- United States

- /

- Pharma

- /

- NasdaqGS:CPIX

Is Cumberland Pharmaceuticals (NASDAQ:CPIX) Using Debt In A Risky Way?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Cumberland Pharmaceuticals Inc. (NASDAQ:CPIX) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Cumberland Pharmaceuticals

What Is Cumberland Pharmaceuticals's Debt?

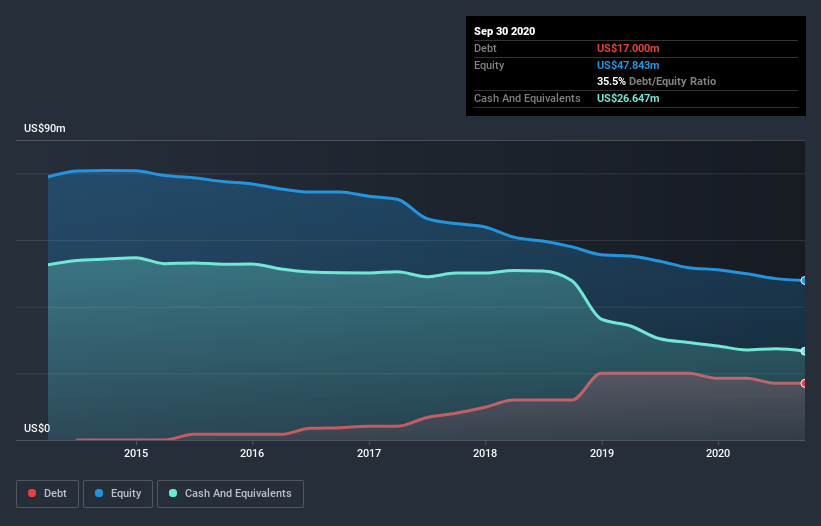

The image below, which you can click on for greater detail, shows that Cumberland Pharmaceuticals had debt of US$17.0m at the end of September 2020, a reduction from US$20.0m over a year. However, its balance sheet shows it holds US$26.6m in cash, so it actually has US$9.65m net cash.

A Look At Cumberland Pharmaceuticals' Liabilities

We can see from the most recent balance sheet that Cumberland Pharmaceuticals had liabilities of US$23.9m falling due within a year, and liabilities of US$24.2m due beyond that. Offsetting these obligations, it had cash of US$26.6m as well as receivables valued at US$9.66m due within 12 months. So it has liabilities totalling US$11.9m more than its cash and near-term receivables, combined.

While this might seem like a lot, it is not so bad since Cumberland Pharmaceuticals has a market capitalization of US$53.8m, and so it could probably strengthen its balance sheet by raising capital if it needed to. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk. While it does have liabilities worth noting, Cumberland Pharmaceuticals also has more cash than debt, so we're pretty confident it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Cumberland Pharmaceuticals's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Cumberland Pharmaceuticals reported revenue of US$50m, which is a gain of 28%, although it did not report any earnings before interest and tax. With any luck the company will be able to grow its way to profitability.

So How Risky Is Cumberland Pharmaceuticals?

While Cumberland Pharmaceuticals lost money on an earnings before interest and tax (EBIT) level, it actually generated positive free cash flow US$3.2m. So taking that on face value, and considering the net cash situation, we don't think that the stock is too risky in the near term. One positive is that Cumberland Pharmaceuticals is growing revenue apace, which makes it easier to sell a growth story and raise capital if need be. But we still think it's somewhat risky. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for Cumberland Pharmaceuticals (of which 1 shouldn't be ignored!) you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade Cumberland Pharmaceuticals, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:CPIX

Cumberland Pharmaceuticals

A specialty pharmaceutical company, focuses on the acquisition, development, and commercialization of prescription products for hospital acute care, gastroenterology, and oncology in the United States and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)