- United States

- /

- Biotech

- /

- NasdaqGS:CYTK

Cytokinetics (CYTK) Is Up 29.9% After Positive Aficamten Phase 3 Data and Regulatory Progress

Reviewed by Simply Wall St

- In late August 2025, Cytokinetics presented new clinical data for aficamten at the European Society of Cardiology Congress in Madrid, with findings published in key medical journals and updates on its regulatory review status in major markets including the U.S., Europe, and China.

- A unique highlight from this announcement was that aficamten showed a minimal incidence of new atrial fibrillation and is accompanied by plans for commercialization, reinforced by the appointment of an experienced commercial leader to the board.

- We'll explore how the release of positive Phase 3 data and progress toward regulatory approval for aficamten influence Cytokinetics' investment outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Cytokinetics Investment Narrative Recap

To be a shareholder in Cytokinetics, you need confidence that aficamten will achieve regulatory approval and meaningful market adoption as a treatment for hypertrophic cardiomyopathy, transforming the company’s financial trajectory. The recent presentation of positive Phase 3 data at the European Society of Cardiology Congress confirms aficamten’s minimal clinical impact on new atrial fibrillation, but does not materially alter the primary short-term catalyst: FDA approval of the drug, with ongoing regulatory review remaining the central risk.

Among the latest company updates, the FDA’s extension of aficamten’s PDUFA action date to December 26, 2025 stands out. This move means that investors must continue monitoring the review process closely, as any further delay or additional regulatory requirements could be significant for near-term expectations tied to aficamten’s commercial launch.

On the other hand, investors should be aware that Cytokinetics remains highly reliant on successful regulatory outcomes for aficamten, which means that...

Read the full narrative on Cytokinetics (it's free!)

Cytokinetics' narrative projects $649.5 million in revenue and $90.6 million in earnings by 2028. This requires 96.4% yearly revenue growth and a $696.9 million increase in earnings from current earnings of -$606.3 million.

Uncover how Cytokinetics' forecasts yield a $73.21 fair value, a 48% upside to its current price.

Exploring Other Perspectives

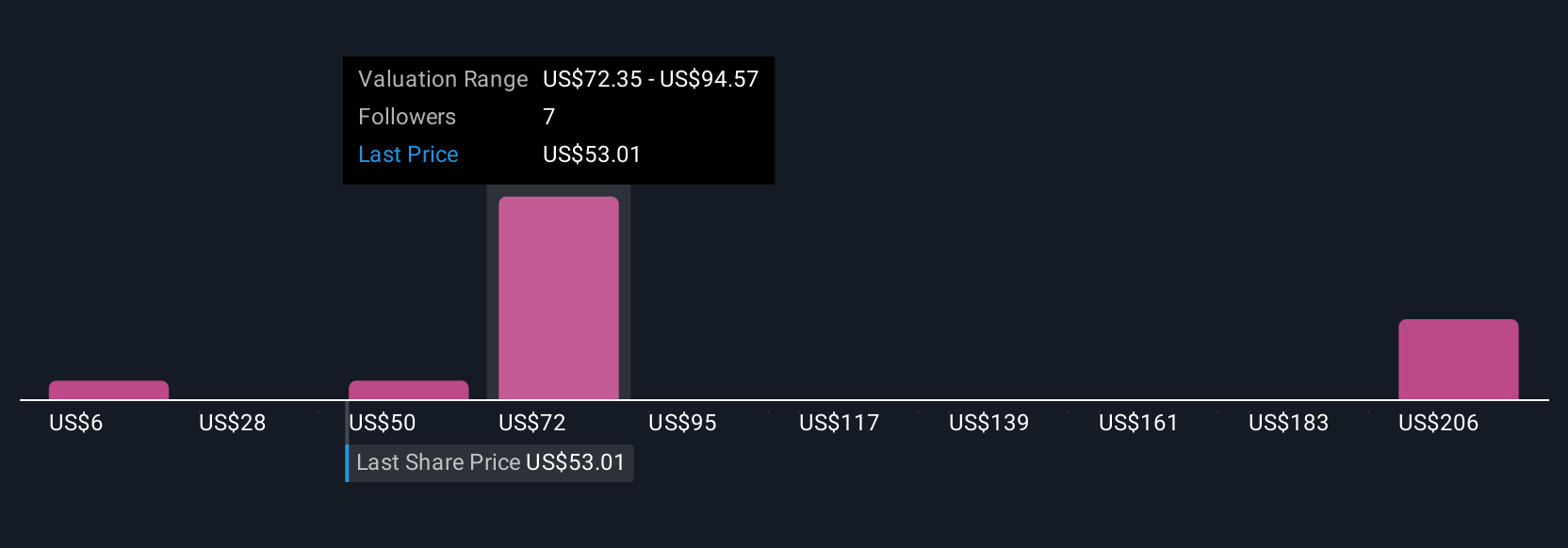

Four fair value estimates from the Simply Wall St Community range widely from US$5.69 to US$231.34 per share. As regulatory decisions approach, the potential for approval-related setbacks remains a point of focus among market participants, explore a variety of opinions to inform your own view.

Explore 4 other fair value estimates on Cytokinetics - why the stock might be worth over 4x more than the current price!

Build Your Own Cytokinetics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cytokinetics research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Cytokinetics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cytokinetics' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CYTK

Cytokinetics

A late-stage biopharmaceutical company, focuses on discovering, developing, and commercializing muscle activators and inhibitors as potential treatments for debilitating diseases in the United States.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives