- United States

- /

- Biotech

- /

- NasdaqCM:ORGO

3 Promising Penny Stocks With Market Caps Under $700M

Reviewed by Simply Wall St

U.S. stock indexes have recently experienced a pullback, with investors closely watching key economic indicators such as inflation data and GDP revisions. In the midst of these market fluctuations, penny stocks continue to capture attention for their potential growth opportunities at accessible price points. Although the term 'penny stocks' might seem outdated, these smaller or newer companies can offer significant upside when supported by strong financials and sound fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.09 | $435.04M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.95 | $694.39M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.22 | $206.93M | ✅ 4 ⚠️ 2 View Analysis > |

| Puma Biotechnology (PBYI) | $4.72 | $237.25M | ✅ 3 ⚠️ 2 View Analysis > |

| Sensus Healthcare (SRTS) | $3.16 | $51.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $2.05 | $23.25M | ✅ 4 ⚠️ 2 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Table Trac (TBTC) | $4.70 | $20.88M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $1.00 | $7.09M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.84 | $86.32M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 371 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Organogenesis Holdings (ORGO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Organogenesis Holdings Inc. is a regenerative medicine company that develops, manufactures, and commercializes products for advanced wound care and surgical and sports medicine markets in the United States, with a market cap of approximately $603.84 million.

Operations: The company's revenue is primarily derived from its regenerative medicine segment, which generated $429.53 million.

Market Cap: $603.84M

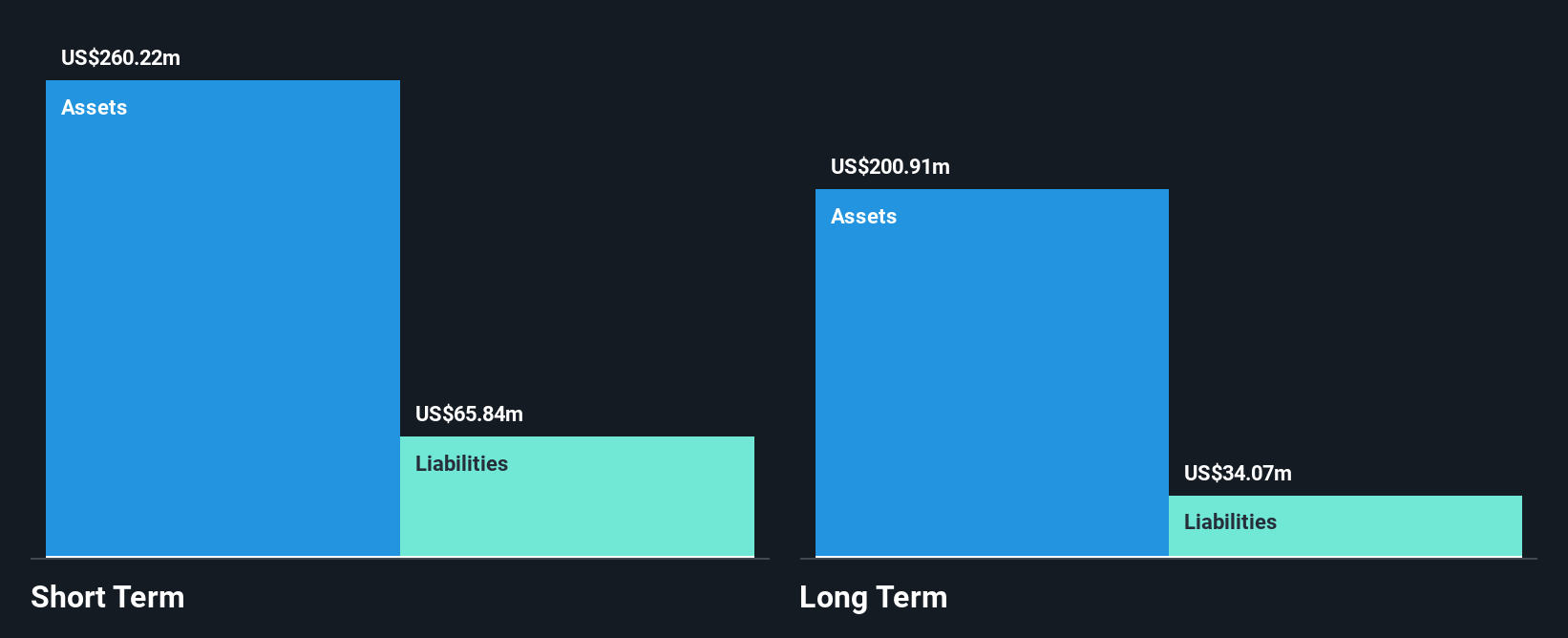

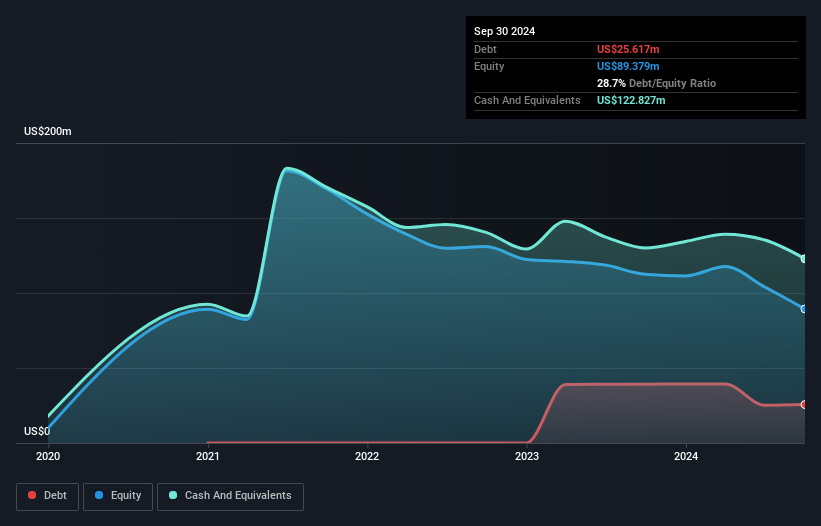

Organogenesis Holdings Inc., a regenerative medicine company, has faced challenges recently, including being dropped from several Russell indices. Despite this, the company maintains a market cap of approximately US$603.84 million and reported revenues of US$101.01 million for Q2 2025. While currently unprofitable with a net loss of US$9.39 million for the quarter, Organogenesis forecasts potential profitability by year-end with projected net product revenue between US$480 million and US$510 million. The company is debt-free and has sufficient cash runway to sustain operations beyond one year based on current free cash flow levels.

- Dive into the specifics of Organogenesis Holdings here with our thorough balance sheet health report.

- Learn about Organogenesis Holdings' future growth trajectory here.

ALX Oncology Holdings (ALXO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ALX Oncology Holdings Inc. is a clinical-stage immuno-oncology company developing cancer therapies in the United States, with a market cap of $67.47 million.

Operations: ALX Oncology Holdings Inc. does not report any revenue segments as it is currently in the clinical stage of developing cancer therapies.

Market Cap: $67.47M

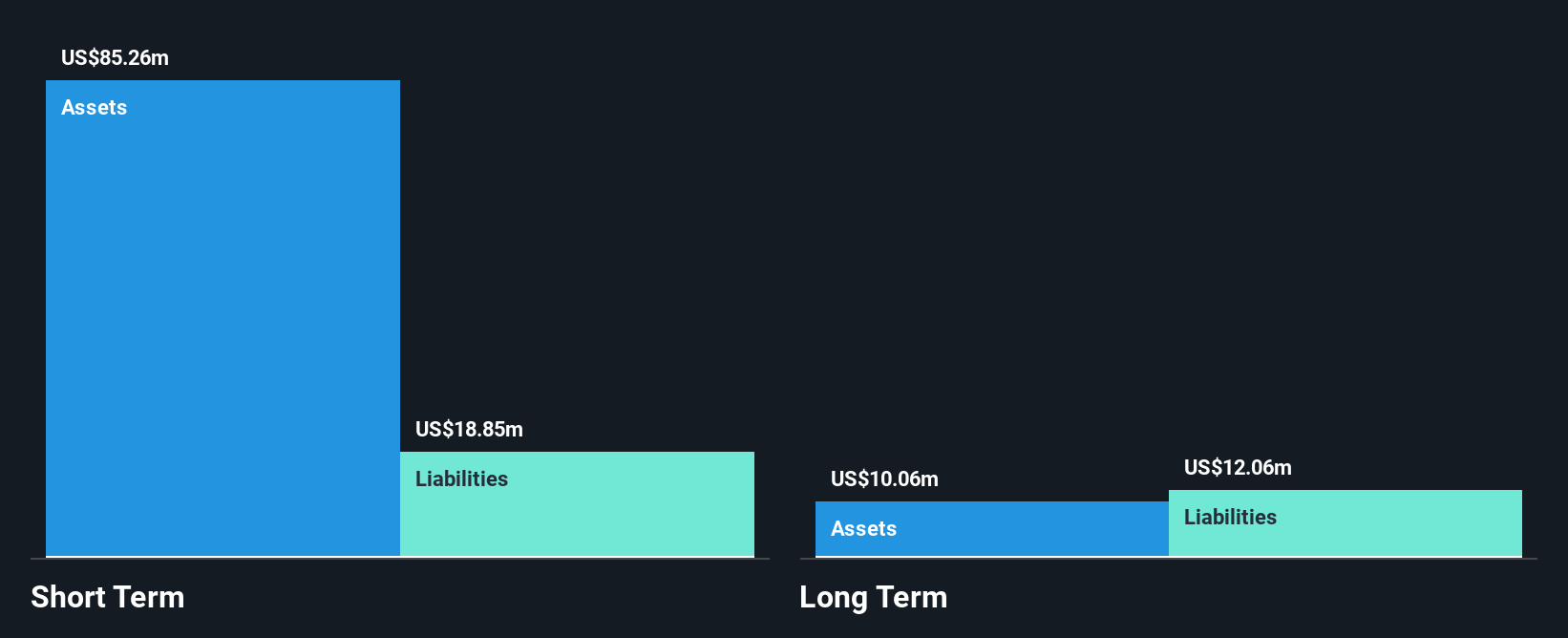

ALX Oncology Holdings Inc., a clinical-stage immuno-oncology company, is pre-revenue with a market cap of US$67.47 million. The company recently dosed its first patient in the Phase 1 trial for ALX2004, targeting EGFR-expressing tumors, showcasing potential differentiation in safety and efficacy. Despite high share price volatility and a negative return on equity due to unprofitability, ALX has more cash than debt and covers both short- and long-term liabilities with its assets. Recent leadership changes include Dr. Barbara Klencke as Interim CMO, bringing extensive R&D expertise to advance the company's strategic goals amidst financial constraints.

- Navigate through the intricacies of ALX Oncology Holdings with our comprehensive balance sheet health report here.

- Understand ALX Oncology Holdings' earnings outlook by examining our growth report.

Werewolf Therapeutics (HOWL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Werewolf Therapeutics, Inc. is a biopharmaceutical company focused on developing therapeutics designed to activate the body's immune system for treating cancer and other immune-mediated conditions, with a market cap of $81.85 million.

Operations: Werewolf Therapeutics, Inc. does not report any revenue segments at this time.

Market Cap: $81.85M

Werewolf Therapeutics, Inc., with a market cap of US$81.85 million, is pre-revenue and unprofitable but has reduced its losses over the past five years. The company maintains more cash than debt and covers both short- and long-term liabilities with its assets. Management and board members are experienced, averaging tenures of 4.4 and 6 years respectively. Despite stable weekly volatility, the stock remains highly volatile over three months. Recent earnings reports show a net loss increase to US$17.98 million for Q2 2025 compared to the previous year, while maintaining a consistent basic loss per share from continuing operations at US$0.4.

- Click here to discover the nuances of Werewolf Therapeutics with our detailed analytical financial health report.

- Gain insights into Werewolf Therapeutics' outlook and expected performance with our report on the company's earnings estimates.

Next Steps

- Discover the full array of 371 US Penny Stocks right here.

- Contemplating Other Strategies? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ORGO

Organogenesis Holdings

A regenerative medicine company, develops, manufactures, and commercializes products for the advanced wound care, and surgical and sports medicine markets in the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives