- United States

- /

- Biotech

- /

- NasdaqCM:CMPX

US Penny Stocks To Watch: 3 Picks With Market Caps Over $40M

Reviewed by Simply Wall St

As the U.S. stock market experiences a rally led by the technology sector, investors are closely monitoring developments such as the presidential election and upcoming Federal Reserve decisions on interest rates. In this context, penny stocks continue to capture attention for their potential to offer both affordability and growth opportunities, despite being considered a somewhat outdated term. These smaller or newer companies can provide unique investment prospects when they demonstrate strong financials, making them intriguing options for those seeking under-the-radar opportunities in today's market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.7995 | $5.56M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.67 | $526.12M | ★★★★★★ |

| Flexible Solutions International (NYSEAM:FSI) | $4.05 | $47.83M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $158.96M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.62 | $2.05B | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.56 | $51.81M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.44 | $128.24M | ★★★★★☆ |

| Commercial Vehicle Group (NasdaqGS:CVGI) | $3.08 | $97.41M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.105 | $95.79M | ★★★★★☆ |

Click here to see the full list of 754 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Compass Therapeutics (NasdaqCM:CMPX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Compass Therapeutics, Inc. is a clinical-stage biopharmaceutical company focused on developing antibody-based therapeutics for oncology treatment in the United States, with a market cap of $233.90 million.

Operations: Compass Therapeutics, Inc. has not reported any revenue segments.

Market Cap: $233.9M

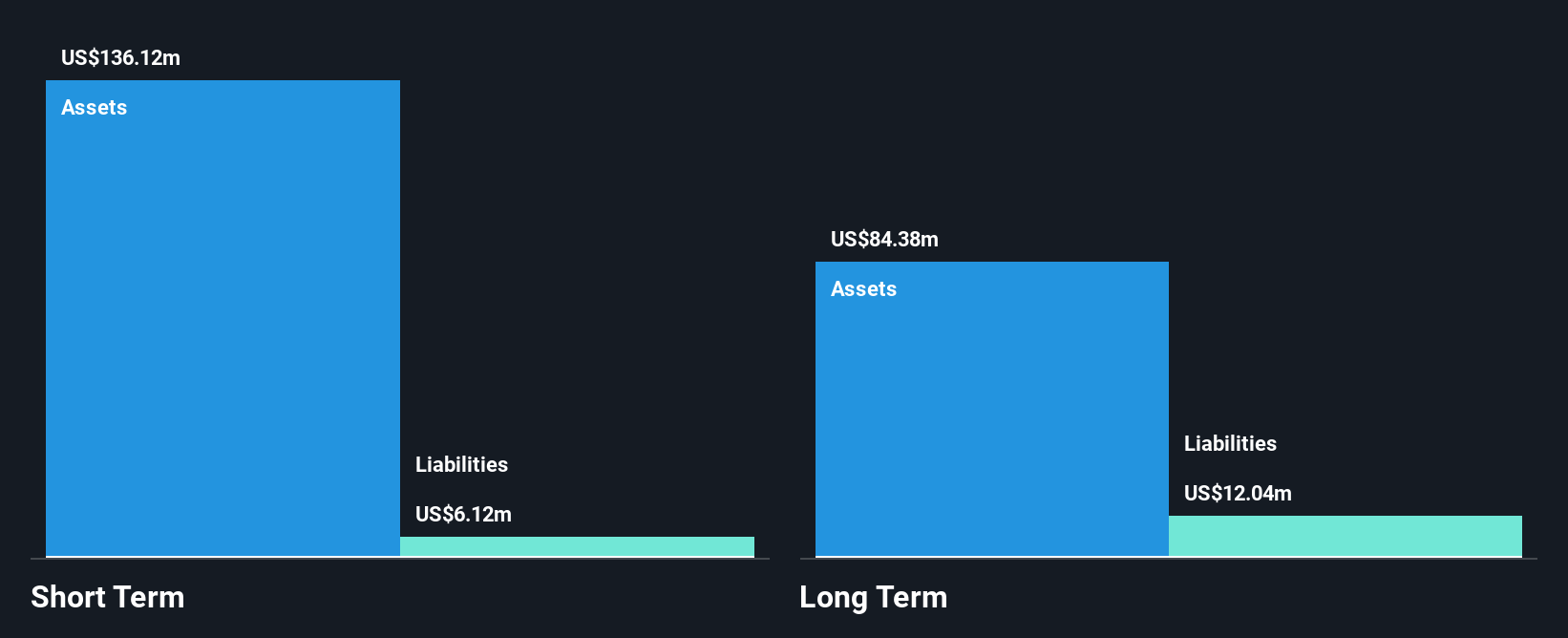

Compass Therapeutics, Inc., with a market cap of US$233.90 million, is a pre-revenue biopharmaceutical company focused on oncology treatments. Despite its unprofitability and increased net losses over the past year, it maintains strong short-term assets (US$153.5 million) exceeding liabilities (US$9.5 million). The company has no long-term liabilities and is debt-free, providing financial flexibility. Recent developments include FDA Fast Track Designation for CTX-009 and promising early-stage trial results for CTX-471 in specific cancer types. However, shareholder dilution by 8% last year and high share price volatility remain concerns for investors in this penny stock space.

- Take a closer look at Compass Therapeutics' potential here in our financial health report.

- Understand Compass Therapeutics' earnings outlook by examining our growth report.

Oramed Pharmaceuticals (NasdaqCM:ORMP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Oramed Pharmaceuticals Inc. is involved in the research and development of pharmaceutical solutions for diabetes treatment and orally ingestible capsules for polypeptide delivery, with a market cap of $94.58 million.

Operations: No revenue segments are reported for Oramed Pharmaceuticals.

Market Cap: $94.58M

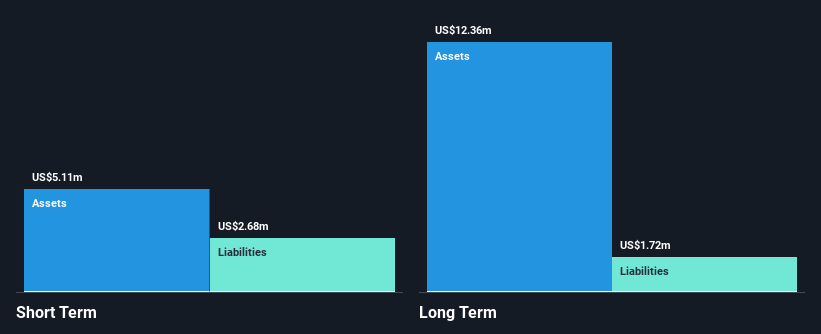

Oramed Pharmaceuticals Inc., with a market cap of US$94.58 million, is a pre-revenue company in the pharmaceutical sector. It has recently become profitable, reporting net income of US$9.21 million for Q2 2024, contrasting with a net loss the previous year. Despite its low Return on Equity (11.8%), Oramed benefits from being debt-free and having strong short-term assets (US$153.3 million) that exceed both short and long-term liabilities significantly. The management team is experienced with an average tenure of 11.9 years, though future earnings are forecasted to decline sharply by an average of 151.6% annually over the next three years.

- Click here and access our complete financial health analysis report to understand the dynamics of Oramed Pharmaceuticals.

- Gain insights into Oramed Pharmaceuticals' outlook and expected performance with our report on the company's earnings estimates.

Indonesia Energy (NYSEAM:INDO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Indonesia Energy Corporation Limited operates as an oil and gas exploration and production company in Indonesia with a market cap of approximately $43.47 million.

Operations: The company generates revenue of $3.13 million from its upstream oil and gas industry operations.

Market Cap: $43.47M

Indonesia Energy Corporation Limited, with a market cap of US$43.47 million, is navigating financial challenges as it reported a net loss of US$2.1 million for the half year ending June 2024, despite generating sales of US$1.44 million. The company has improved its debt position significantly over five years, now holding more cash than total debt and covering both short and long-term liabilities with its assets. However, high share price volatility persists alongside limited revenue growth and shareholder dilution concerns. Its seasoned management team offers stability amid these financial strains but faces pressure from an insufficient cash runway under current conditions.

- Jump into the full analysis health report here for a deeper understanding of Indonesia Energy.

- Review our historical performance report to gain insights into Indonesia Energy's track record.

Key Takeaways

- Dive into all 754 of the US Penny Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CMPX

Compass Therapeutics

A clinical-stage oncology-focused biopharmaceutical company, engages in the development of antibody-based therapeutics for the treatment of various human diseases in the United States.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives