- United States

- /

- Biotech

- /

- NasdaqGS:DNLI

How Investors Are Reacting To Denali Therapeutics (DNLI) FDA Review Extension for Hunter Syndrome Treatment

Reviewed by Sasha Jovanovic

- Denali Therapeutics recently announced that the U.S. FDA has extended the review timeline for its Biologics License Application for tividenofusp alfa, a potential treatment for Hunter syndrome, from January 5, 2026, to April 5, 2026, following the submission of updated clinical pharmacology information.

- This extension, classified as a Major Amendment, was not prompted by concerns about efficacy, safety, or biomarkers, and required no additional data from Denali.

- We’ll explore how this review timeline extension influences Denali Therapeutics’ investment narrative, especially as the FDA highlighted no new efficacy or safety concerns.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Denali Therapeutics' Investment Narrative?

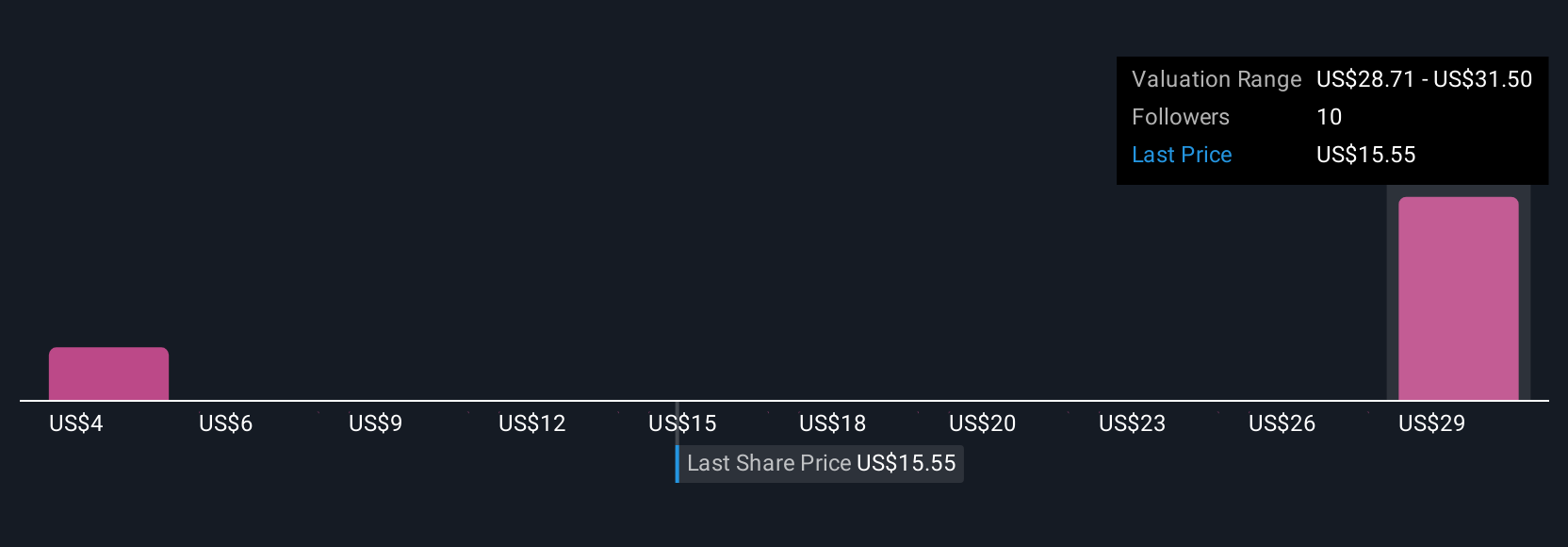

Being a Denali Therapeutics shareholder means believing in the potential for a groundbreaking therapy in Hunter syndrome to transform both lives and the company’s future trajectory. The recent FDA review extension for tividenofusp alfa slightly shifts the timing on Denali's most important near-term catalyst, potential accelerated approval and commercial launch, but does not change the core investment thesis. The update, unrelated to efficacy or safety, likely has only a limited impact on investor sentiment, as analysis and the stock’s muted recent moves suggest. Denali’s ongoing financial losses remain a key risk, with rising net losses year-over-year and no clear path to profitability. Investors still face the reality that a single approval now lands a few months later than anticipated. Current consensus price targets and optimism around revenue growth potential appear largely intact, but a delay, even minor, adds another reminder that timelines in biotech are never set in stone. However, Denali’s unprofitable status and increasing losses are important risks investors shouldn't ignore.

Denali Therapeutics' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Denali Therapeutics - why the stock might be worth over 2x more than the current price!

Build Your Own Denali Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Denali Therapeutics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Denali Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Denali Therapeutics' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DNLI

Denali Therapeutics

A biopharmaceutical company, discovers and develops therapeutics to treat neurodegenerative and lysosomal storage diseases.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives