- United States

- /

- Pharma

- /

- NasdaqCM:CORT

3 Growth Companies With High Insider Ownership Seeing 30% Revenue Growth

Reviewed by Simply Wall St

As the U.S. markets rebound with tech and crypto-related stocks leading the charge, investors are keenly observing growth companies that demonstrate robust insider ownership and impressive revenue trajectories. In this environment, firms showcasing significant insider stakes alongside strong revenue growth often signal confidence in their business models and potential resilience amid fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 23.3% | 73.5% |

| SES AI (SES) | 12% | 68.9% |

| Prairie Operating (PROP) | 29.2% | 114.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Here Group (HERE) | 36.1% | 38.8% |

| Credo Technology Group Holding (CRDO) | 10.4% | 28.0% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 11.9% | 29.0% |

| AppLovin (APP) | 27.5% | 27.3% |

We'll examine a selection from our screener results.

Corcept Therapeutics (CORT)

Simply Wall St Growth Rating: ★★★★★☆

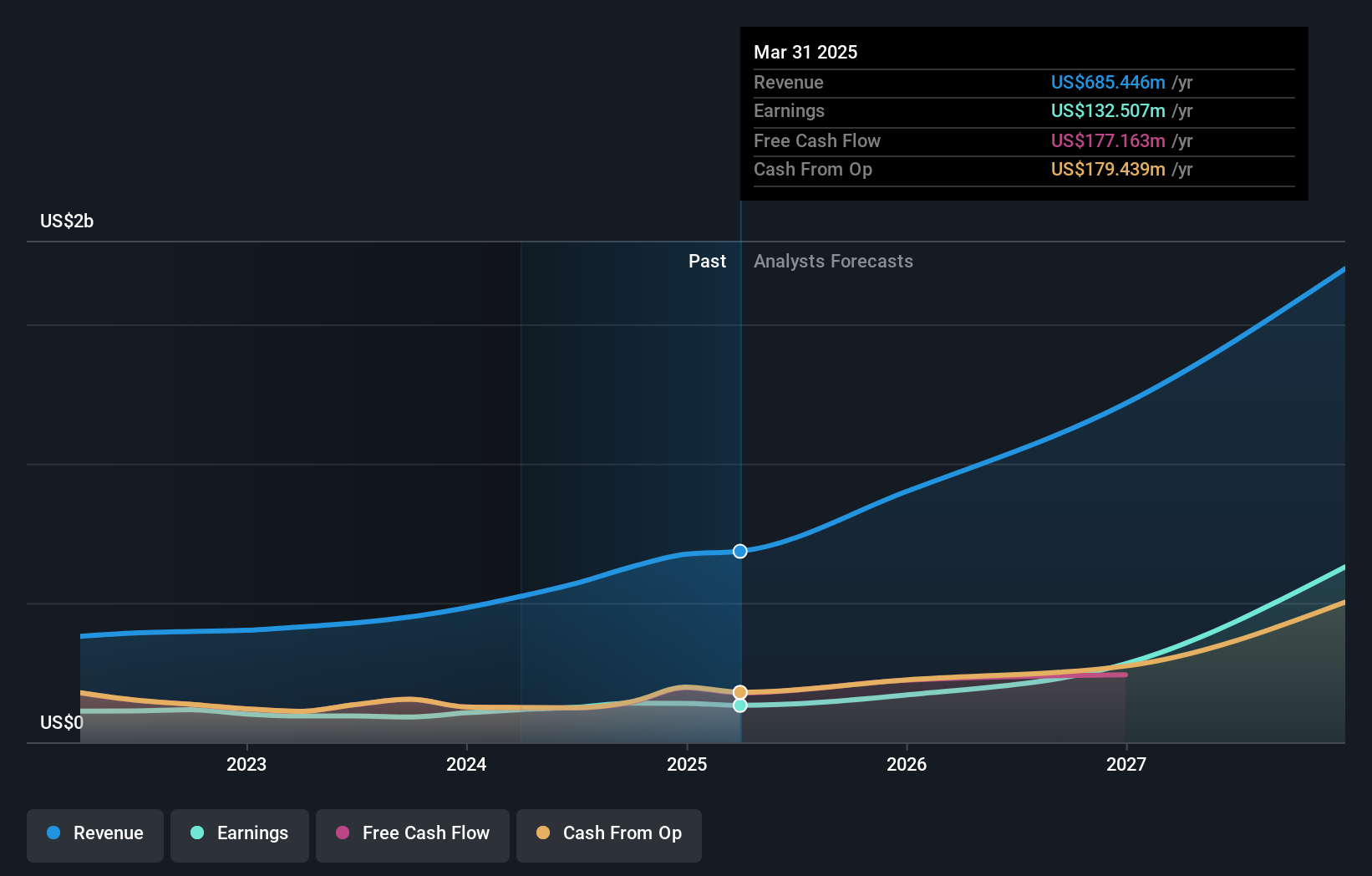

Overview: Corcept Therapeutics Incorporated focuses on discovering and developing medications for severe endocrinologic, oncologic, metabolic, and neurologic disorders in the United States with a market cap of approximately $8.50 billion.

Operations: The company's revenue primarily comes from the discovery, development, and commercialization of pharmaceutical products, amounting to $741.17 million.

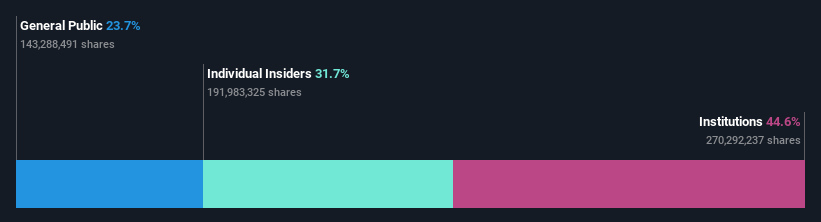

Insider Ownership: 11.4%

Revenue Growth Forecast: 30.3% p.a.

Corcept Therapeutics is positioned for growth with forecasted annual revenue and earnings growth rates of 30.3% and 52.7%, respectively, surpassing US market averages. Despite a recent decline in profit margins, the company is trading significantly below its estimated fair value and analysts anticipate a substantial price increase. Although insider buying has not been substantial recently, Corcept's strategic advancements in drug development, particularly relacorilant for ovarian cancer, underscore its potential for long-term success.

- Click to explore a detailed breakdown of our findings in Corcept Therapeutics' earnings growth report.

- According our valuation report, there's an indication that Corcept Therapeutics' share price might be on the cheaper side.

Power Solutions International (PSIX)

Simply Wall St Growth Rating: ★★★★★☆

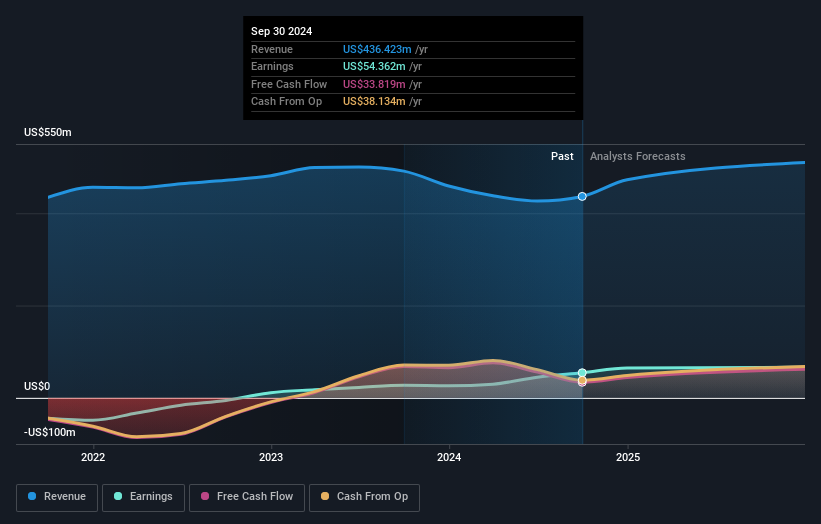

Overview: Power Solutions International, Inc. designs, engineers, manufactures, markets, and sells engines and power systems globally with a market cap of $1.26 billion.

Operations: The company's revenue is primarily derived from its Engineered Integrated Electrical Power Generation Systems segment, which generated $675.48 million.

Insider Ownership: 17.4%

Revenue Growth Forecast: 17.5% p.a.

Power Solutions International is poised for growth with projected annual earnings and revenue increases of 23.1% and 17.5%, respectively, outpacing US market averages. Recent third-quarter results showed significant sales and net income growth, indicating strong operational performance. Despite recent insider selling, the company trades well below its estimated fair value, suggesting potential undervaluation. Leadership changes with key appointments from major shareholder Weichai America Corp. may further influence strategic direction positively.

- Unlock comprehensive insights into our analysis of Power Solutions International stock in this growth report.

- Insights from our recent valuation report point to the potential undervaluation of Power Solutions International shares in the market.

TAL Education Group (TAL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TAL Education Group offers K-12 after-school tutoring services in China and has a market cap of approximately $6.80 billion.

Operations: The company's revenue primarily comes from its K-12 after-school tutoring services, generating approximately $2.65 billion.

Insider Ownership: 31.6%

Revenue Growth Forecast: 17.2% p.a.

TAL Education Group demonstrates strong growth potential, with earnings expected to rise significantly over the next three years, outpacing the US market. Recent financial results showed impressive sales and net income increases. The stock trades substantially below its estimated fair value, suggesting possible undervaluation. Despite no recent insider trading activity, TAL's revenue is forecasted to grow faster than the broader US market but remains below 20% annually. Recent share buybacks indicate management's confidence in future prospects.

- Click here and access our complete growth analysis report to understand the dynamics of TAL Education Group.

- Our valuation report here indicates TAL Education Group may be undervalued.

Make It Happen

- Reveal the 199 hidden gems among our Fast Growing US Companies With High Insider Ownership screener with a single click here.

- Contemplating Other Strategies? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CORT

Corcept Therapeutics

Engages in discovery and development of medication for the treatment of severe endocrinologic, oncologic, metabolic, and neurologic disorders in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026