- United States

- /

- Biotech

- /

- NasdaqCM:EXAS

High Growth Tech Stocks To Watch In January 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 2.5%, yet it remains up by 22% over the past year with earnings forecasted to grow by 15% annually. In this environment, identifying high growth tech stocks involves looking for companies that demonstrate strong potential for innovation and expansion while aligning with broader positive market trends.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.13% | 24.28% | ★★★★★★ |

| Ardelyx | 22.86% | 54.70% | ★★★★★★ |

| AVITA Medical | 33.33% | 51.81% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| AsiaFIN Holdings | 51.75% | 82.69% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.39% | 56.40% | ★★★★★★ |

| TG Therapeutics | 30.33% | 44.07% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Blueprint Medicines | 22.61% | 55.18% | ★★★★★★ |

| Travere Therapeutics | 29.54% | 61.86% | ★★★★★★ |

Click here to see the full list of 226 stocks from our US High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Exact Sciences (NasdaqCM:EXAS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Exact Sciences Corporation focuses on developing cancer screening and diagnostic test products, operating both in the United States and internationally, with a market cap of approximately $10.46 billion.

Operations: The company generates revenue primarily from its biotechnology segment, with reported revenues of $2.69 billion.

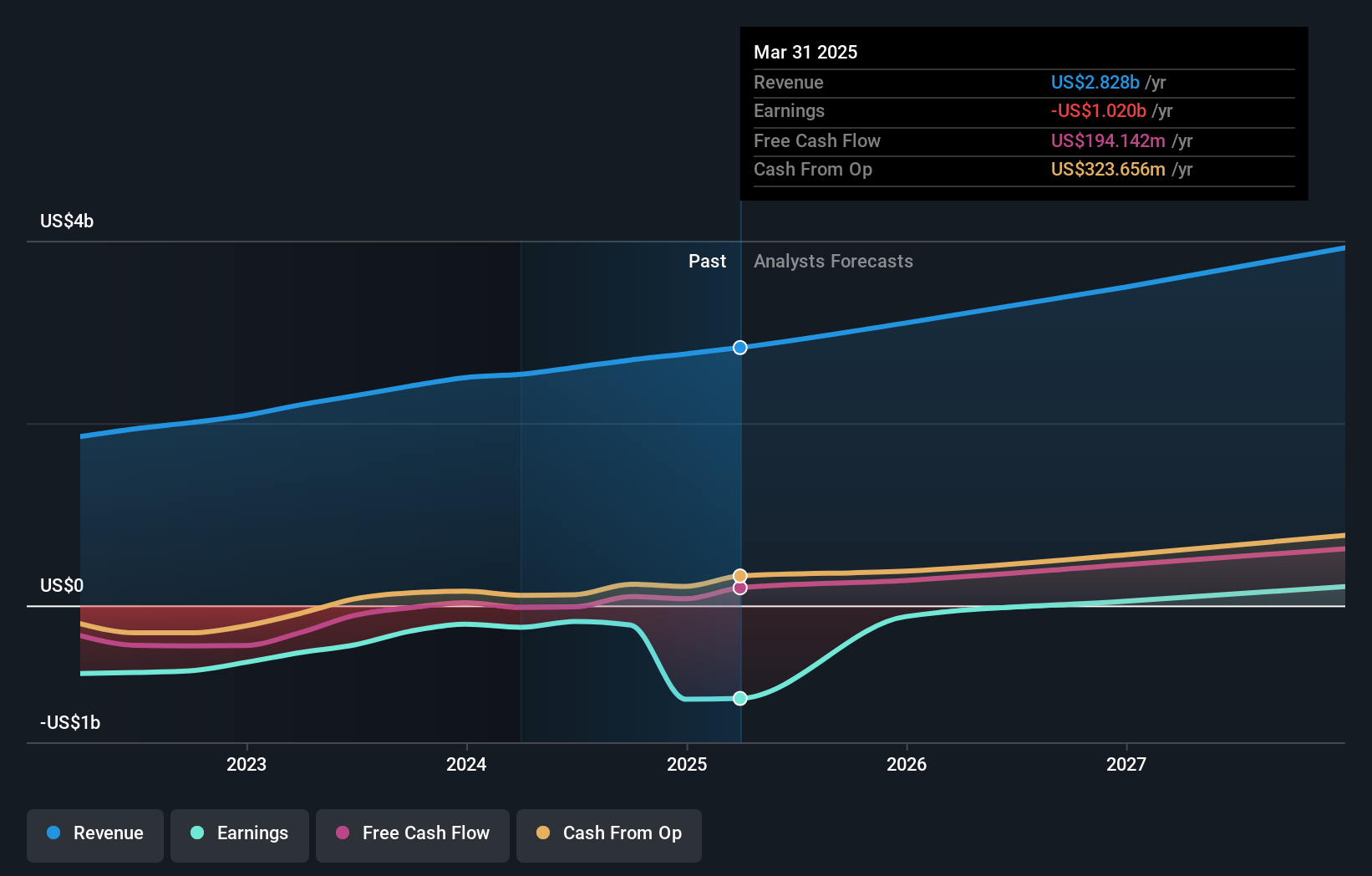

Exact Sciences, currently navigating through unprofitability, is poised for a transformative phase with its aggressive M&A strategy and a disciplined approach to acquisitions as highlighted at the recent JPMorgan Conference. Despite a net loss in Q3 2024, the company's commitment to innovation is evident from its R&D expenses which are crucial for future profitability. With revenue growth forecasted at 9.5% annually—outpacing the US market—Exact Sciences is strategically expanding its board and exploring new market opportunities, signaling readiness for upcoming industry shifts and potential profitability within three years. This strategic positioning could enhance its role in high-growth tech sectors by leveraging advanced diagnostics and personalized medicine technologies.

Vericel (NasdaqGM:VCEL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vericel Corporation is a commercial-stage biopharmaceutical company focused on the research, development, manufacture, and distribution of cellular therapies for sports medicine and severe burn care markets in North America, with a market cap of approximately $2.94 billion.

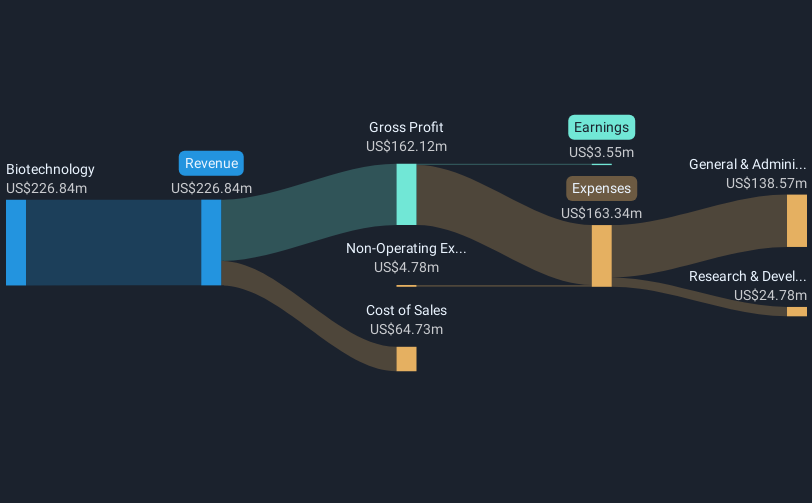

Operations: The company generates revenue primarily from its biotechnology segment, amounting to $226.84 million.

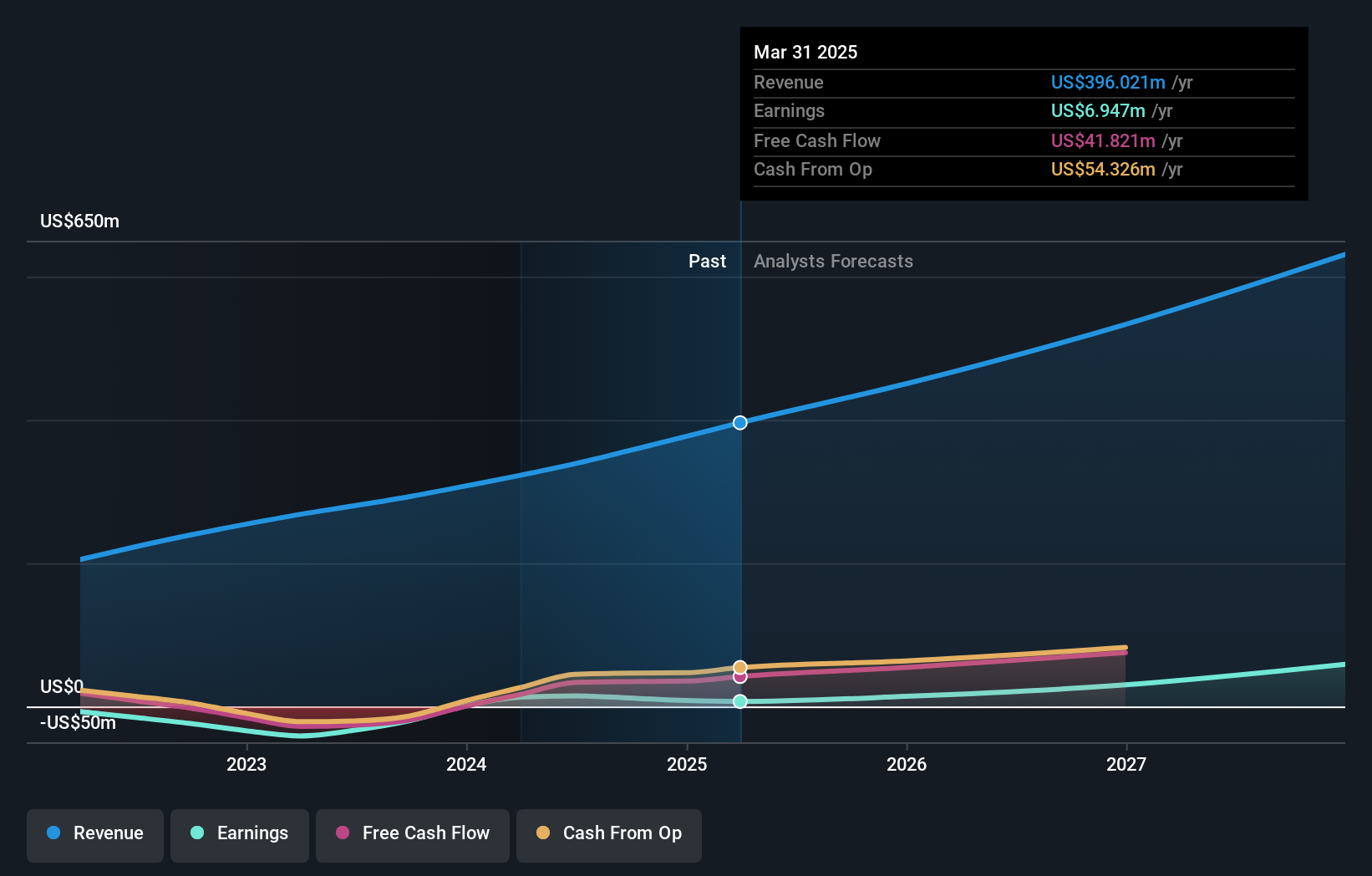

Vericel stands out in the high-growth tech landscape, recently showcasing a robust annual revenue increase of 20.3%, significantly outpacing the US market average of 9%. Despite a challenging year with shareholder dilution and a net loss of $0.901 million in Q3 2024, the company's commitment to innovation is underscored by its substantial R&D investments, which are essential for sustaining its rapid earnings growth projected at 42.3% annually. These figures highlight Vericel's potential resilience and adaptability within the biotech sector, positioning it well for future profitability as it continues to navigate through current market dynamics and enhance its technological offerings.

- Click here to discover the nuances of Vericel with our detailed analytical health report.

Assess Vericel's past performance with our detailed historical performance reports.

Semrush Holdings (NYSE:SEMR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Semrush Holdings, Inc. provides an online visibility management software-as-a-service platform across the United States, the United Kingdom, and internationally, with a market cap of approximately $1.86 billion.

Operations: Semrush generates revenue primarily through its software and programming segment, amounting to approximately $357.57 million. The company focuses on providing a comprehensive platform for online visibility management internationally.

Semrush Holdings, a key participant in the tech sector, recently projected an impressive annual revenue growth of 16.7%, outpacing the US market's average of 9%. This growth is complemented by an expected surge in earnings by 66.4% per year, highlighting its robust financial health and market position. Notably, Semrush has transitioned into profitability this year, a significant turnaround reflected by its latest quarterly net income of $1.09 million compared to a net loss previously. The firm's commitment to innovation is evident from its R&D investments which strategically support its expanding product offerings and market reach—an approach that not only enhances current operations but also positions it strongly for future technological advancements and customer engagement strategies.

- Navigate through the intricacies of Semrush Holdings with our comprehensive health report here.

Gain insights into Semrush Holdings' past trends and performance with our Past report.

Make It Happen

- Dive into all 226 of the US High Growth Tech and AI Stocks we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exact Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:EXAS

Exact Sciences

Provides cancer screening and diagnostic test products in the United States and internationally.

Very undervalued with reasonable growth potential.