- United States

- /

- Biotech

- /

- NasdaqGM:IMAB

US Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates rising Treasury yields and strong economic data, investors are keenly watching how these factors might influence interest rates and broader market movements. Penny stocks, a term that may seem outdated but remains relevant, often represent smaller or less-established companies with potential value. By focusing on those with robust financials and clear growth prospects, investors can uncover opportunities in these under-the-radar stocks that might offer both stability and upside potential.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.80 | $5.97M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.22 | $1.76B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $102.23M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.90 | $10.89M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.3021 | $12.01M | ★★★★★★ |

| North European Oil Royalty Trust (NYSE:NRT) | $4.755 | $43.66M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.77 | $47.54M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.86 | $24.83M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.04 | $88.55M | ★★★★★☆ |

Click here to see the full list of 720 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

Compass Therapeutics (NasdaqCM:CMPX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Compass Therapeutics, Inc. is a clinical-stage biopharmaceutical company in the United States that develops antibody-based therapeutics for oncology, with a market cap of $214.64 million.

Operations: Compass Therapeutics, Inc. currently does not report any revenue segments.

Market Cap: $214.64M

Compass Therapeutics, Inc., a clinical-stage biopharmaceutical company, remains pre-revenue with earnings forecasts indicating continued unprofitability over the next three years. Despite a market cap of US$214.64 million, the company has faced shareholder dilution and high share price volatility recently. However, it maintains a strong cash position with short-term assets of US$141.1 million significantly exceeding liabilities. Recent executive changes include appointing Barry Shin as CFO and Neil Lerner as principal accounting officer, potentially strengthening financial leadership amid ongoing net losses—US$10.48 million in Q3 2024 compared to US$9.96 million in Q3 2023—highlighting its challenging financial landscape.

- Click here and access our complete financial health analysis report to understand the dynamics of Compass Therapeutics.

- Understand Compass Therapeutics' earnings outlook by examining our growth report.

Guardforce AI (NasdaqCM:GFAI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Guardforce AI Co., Limited provides cash solutions and cash handling services across Singapore, Hong Kong, Macau, Malaysia, Thailand, and other international markets with a market cap of $19.76 million.

Operations: The company's revenue is primarily derived from Secured Logistics at $31.71 million, followed by General Security Solutions at $3.68 million, and Robotics AI Solutions contributing $0.45 million.

Market Cap: $19.76M

Guardforce AI Co., Limited, with a market cap of US$19.76 million, primarily generates revenue from Secured Logistics (US$31.71 million). Despite its unprofitability and increased losses over five years, the company has reduced its debt-to-equity ratio significantly and maintains more cash than total debt. Recent advancements in AI technology through collaboration with Librum Technologies Inc. aim to enhance user experience in travel and retail solutions, potentially strengthening its technological foundation. However, shareholder dilution and high share price volatility persist as challenges for investors considering this penny stock's potential risks and opportunities.

- Jump into the full analysis health report here for a deeper understanding of Guardforce AI.

- Evaluate Guardforce AI's prospects by accessing our earnings growth report.

I-Mab (NasdaqGM:IMAB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: I-Mab is a clinical stage biopharmaceutical company focused on discovering, developing, and commercializing biologics for immuno-oncology and immuno-inflammation diseases, primarily in the United States, with a market cap of $76.60 million.

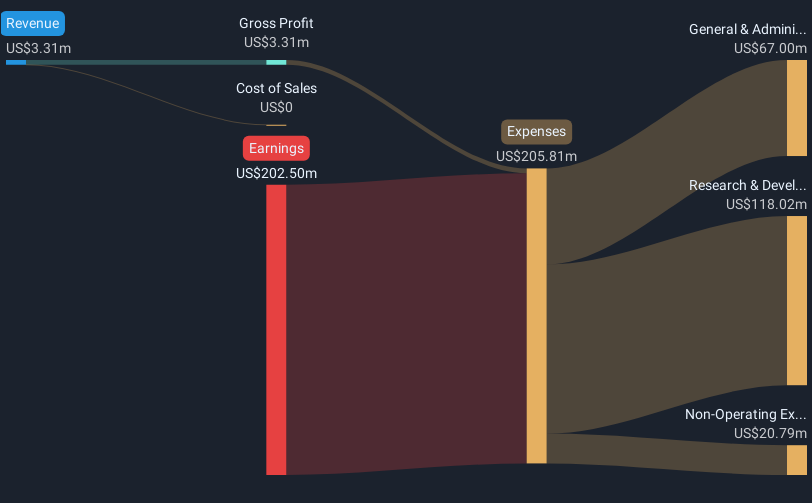

Operations: I-Mab has not reported any revenue segments.

Market Cap: $76.6M

I-Mab, with a market cap of US$76.60 million, remains pre-revenue and unprofitable, experiencing increased losses over five years. The company's financials show strong short-term asset coverage for both short and long-term liabilities, and it is debt-free. Recent strategic shifts focus on advancing its lead program, givastomig, targeting metastatic gastric cancers in collaboration with ABL Bio. Despite stable weekly volatility compared to other stocks, I-Mab's share price has been highly volatile recently. Leadership changes include the appointment of Sean Fu as CEO to drive clinical-stage developments forward amidst ongoing challenges in achieving profitability.

- Click to explore a detailed breakdown of our findings in I-Mab's financial health report.

- Gain insights into I-Mab's future direction by reviewing our growth report.

Summing It All Up

- Dive into all 720 of the US Penny Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:IMAB

I-Mab

A biotech company, focuses on the development of immuno-oncology agents for the treatment of cancer in the United States.

Excellent balance sheet moderate.

Similar Companies

Market Insights

Community Narratives