- United States

- /

- Pharma

- /

- NasdaqCM:CNTX

We're A Little Worried About Context Therapeutics' (NASDAQ:CNTX) Cash Burn Rate

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. By way of example, Context Therapeutics (NASDAQ:CNTX) has seen its share price rise 117% over the last year, delighting many shareholders. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So notwithstanding the buoyant share price, we think it's well worth asking whether Context Therapeutics' cash burn is too risky. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

View our latest analysis for Context Therapeutics

When Might Context Therapeutics Run Out Of Money?

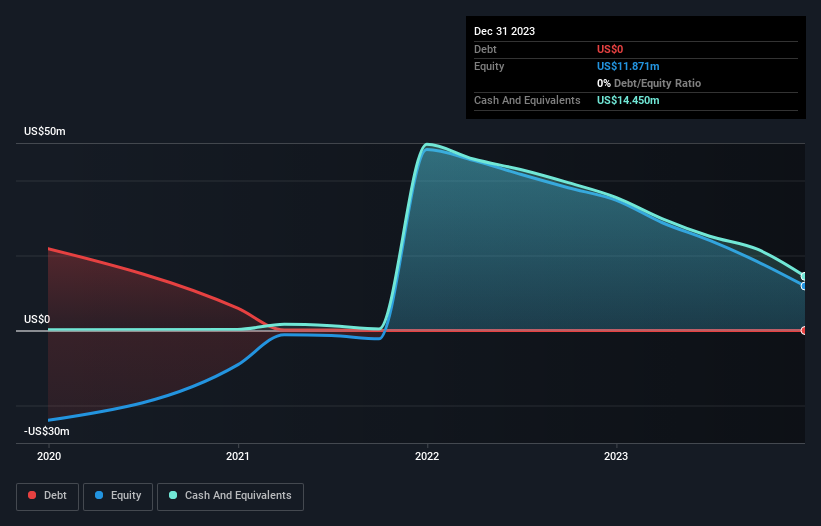

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In December 2023, Context Therapeutics had US$14m in cash, and was debt-free. In the last year, its cash burn was US$21m. That means it had a cash runway of around 8 months as of December 2023. To be frank, this kind of short runway puts us on edge, as it indicates the company must reduce its cash burn significantly, or else raise cash imminently. You can see how its cash balance has changed over time in the image below.

How Is Context Therapeutics' Cash Burn Changing Over Time?

Context Therapeutics didn't record any revenue over the last year, indicating that it's an early stage company still developing its business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. With the cash burn rate up 49% in the last year, it seems that the company is ratcheting up investment in the business over time. However, the company's true cash runway will therefore be shorter than suggested above, if spending continues to increase. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

Can Context Therapeutics Raise More Cash Easily?

Since its cash burn is moving in the wrong direction, Context Therapeutics shareholders may wish to think ahead to when the company may need to raise more cash. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Context Therapeutics' cash burn of US$21m is about the same as its market capitalisation of US$20m. That suggests the company may have some funding difficulties, and we'd be very wary of the stock.

Is Context Therapeutics' Cash Burn A Worry?

There are no prizes for guessing that we think Context Therapeutics' cash burn is a bit of a worry. Take, for example, its cash burn relative to its market cap, which suggests the company may have difficulty funding itself, in the future. And although we accept its increasing cash burn wasn't as worrying as its cash burn relative to its market cap, it was still a real negative; as indeed were all the factors we considered in this article. After considering the data discussed in this article, we don't have a lot of confidence that its cash burn rate is prudent, as it seems like it might need more cash soon. On another note, we conducted an in-depth investigation of the company, and identified 6 warning signs for Context Therapeutics (3 are concerning!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CNTX

Context Therapeutics

A biopharmaceutical company, develops products for the treatment of solid tumors.

Flawless balance sheet medium-low.