- United States

- /

- Software

- /

- NYSE:QTWO

Exploring 3 High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

As the U.S. market approaches record highs, with the S&P 500 nearing its peak and the Dow Jones Industrial Average inching closer to a new high, investor sentiment is being shaped by ongoing trade uncertainties and robust earnings reports from sectors like airlines. In this dynamic environment, identifying high-growth tech stocks requires a keen understanding of their potential to capitalize on technological advancements and market trends that are currently influencing broader indices.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.75% | 38.20% | ★★★★★★ |

| Circle Internet Group | 30.78% | 60.64% | ★★★★★★ |

| Ardelyx | 21.16% | 61.58% | ★★★★★★ |

| Mereo BioPharma Group | 50.84% | 58.22% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| AVITA Medical | 27.42% | 61.04% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.86% | 59.49% | ★★★★★★ |

| Alkami Technology | 20.53% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.02% | 60.01% | ★★★★★★ |

| Lumentum Holdings | 23.14% | 103.97% | ★★★★★★ |

Click here to see the full list of 227 stocks from our US High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Exact Sciences (EXAS)

Simply Wall St Growth Rating: ★★★★☆☆

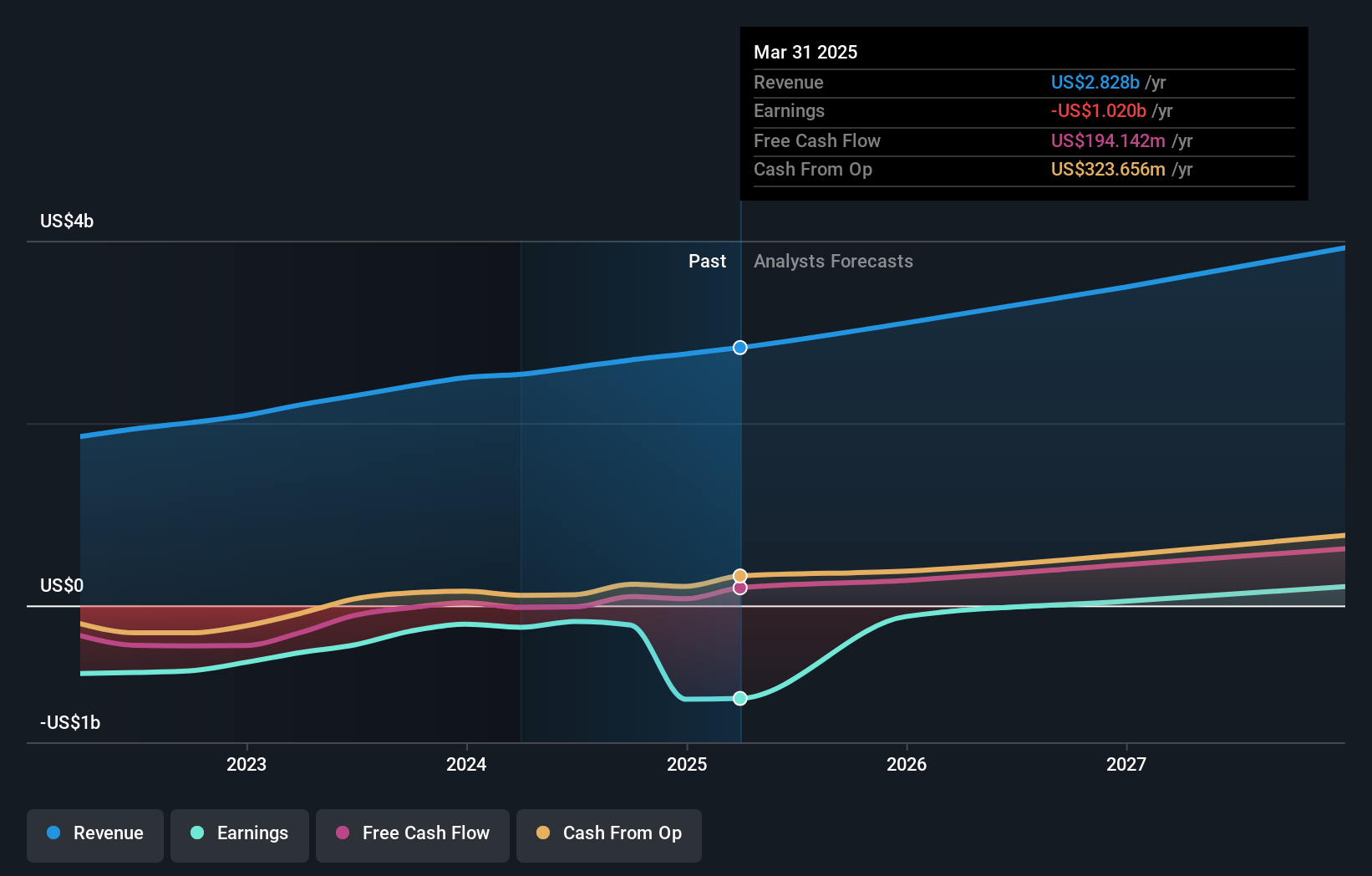

Overview: Exact Sciences Corporation specializes in cancer screening and diagnostic test products, operating both in the United States and internationally, with a market cap of $10.10 billion.

Operations: The company generates revenue primarily from its biotechnology segment, which contributed $2.83 billion. Its focus on cancer screening and diagnostic tests positions it within the healthcare sector, targeting both domestic and international markets.

Exact Sciences is poised for significant advancements in the oncology sector, particularly with its recent Medicare coverage approval for the Oncodetect MRD test. This approval enhances its role in colorectal cancer management, potentially impacting over three million Americans eligible for MRD testing. The company's R&D focus is evident from its continued innovation, such as integrating Broad Institute's MAESTRO technology into their next-generation tests, promising ultra-low detection limits that could revolutionize cancer monitoring. With a revenue growth forecast of 10.2% annually and an anticipated profitability within three years, Exact Sciences demonstrates a robust trajectory in harnessing advanced diagnostics to improve cancer treatment outcomes.

- Click here to discover the nuances of Exact Sciences with our detailed analytical health report.

Examine Exact Sciences' past performance report to understand how it has performed in the past.

Commvault Systems (CVLT)

Simply Wall St Growth Rating: ★★★★★☆

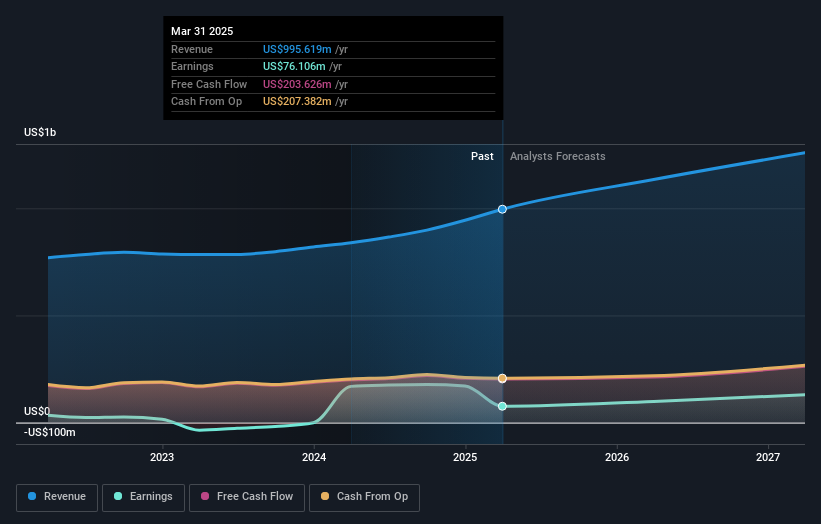

Overview: Commvault Systems, Inc. offers a cyber resilience platform focused on data protection and recovery for cloud-native applications across the Americas and internationally, with a market cap of $7.69 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, which accounts for $995.62 million. It operates in the field of data protection and recovery solutions for cloud-native applications across various regions.

Commvault Systems, a key participant in the tech sector, recently expanded its strategic partnership with Hewlett Packard Enterprise to enhance cyber resilience and data protection capabilities for hybrid cloud environments. This collaboration is pivotal as it integrates HPE Zerto Software into Commvault's offerings, providing near-zero recovery objectives crucial for operational resilience. Furthermore, the company's recent earnings report indicated a revenue increase to $995.62 million from the previous year's $839.25 million, underscoring its growth trajectory amid evolving cybersecurity challenges. With R&D investments sharply focused on enhancing data integrity and recovery technologies, Commvault is strategically positioned to address increasing cyber threats while expanding its market footprint through significant partnerships and innovative solutions.

- Take a closer look at Commvault Systems' potential here in our health report.

Explore historical data to track Commvault Systems' performance over time in our Past section.

Q2 Holdings (QTWO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Q2 Holdings, Inc. offers digital solutions tailored for financial institutions, FinTechs, and alternative finance companies in the United States, with a market capitalization of $5.84 billion.

Operations: Q2 Holdings generates revenue primarily through the sale, implementation, and support of its digital solutions, amounting to $720.69 million. The company focuses on serving financial institutions, FinTechs, and alternative finance companies in the U.S.

Amidst a transformative phase in the tech sector, Q2 Holdings has demonstrated resilience and innovation, particularly with its recent launch of Direct ERP. This solution integrates banking directly into ERP systems, addressing inefficiencies between banking and accounting operations—a significant pain point for businesses. This strategic move not only enhances user experience but also positions Q2 to capitalize on the growing demand for integrated financial solutions, as evidenced by Datos Insights highlighting that 91% of North American mid-size and large businesses value such integration. Furthermore, Q2's robust performance is reflected in its latest quarterly results with sales rising to $189.74 million from $165.51 million year-over-year and a swing to a net income of $4.75 million from a previous net loss of $13.84 million, showcasing substantial recovery and growth potential in its operational strategy.

- Navigate through the intricacies of Q2 Holdings with our comprehensive health report here.

Gain insights into Q2 Holdings' historical performance by reviewing our past performance report.

Make It Happen

- Delve into our full catalog of 227 US High Growth Tech and AI Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Q2 Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QTWO

Q2 Holdings

Provides digital solutions to financial institutions, financial technology companies, FinTechs, and alternative finance companies (Alt-FIs) in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives