- United States

- /

- Biotech

- /

- NasdaqCM:CRVO

CervoMed Inc.'s (NASDAQ:CRVO) 27% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

Unfortunately for some shareholders, the CervoMed Inc. (NASDAQ:CRVO) share price has dived 27% in the last thirty days, prolonging recent pain. Indeed, the recent drop has reduced its annual gain to a relatively sedate 6.0% over the last twelve months.

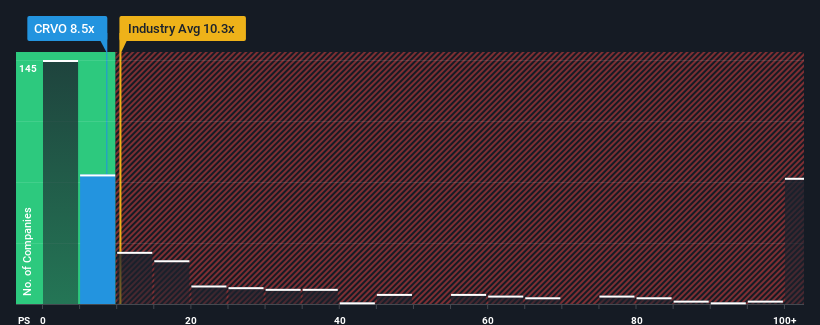

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about CervoMed's P/S ratio of 8.5x, since the median price-to-sales (or "P/S") ratio for the Biotechs industry in the United States is also close to 10.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for CervoMed

What Does CervoMed's Recent Performance Look Like?

Recent times haven't been great for CervoMed as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on CervoMed will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For CervoMed?

CervoMed's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 116%. Still, revenue has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the five analysts covering the company suggest revenue growth is heading into negative territory, declining 100% per annum over the next three years. That's not great when the rest of the industry is expected to grow by 119% each year.

In light of this, it's somewhat alarming that CervoMed's P/S sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What Does CervoMed's P/S Mean For Investors?

CervoMed's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It appears that CervoMed currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

You need to take note of risks, for example - CervoMed has 5 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CRVO

CervoMed

A biotechnology company, engages in the development and commercialization of treatments for age-related neurologic disorders.

Flawless balance sheet moderate.

Market Insights

Community Narratives