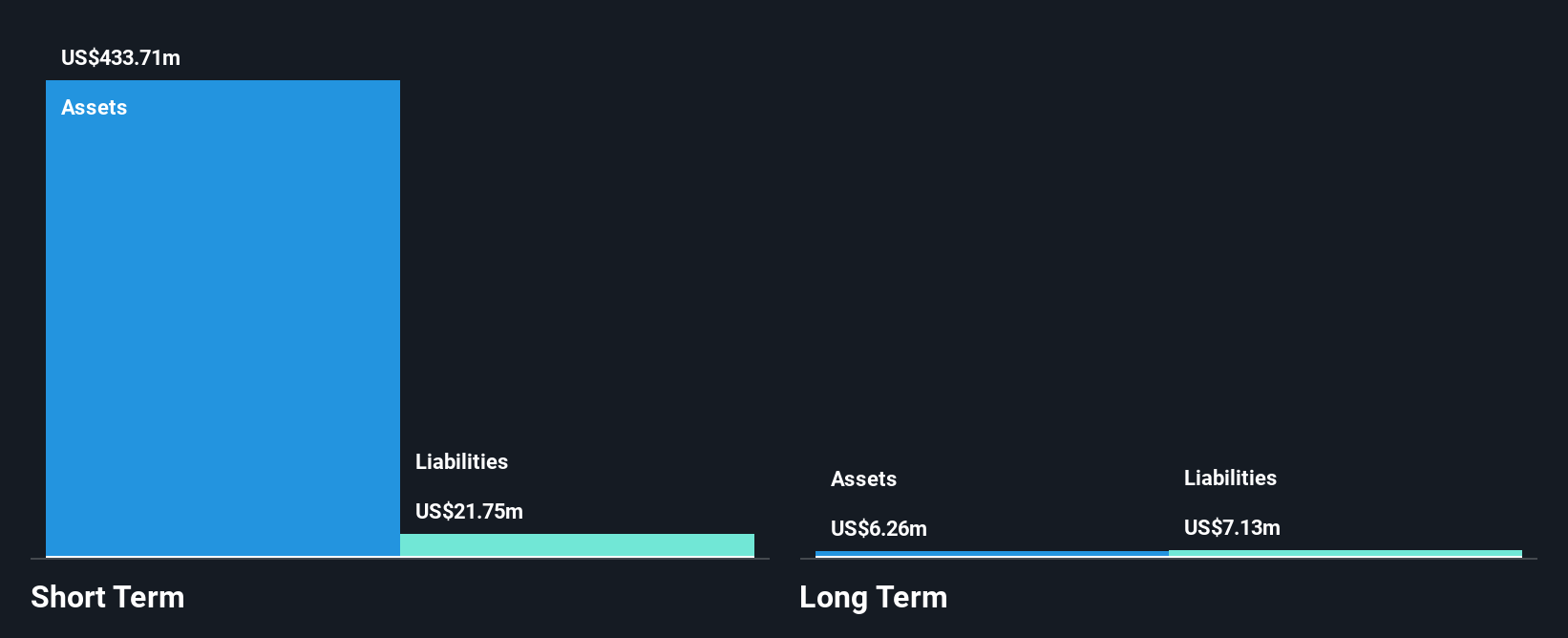

Atea Pharmaceuticals, Inc., with a market cap of US$269.44 million, is a pre-revenue clinical-stage biopharmaceutical company. Its recent Phase 2 study for hepatitis C treatment showed promising results, achieving high efficacy and safety benchmarks. Despite being unprofitable and having increased losses over the past five years, Atea remains debt-free with sufficient cash runway for more than three years based on current free cash flow trends. Analysts suggest potential stock price appreciation; however, significant insider selling has occurred recently. The company is preparing for its Phase 3 program following successful regulatory discussions anticipated in early 2025.

- Navigate through the intricacies of Atea Pharmaceuticals with our comprehensive balance sheet health report here.

- Learn about Atea Pharmaceuticals' future growth trajectory here.

InflaRx (NasdaqGS:IFRX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: InflaRx N.V. is a clinical-stage biopharmaceutical company focused on discovering and developing C5a inhibitor technology in Germany and the United States, with a market cap of $131.90 million.

Operations: The company's revenue is primarily derived from its Pharmaceuticals segment, totaling €0.17 million.

Market Cap: $131.9M

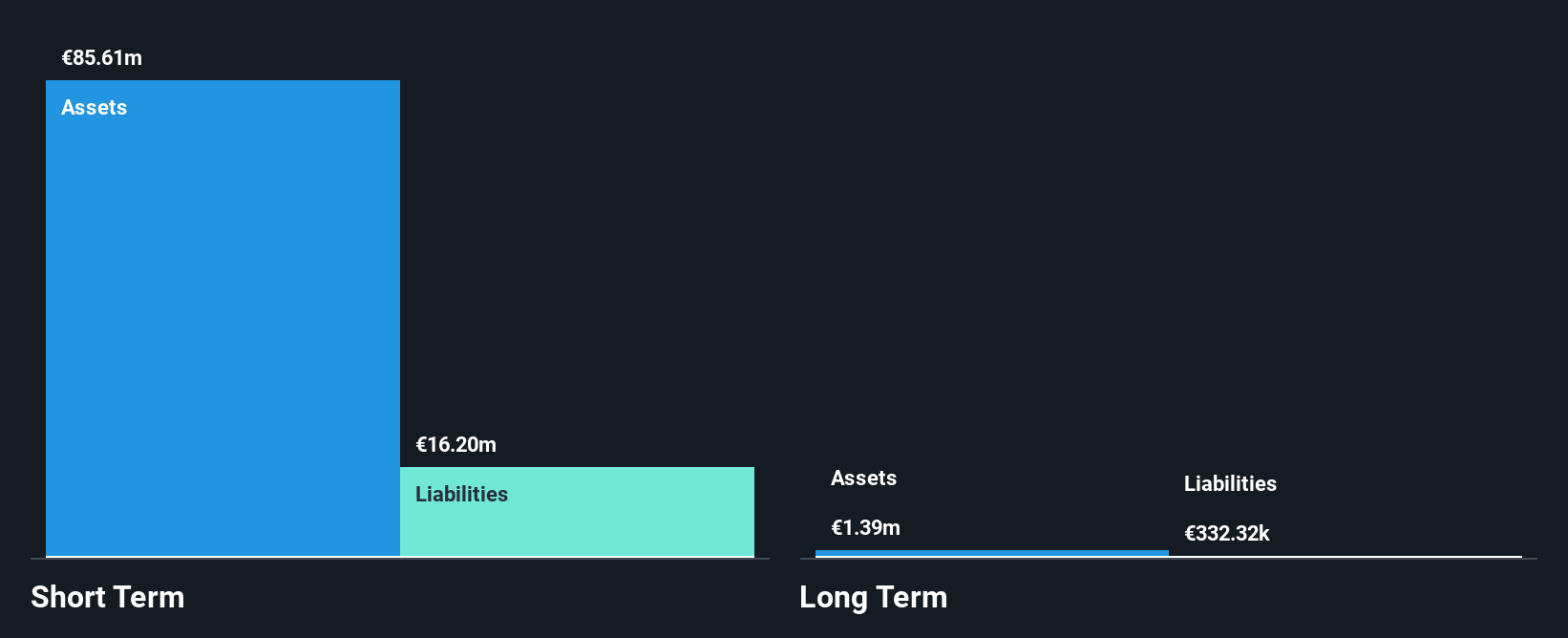

InflaRx N.V., with a market cap of $131.90 million, is a pre-revenue biopharmaceutical company engaged in the development of C5a inhibitor technology. The company recently dosed its first patient in a Phase 2a study for chronic spontaneous urticaria and hidradenitis suppurativa, with data expected by summer 2025. Despite positive developments like the European Medicines Agency's recommendation for GOHIBIC's marketing authorization, InflaRx faces challenges such as high volatility and limited cash runway under one year. While debt-free and having reduced losses over five years, it remains unprofitable without near-term profitability forecasts.

- Click here and access our complete financial health analysis report to understand the dynamics of InflaRx.

- Explore InflaRx's analyst forecasts in our growth report.

Zedge (NYSEAM:ZDGE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zedge, Inc. develops digital marketplaces and competitive games focused on self-expression content, with a market cap of $33.38 million.

Operations: The company generates revenue through two primary segments: Zedge Marketplace, contributing $27.03 million, and Gurushots, which adds $3.18 million.

Market Cap: $33.38M

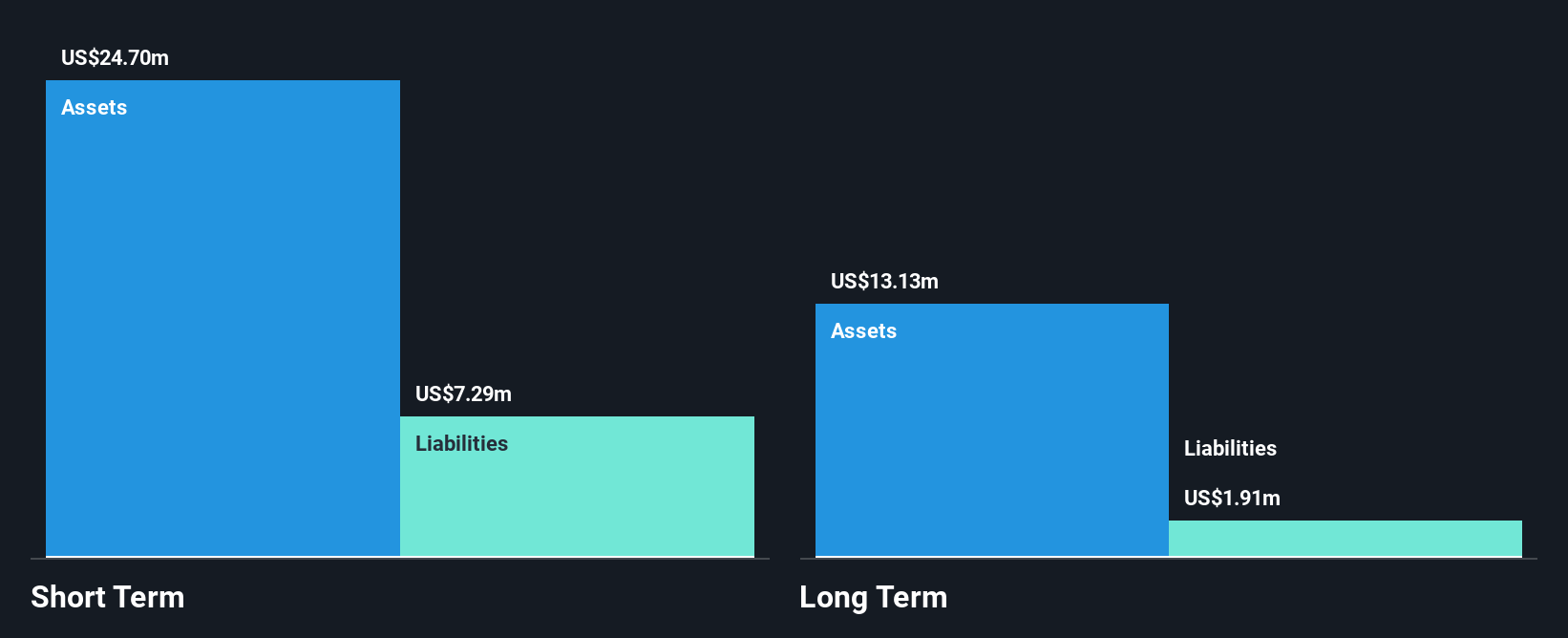

Zedge, Inc., with a market cap of US$33.38 million, operates in the digital marketplaces sector and is currently unprofitable. The company reported first-quarter sales of US$7.19 million, slightly up from last year, but net losses widened to US$0.339 million from US$0.015 million. Despite these challenges, Zedge maintains a strong cash runway for over three years due to positive free cash flow growth and remains debt-free with short-term assets exceeding liabilities significantly. Recent enhancements to its Marketplace aim to increase user engagement by allowing direct purchases on its website, potentially boosting revenue streams moving forward.

- Unlock comprehensive insights into our analysis of Zedge stock in this financial health report.

- Understand Zedge's earnings outlook by examining our growth report.

Where To Now?

- Unlock our comprehensive list of 742 US Penny Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IFRX

InflaRx

A clinical-stage biopharmaceutical company, discovers and develops inhibitors using C5a technology in Germany and the United States.

Adequate balance sheet slight.