- United States

- /

- Software

- /

- NYSE:BLND

3 US Penny Stocks With Market Caps Under $900M To Consider

Reviewed by Simply Wall St

As the U.S. stock market experiences a rise amidst a busy week of earnings reports and economic data releases, investors are keeping a close eye on potential opportunities across various sectors. Penny stocks, often associated with smaller or emerging companies, remain an intriguing area for those looking to explore affordable investments with growth potential. Despite their name suggesting bygone trading days, these stocks can still offer significant opportunities when backed by solid financials and strategic positioning in the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.78982 | $5.74M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.12 | $512.97M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.61 | $2.05B | ★★★★★★ |

| ARC Document Solutions (NYSE:ARC) | $3.43 | $148.35M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.59 | $52.47M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| MIND C.T.I (NasdaqGM:MNDO) | $1.88 | $39.06M | ★★★★★★ |

| Better Choice (NYSEAM:BTTR) | $1.68 | $2.78M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.10 | $98.93M | ★★★★★☆ |

Click here to see the full list of 760 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Gossamer Bio (NasdaqGS:GOSS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Gossamer Bio, Inc. is a clinical-stage biopharmaceutical company dedicated to developing and commercializing seralutinib for treating pulmonary arterial hypertension (PAH) in the United States, with a market cap of $212.90 million.

Operations: Gossamer Bio, Inc. currently does not report any revenue segments.

Market Cap: $212.9M

Gossamer Bio, Inc., with a market cap of US$212.90 million, is navigating challenges typical for penny stocks. The company is pre-revenue and currently unprofitable, though it has reduced losses by 2.9% annually over the past five years. Its short-term assets of US$370.9 million exceed both its short-term and long-term liabilities, indicating strong liquidity management. Despite trading at a significant discount to estimated fair value, Gossamer faces potential delisting from Nasdaq due to its stock price falling below the minimum bid requirement of $1 per share but has until March 2025 to regain compliance or seek alternatives like a reverse stock split.

- Take a closer look at Gossamer Bio's potential here in our financial health report.

- Assess Gossamer Bio's future earnings estimates with our detailed growth reports.

TrueCar (NasdaqGS:TRUE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: TrueCar, Inc. is a U.S.-based company providing internet-based information, technology, and communication services with a market cap of approximately $339.93 million.

Operations: The company generates revenue of $165.28 million from its Internet Information Providers segment.

Market Cap: $339.93M

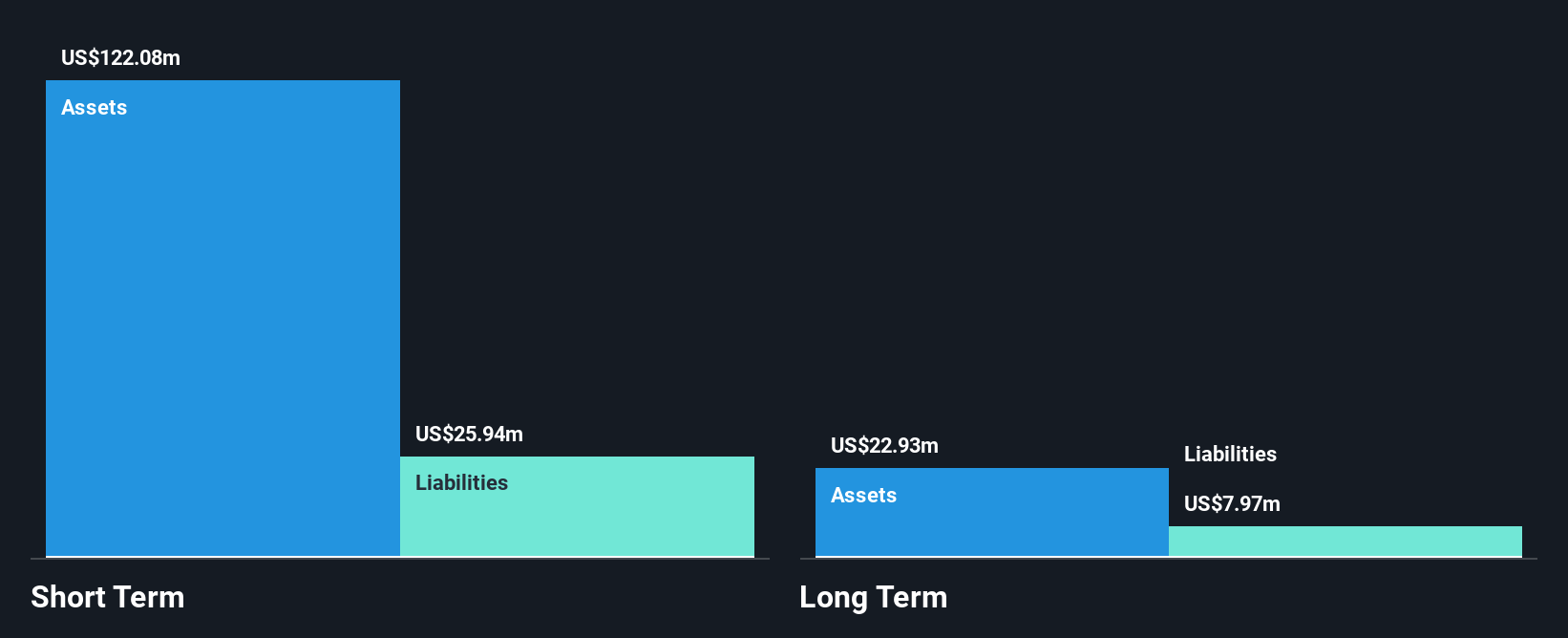

TrueCar, Inc., with a market cap of US$339.93 million, is navigating the penny stock landscape with mixed results. While it remains unprofitable and has seen losses increase over the past five years, its revenue from internet services reached US$165.28 million. The company is debt-free and has a strong cash position, covering both short-term (US$28.9M) and long-term liabilities (US$10.3M). Recent management changes include appointing Jill Angel as COO to drive operational goals forward. Despite insider selling in recent months, TrueCar's revenue growth forecast of 13.67% annually reflects potential upside for investors seeking speculative opportunities.

- Navigate through the intricacies of TrueCar with our comprehensive balance sheet health report here.

- Evaluate TrueCar's prospects by accessing our earnings growth report.

Blend Labs (NYSE:BLND)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Blend Labs, Inc. provides cloud-based software platform solutions for financial services firms in the United States and has a market cap of approximately $851.72 million.

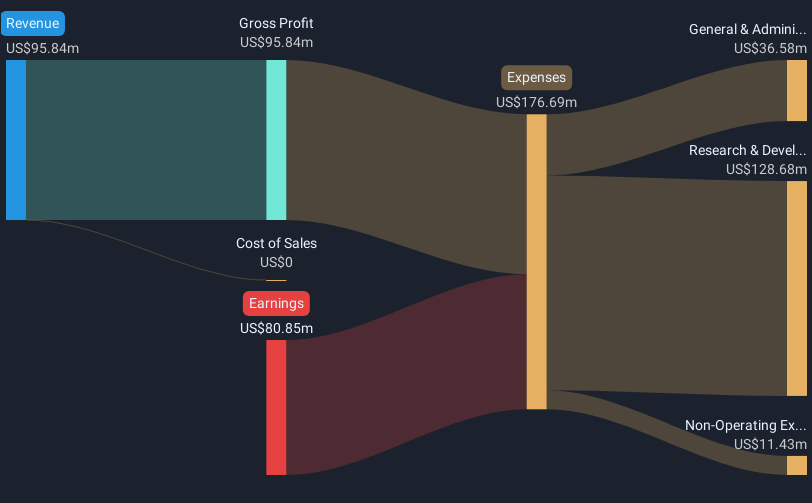

Operations: The company's revenue is derived from two segments: Blend Platform, which generated $107.05 million, and Title, contributing $45.07 million.

Market Cap: $851.72M

Blend Labs, Inc., with a market cap of US$851.72 million, is navigating the penny stock arena with both opportunities and challenges. The company remains unprofitable, with losses increasing at 20% annually over five years. Despite this, Blend's recent partnerships have enhanced operational efficiency and customer experience for clients like SouthState Bank and Langley Federal Credit Union. Revenue from its platform and title segments totaled US$152.12 million last year. While its cash runway is stable for over a year without debt concerns, shareholder dilution has occurred recently due to increased shares outstanding by 3.4%.

- Click to explore a detailed breakdown of our findings in Blend Labs' financial health report.

- Understand Blend Labs' earnings outlook by examining our growth report.

Taking Advantage

- Click through to start exploring the rest of the 757 US Penny Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blend Labs might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLND

Blend Labs

Engages in the provision of cloud-based software platform solutions for financial services firms in the United States.

Excellent balance sheet with reasonable growth potential.