- United States

- /

- Biotech

- /

- NasdaqCM:EXAS

Why Is Exact Sciences (EXAS) Down 11.9% After Upbeat Results and a Major Humana Partnership?

Reviewed by Simply Wall St

- Exact Sciences recently reported second-quarter 2025 results showing a rise in sales to US$811.09 million and a reduction in net loss, alongside an upward revision of full-year revenue guidance and a reaffirmed long-term growth outlook.

- Humana announced an expanded partnership that will make Exact Sciences’ newly launched Cologuard Plus™ test available nationwide to around 5.8 million Humana Medicare Advantage members, significantly broadening access to noninvasive colorectal cancer screening.

- We'll explore how growing insurance partnerships, particularly with Humana, could impact Exact Sciences' future revenue growth and investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Exact Sciences Investment Narrative Recap

To own Exact Sciences stock, I believe you have to buy into its vision of expanding access to noninvasive cancer screening, especially as payer partnerships like the new Humana agreement could unlock higher test volumes for Cologuard Plus. While the enhanced revenue guidance and narrowing net losses provide optimism for near-term performance, the concentration of revenue in Cologuard still leaves the company highly vulnerable to potential changes in screening guidelines or reimbursement, this risk is not materially reduced by the latest agreements or earnings report.

The expanded partnership with Humana, bringing Cologuard Plus to approximately 5.8 million new Medicare Advantage members, is most relevant right now, as it underscores the company's efforts to strengthen its payer network and broaden product access, which is a key current growth catalyst as screening volumes may rise alongside improved insurance coverage.

However, investors should also be mindful that, despite the strong uptake and new contracts, a sudden shift in payer policy or guideline changes could still sharply affect Exact Sciences’ core revenues…

Read the full narrative on Exact Sciences (it's free!)

Exact Sciences' narrative projects $4.1 billion revenue and $291.1 million earnings by 2028. This requires 11.6% yearly revenue growth and a $1.29 billion increase in earnings from -$1.0 billion today.

Uncover how Exact Sciences' forecasts yield a $64.60 fair value, a 55% upside to its current price.

Exploring Other Perspectives

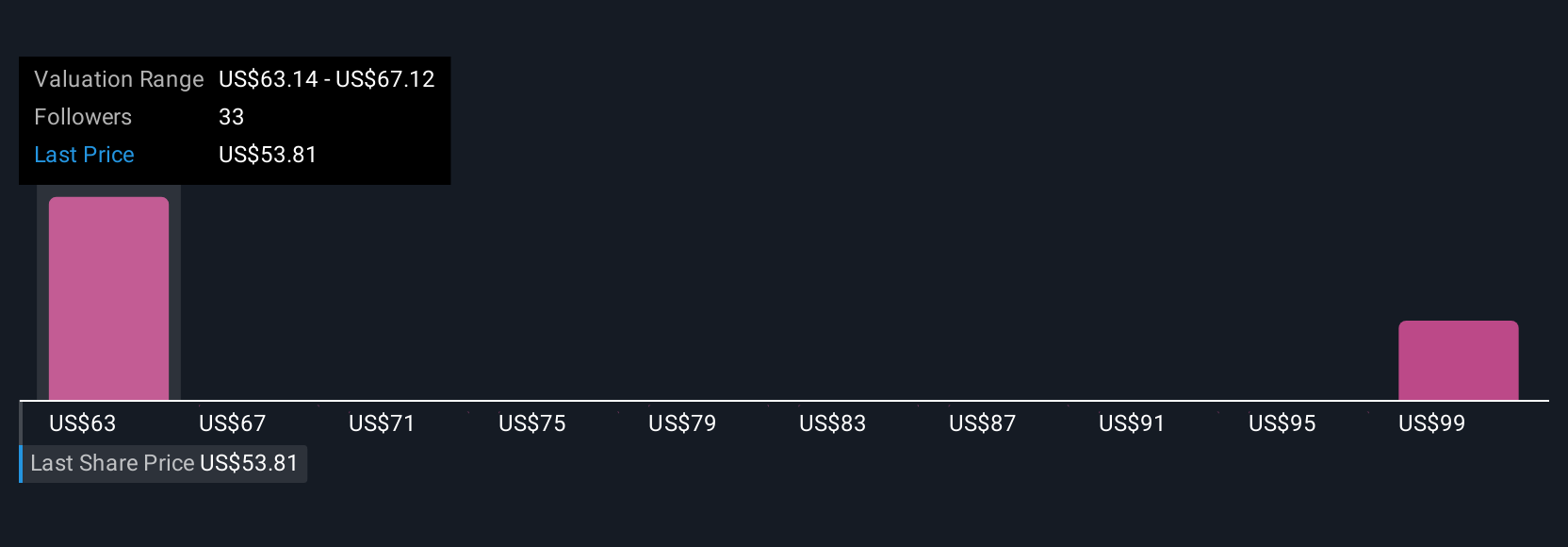

Six Simply Wall St Community members see Exact Sciences’ fair value between US$64.60 and US$101.94 per share. While expanded insurance coverage could influence future revenue growth, these independent investor opinions spotlight how outlooks on Exact’s prospects vary widely, explore the different perspectives to form your own view.

Explore 6 other fair value estimates on Exact Sciences - why the stock might be worth just $64.60!

Build Your Own Exact Sciences Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Exact Sciences research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Exact Sciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Exact Sciences' overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Exact Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:EXAS

Exact Sciences

Provides cancer screening and diagnostic test products in the United States and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)